Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please help me on 5-19? LO 2,3 Costierarchy classification. The following outlines a number of activities related to operations at Nordan Manufacturing Ltd.:

Can you please help me on 5-19?

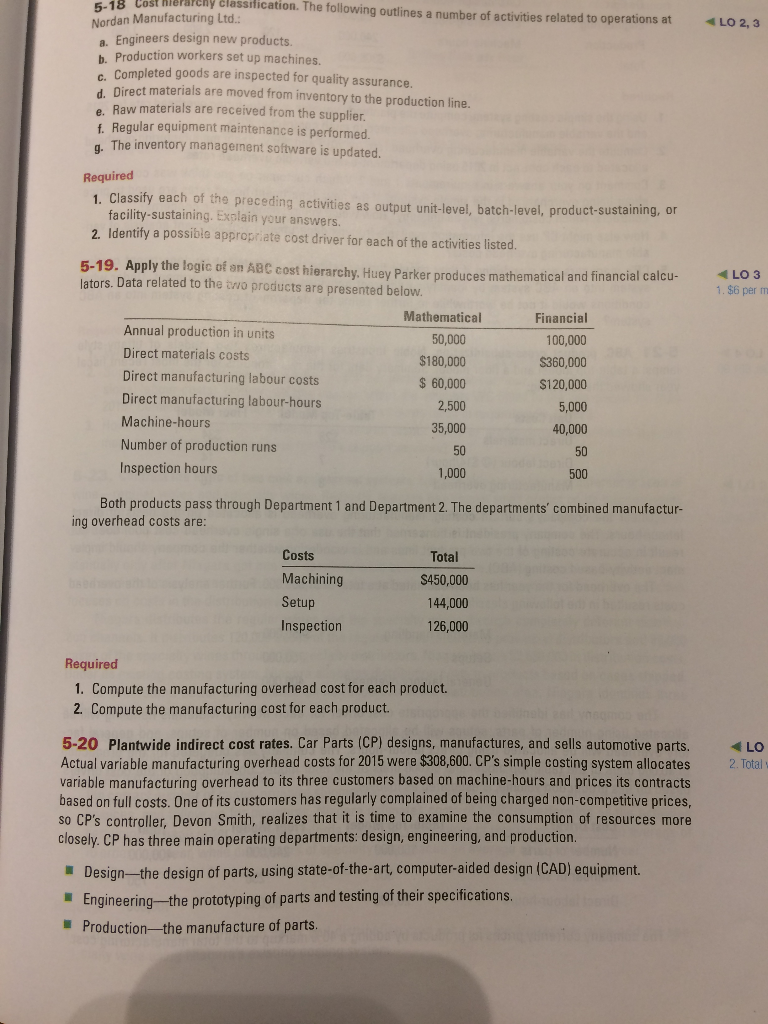

LO 2,3 Costierarchy classification. The following outlines a number of activities related to operations at Nordan Manufacturing Ltd.: a. Engineers design new products. b. Production workers set up machines. c. Completed goods are inspected for quality assurance. d. Direct materials are moved from inventory to the production line e. Raw materials are received from the supplier. f. Regular equipment maintenance is performed. a. The inventory management software is updated. Required 1. Classify each of the preceding activities as output unit-level, batch-level, product-sustaining, or facility-sustaining. Explain your answers. 2. Identify a possible appropriate cost driver for each of the activities listed. LO 3 1. $6 per 5-19. Apply the logic of an ABC cost hierarchy. Huey Parker produces mathematical and financial calcu. lators. Data related to the two products are presented below. Mathematical Financial Annual production in units 50,000 100,000 Direct materials costs $180,000 $360,000 Direct manufacturing labour costs $ 60,000 $120,000 Direct manufacturing labour-hours 2,500 5,000 Machine-hours 35,000 40,000 Number of production runs Inspection hours 1,000 500 Both products pass through Department 1 and Department 2. The departments' combined manufactur- ing overhead costs are: Costs Machining Setup Inspection Total $450,000 144,000 126,000 Required 1. Compute the manufacturing overhead cost for each product. 2. Compute the manufacturing cost for each product. LO 2. Total: 5-20 Plantwide indirect cost rates. Car Parts (CP) designs, manufactures, and sells automotive parts. Actual variable manufacturing overhead costs for 2015 were $308,600. CP's simple costing system allocates variable manufacturing overhead to its three customers based on machine-hours and prices its contracts based on full costs. One of its customers has regularly complained of being charged non-competitive prices. So CP's controller. Devon Smith, realizes that it is time to examine the consumption of resources more closely. CP has three main operating departments: design, engineering, and production Design--the design of parts, using state-of-the-art, computer-aided design (CAD) equipment. Engineering the prototyping of parts and testing of their specifications. Productionthe manufacture of parts. LO 2,3 Costierarchy classification. The following outlines a number of activities related to operations at Nordan Manufacturing Ltd.: a. Engineers design new products. b. Production workers set up machines. c. Completed goods are inspected for quality assurance. d. Direct materials are moved from inventory to the production line e. Raw materials are received from the supplier. f. Regular equipment maintenance is performed. a. The inventory management software is updated. Required 1. Classify each of the preceding activities as output unit-level, batch-level, product-sustaining, or facility-sustaining. Explain your answers. 2. Identify a possible appropriate cost driver for each of the activities listed. LO 3 1. $6 per 5-19. Apply the logic of an ABC cost hierarchy. Huey Parker produces mathematical and financial calcu. lators. Data related to the two products are presented below. Mathematical Financial Annual production in units 50,000 100,000 Direct materials costs $180,000 $360,000 Direct manufacturing labour costs $ 60,000 $120,000 Direct manufacturing labour-hours 2,500 5,000 Machine-hours 35,000 40,000 Number of production runs Inspection hours 1,000 500 Both products pass through Department 1 and Department 2. The departments' combined manufactur- ing overhead costs are: Costs Machining Setup Inspection Total $450,000 144,000 126,000 Required 1. Compute the manufacturing overhead cost for each product. 2. Compute the manufacturing cost for each product. LO 2. Total: 5-20 Plantwide indirect cost rates. Car Parts (CP) designs, manufactures, and sells automotive parts. Actual variable manufacturing overhead costs for 2015 were $308,600. CP's simple costing system allocates variable manufacturing overhead to its three customers based on machine-hours and prices its contracts based on full costs. One of its customers has regularly complained of being charged non-competitive prices. So CP's controller. Devon Smith, realizes that it is time to examine the consumption of resources more closely. CP has three main operating departments: design, engineering, and production Design--the design of parts, using state-of-the-art, computer-aided design (CAD) equipment. Engineering the prototyping of parts and testing of their specifications. Productionthe manufacture of partsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started