Can you please help me on this, thank you! This is all one question.

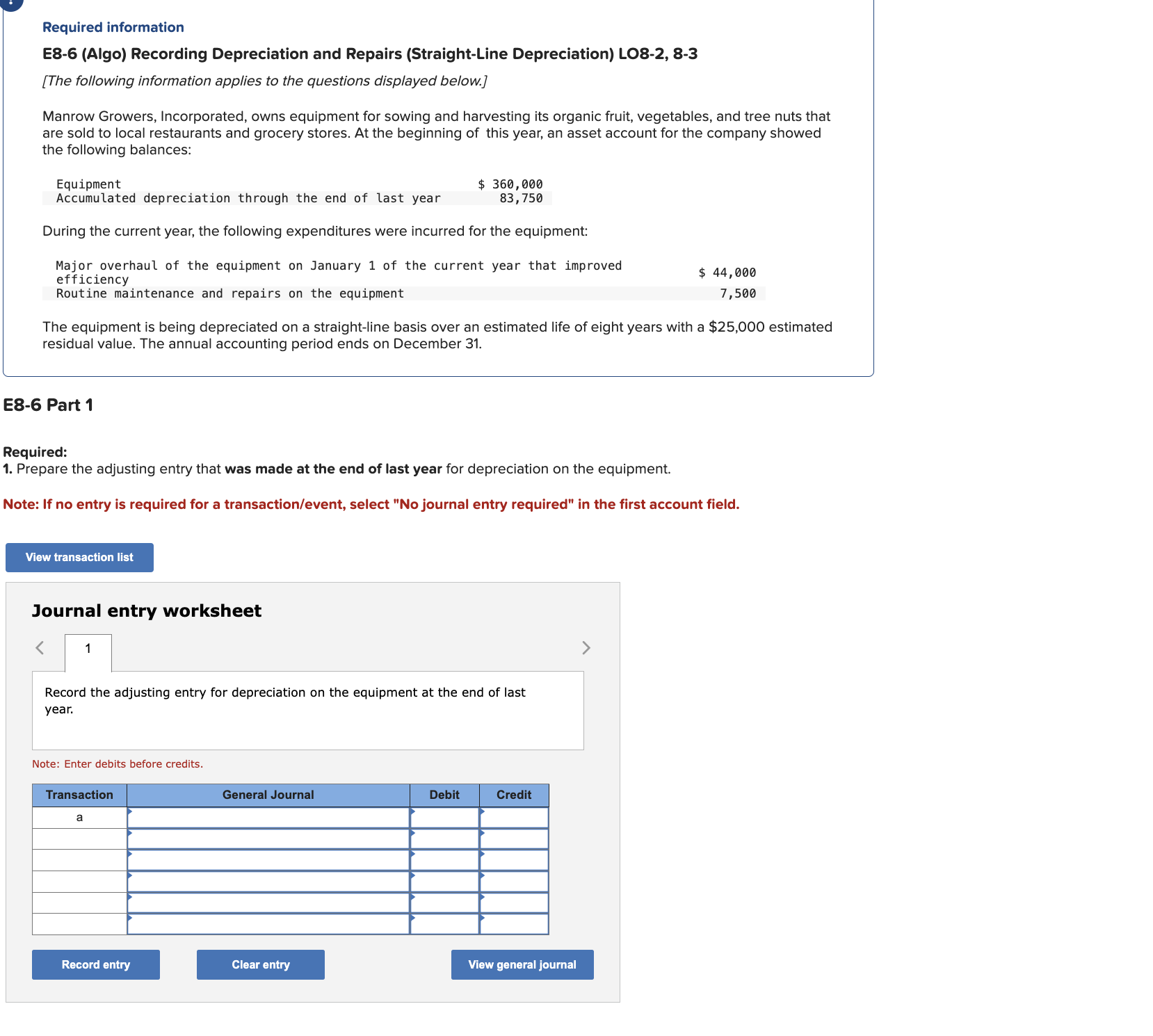

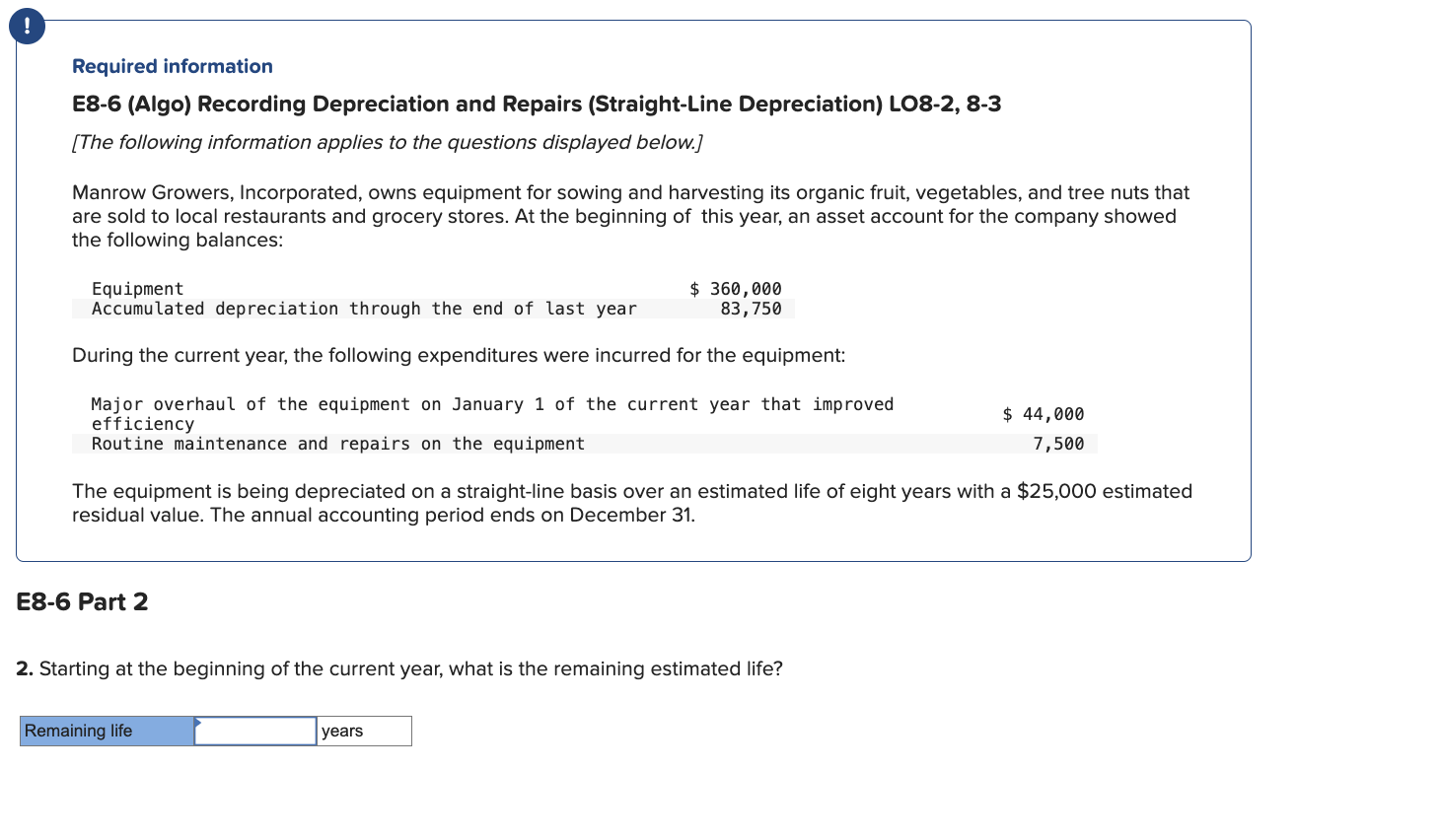

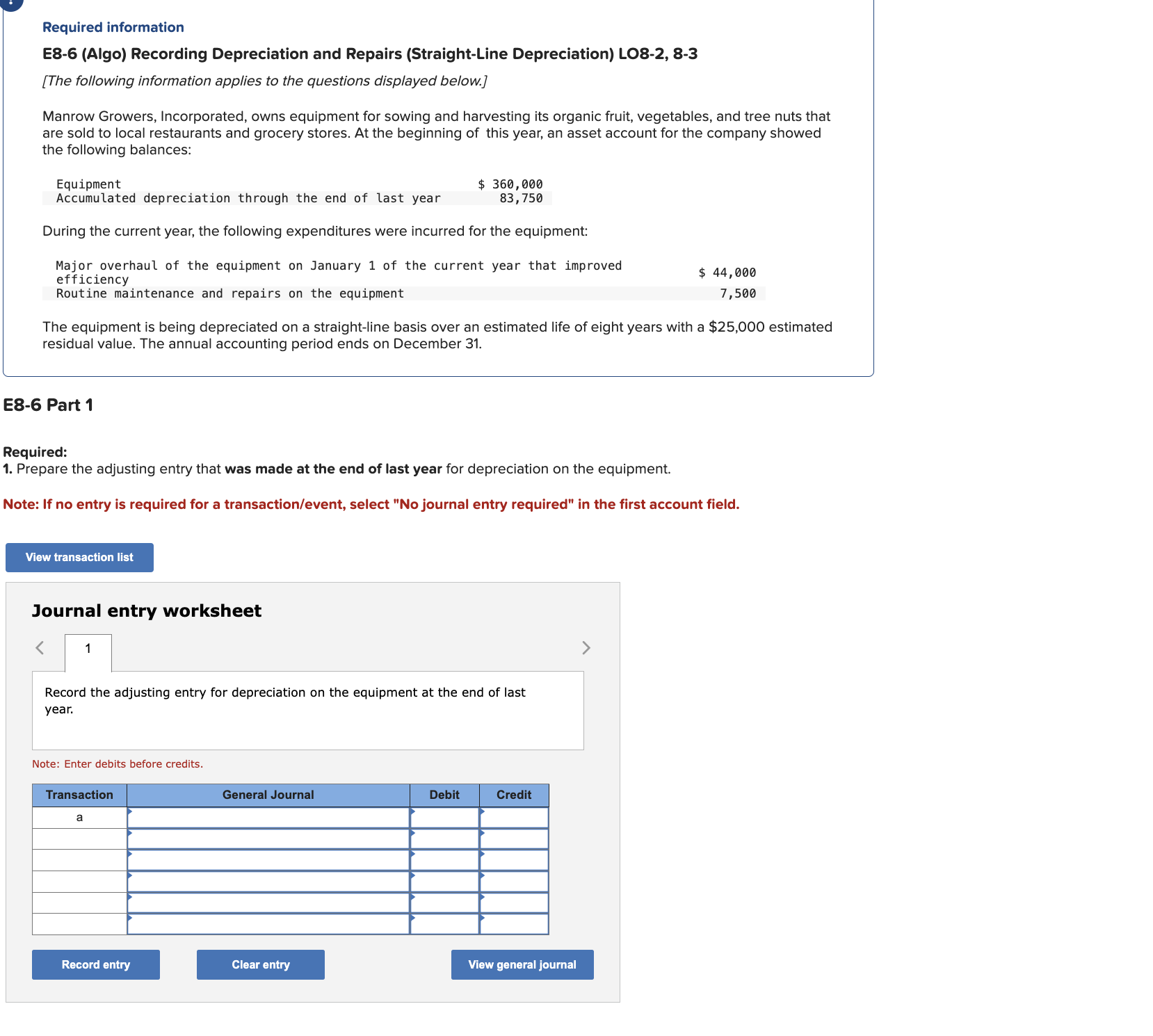

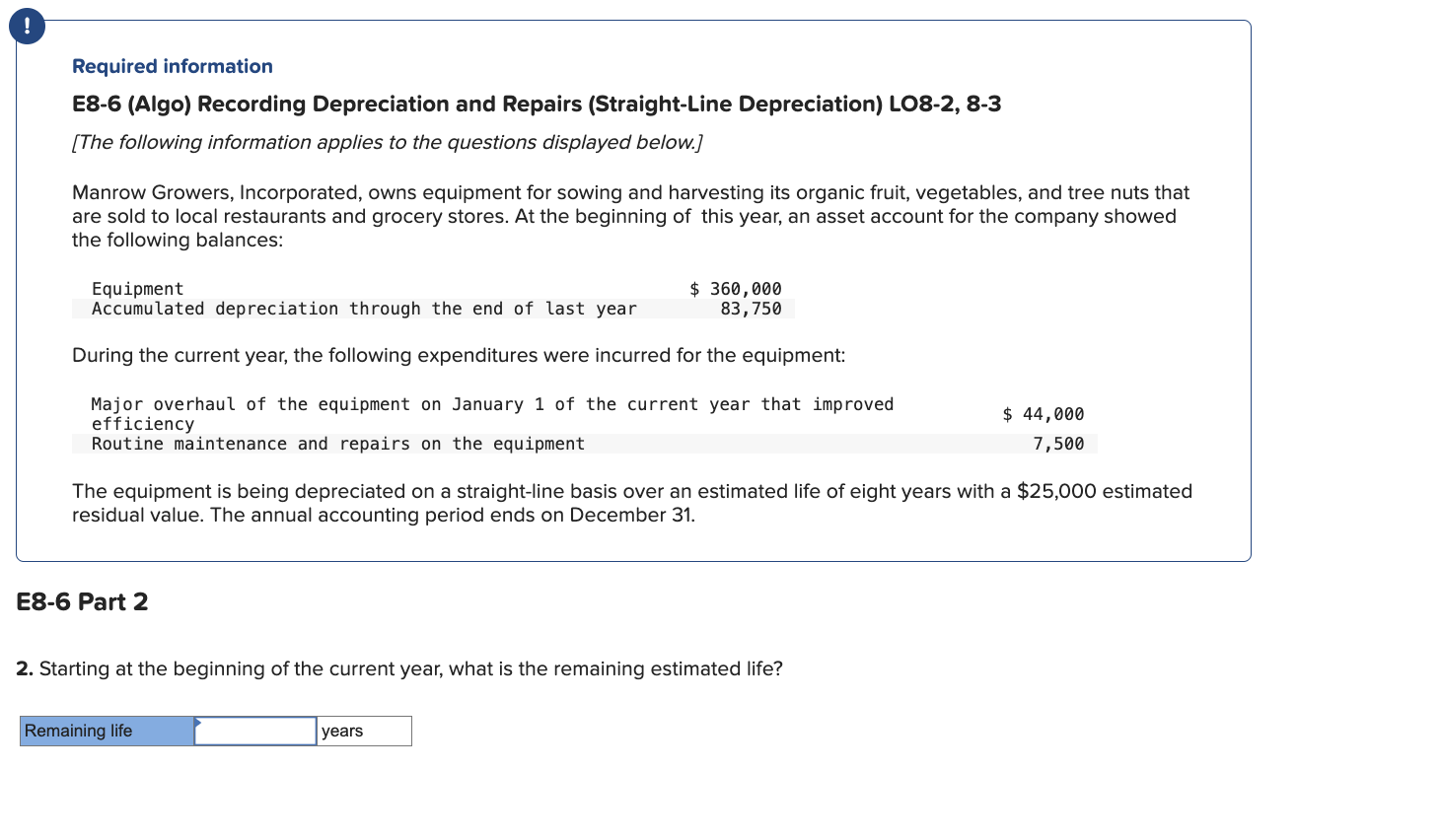

Required information E8-6 (Algo) Recording Depreciation and Repairs (Straight-Line Depreciation) L08-2, 8-3 [The following information applies to the questions displayed below.] Manrow Growers, Incorporated, owns equipment for sowing and harvesting its organic fruit, vegetables, and tree nuts that are sold to local restaurants and grocery stores. At the beginning of this year, an asset account for the company showed the following balances: Equipment Accumulated depreciation through the end of last year $360,00083,750 During the current year, the following expenditures were incurred for the equipment: Major overhaul of the equipment on January 1 of the current year that improved efficiency Routine maintenance and repairs on the equipment $44,0007,500 The equipment is being depreciated on a straight-line basis over an estimated life of eight years with a $25,000 estimated residual value. The annual accounting period ends on December 31. E8-6 Part 1 Required: 1. Prepare the adjusting entry that was made at the end of last year for depreciation on the equipment. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the adjusting entry for depreciation on the equipment at the end of last year. Note: Enter debits before credits. Required information E8-6 (Algo) Recording Depreciation and Repairs (Straight-Line Depreciation) L08-2, 8-3 [The following information applies to the questions displayed below.] Manrow Growers, Incorporated, owns equipment for sowing and harvesting its organic fruit, vegetables, and tree nuts that are sold to local restaurants and grocery stores. At the beginning of this year, an asset account for the company showed the following balances: Equipment Accumulated depreciation through the end of last year $360,000 3,750 During the current year, the following expenditures were incurred for the equipment: Major overhaul of the equipment on January 1 of the current year that improved efficiency Routine maintenance and repairs on the equipment $44,0007,500 The equipment is being depreciated on a straight-line basis over an estimated life of eight years with a $25,000 estimated residual value. The annual accounting period ends on December 31. E8-6 Part 2 2. Starting at the beginning of the current year, what is the remaining estimated life