Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please help me solve the part D? I got all the all the results for part a,b,and c. Oriole Sawmill Co. runs rough

Can you please help me solve the part D? I got all the all the results for part a,b,and c.

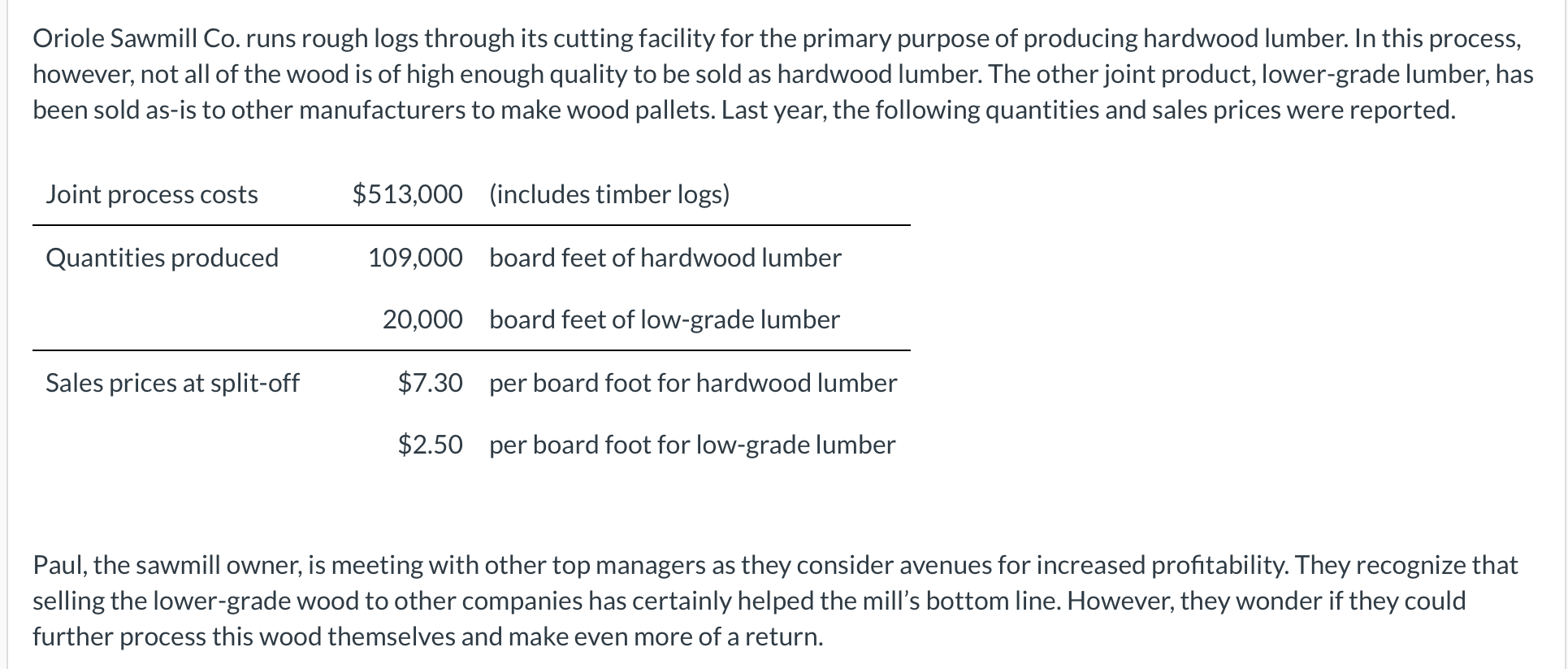

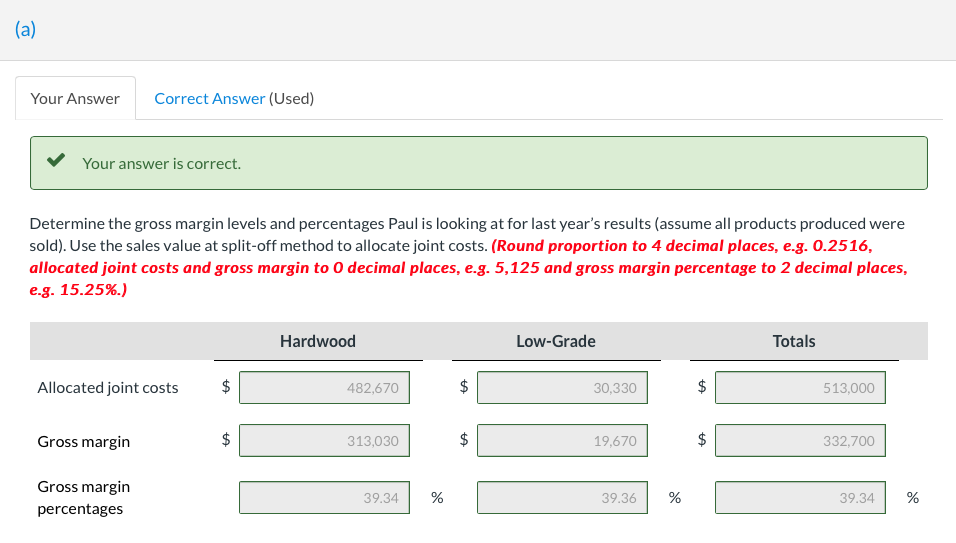

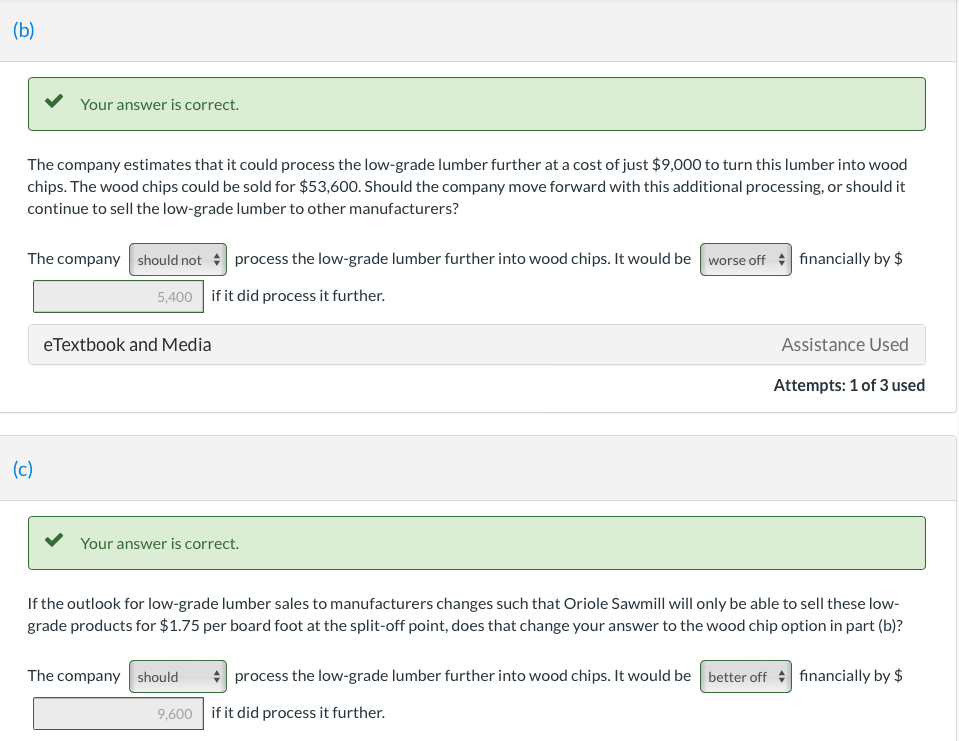

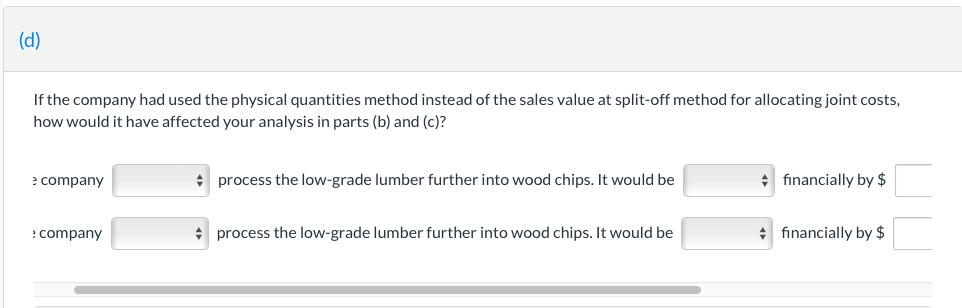

Oriole Sawmill Co. runs rough logs through its cutting facility for the primary purpose of producing hardwood lumber. In this process, however, not all of the wood is of high enough quality to be sold as hardwood lumber. The other joint product, lower-grade lumber, has been sold as-is to other manufacturers to make wood pallets. Last year, the following quantities and sales prices were reported. Paul, the sawmill owner, is meeting with other top managers as they consider avenues for increased profitability. They recognize that selling the lower-grade wood to other companies has certainly helped the mill's bottom line. However, they wonder if they could further process this wood themselves and make even more of a return. Determine the gross margin levels and percentages Paul is looking at for last year's results (assume all products produced were sold). Use the sales value at split-off method to allocate joint costs. (Round proportion to 4 decimal places, e.g. 0.2516, allocated joint costs and gross margin to 0 decimal places, e.g. 5,125 and gross margin percentage to 2 decimal places, e.g. 15.25\%.) The company estimates that it could process the low-grade lumber further at a cost of just $9,000 to turn this lumber into wood chips. The wood chips could be sold for $53,600. Should the company move forward with this additional processing, or should it continue to sell the low-grade lumber to other manufacturers? The company process the low-grade lumber further into wood chips. It would be financially by $ if it did process it further. eTextbook and Media Assistance Used Attempts: 1 of 3 used (c) Your answer is correct. If the outlook for low-grade lumber sales to manufacturers changes such that Oriole Sawmill will only be able to sell these lowgrade products for $1.75 per board foot at the split-off point, does that change your answer to the wood chip option in part (b)? The company process the low-grade lumber further into wood chips. It would be financially by $ if it did process it further. If the company had used the physical quantities method instead of the sales value at split-off method for allocating joint costs, how would it have affected your analysis in parts (b) and (c)? z company process the low-grade lumber further into wood chips. It would be financially by $ company process the low-grade lumber further into wood chips. It would be financially by $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started