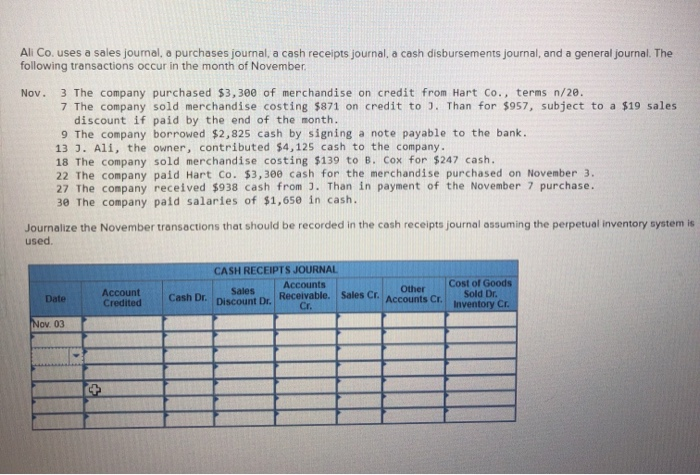

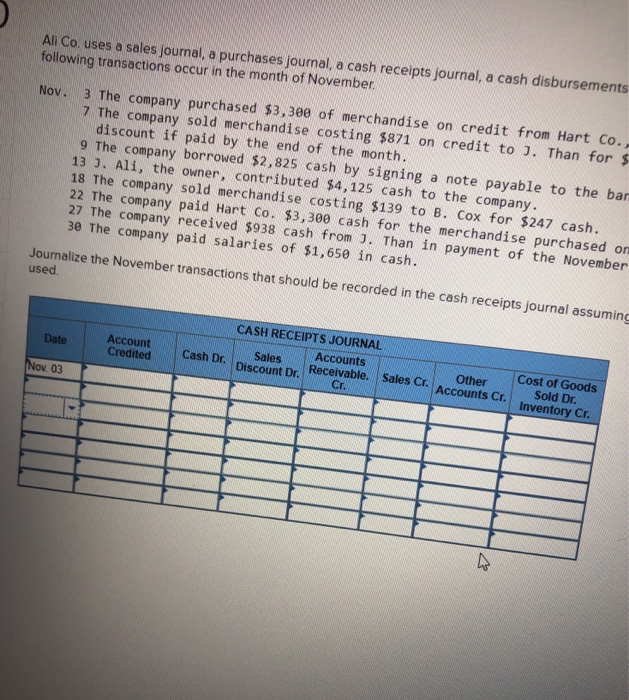

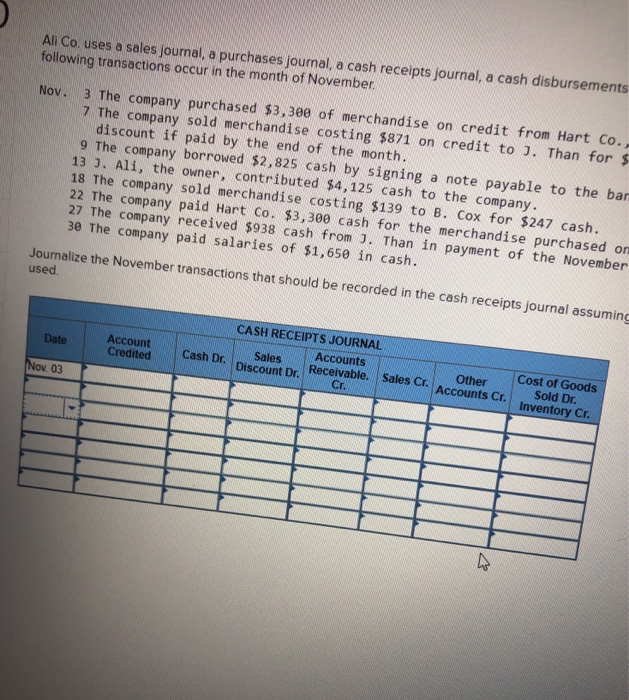

Ali Co. uses a sales journal, a purchases journal, a cash receipts journal, a cash disbursements journal, and a general journal. The following transactions occur in the month of November Nov. 3 The company purchased $3,300 of merchandise on credit from Hart Co., terms n/20. 7 The company sold merchandise costing $871 on credit to ). Than for $957, subject to a $19 sales discount if paid by the end of the month. 9 The company borrowed $2,825 cash by signing a note payable to the bank. 13 J. Ali, the owner, contributed $4,125 cash to the company. 18 The company sold merchandise costing $139 to B. Cox for $247 cash. 22 The company paid Hart Co. $3,300 cash for the merchandise purchased on November 3. 27 The company received $938 cash from ). Than in payment of the November 7 purchase. 30 The company paid salaries of $1,650 in cash. Journalize the November transactions that should be recorded in the cash receipts journal assuming the perpetual inventory system is used. CASH RECEIPTS JOURNAL Sales Accounts Date Account Credited Cost of Goods Sales Other able CE Sales CI Accounts CE Discount De Receivable. Sold Dr. inventory Cr. Nov. 03 Ali Co. uses a sales journal, a purchases journal, a cash receipts journal, a cash disbursements following transactions occur in the month of November Nov. 3. The company purchased $3,300 of merchandise on credit from Hart Co. 7 The company sold merchandise costing $871 on credit to ]. Than for $ discount if paid by the end of the month. 9 The company borrowed $2,825 cash by signing a note payable to the bar 13 J. Ali, the owner, contributed $4,125 cash to the company. 18 The company sold merchandise costing $139 to B. Cox for $247 cash. 22 The company paid Hart Co. $3,300 cash for the merchandise purchased on 27 The company received $938 cash from J. Than in payment of the November 30 The company paid salaries of $1,650 in cash. Journalize the November transactions that should be recorded in the cash receipts journal assuming used. CASH RECEIPTS JOURNAL Date Account Credited Cash Dr Nov. 03 Sales Accounts Discount Dr. Receivable. Sales Cr Other Other Accounts Cr. Cost of Goods Sold Dr. Inventory Cr