can you please help me with number 70,69,68,67

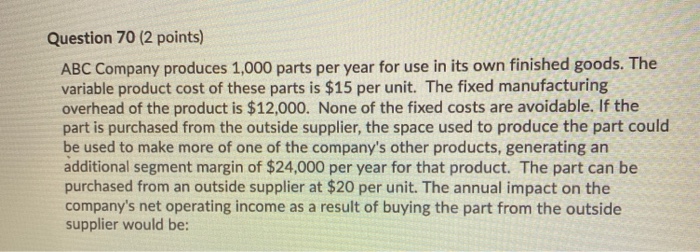

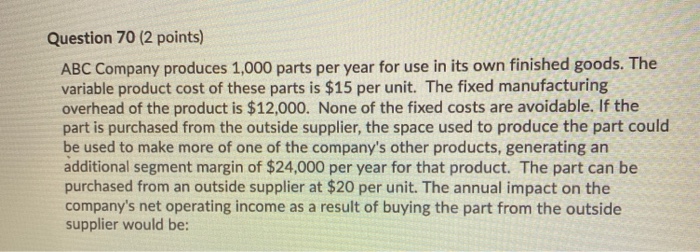

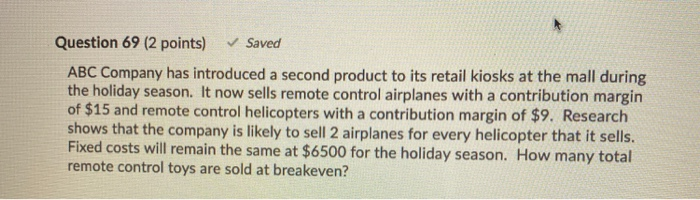

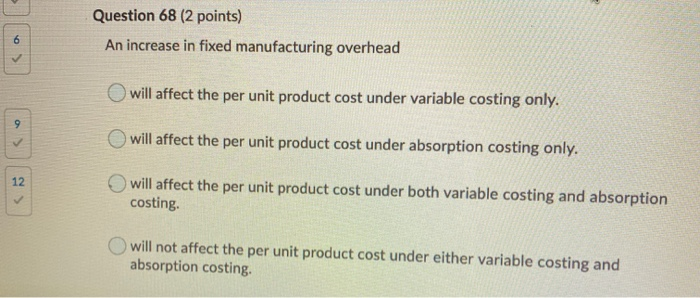

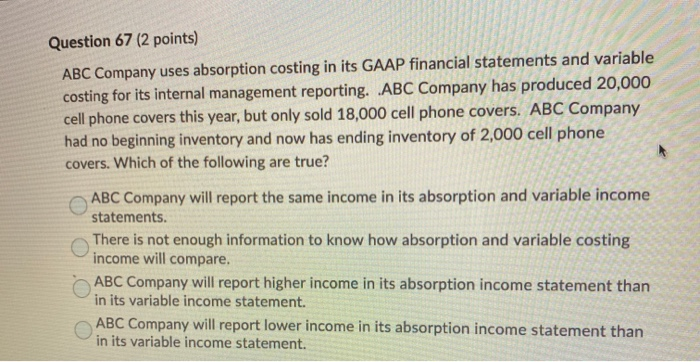

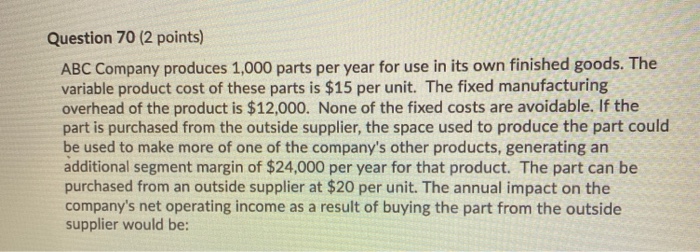

Question 70 (2 points) ABC Company produces 1,000 parts per year for use in its own finished goods. The variable product cost of these parts is $15 per unit. The fixed manufacturing overhead of the product is $12,000. None of the fixed costs are avoidable. If the part is purchased from the outside supplier, the space used to produce the part could be used to make more of one of the company's other products, generating an additional segment margin of $24,000 per year for that product. The part can be purchased from an outside supplier at $20 per unit. The annual impact on the company's net operating income as a result of buying the part from the outside supplier would be: Question 69 (2 points) Saved ABC Company has introduced a second product to its retail kiosks at the mall during the holiday season. It now sells remote control airplanes with a contribution margin of $15 and remote control helicopters with a contribution margin of $9. Research shows that the company is likely to sell 2 airplanes for every helicopter that it sells. Fixed costs will remain the same at $6500 for the holiday season. How many total remote control toys are sold at breakeven? Question 68 (2 points) An increase in fixed manufacturing overhead 6 will affect the per unit product cost under variable costing only. 9 will affect the per unit product cost under absorption costing only. 12 will affect the per unit product cost under both variable costing and absorption costing. will not affect the per unit product cost under either variable costing and absorption costing. Question 67 (2 points) ABC Company uses absorption costing in its GAAP financial statements and variable costing for its internal management reporting. ABC Company has produced 20,000 cell phone covers this year, but only sold 18,000 cell phone covers. ABC Company had no beginning inventory and now has ending inventory of 2,000 cell phone covers. Which of the following are true? ABC Company will report the same income in its absorption and variable income statements. There is not enough information to know how absorption and variable costing income will compare. ABC Company will report higher income in its absorption income statement than in its variable income statement. ABC Company will report lower income in its absorption income statement than in its variable income statement