Can you please help me with problem 32?

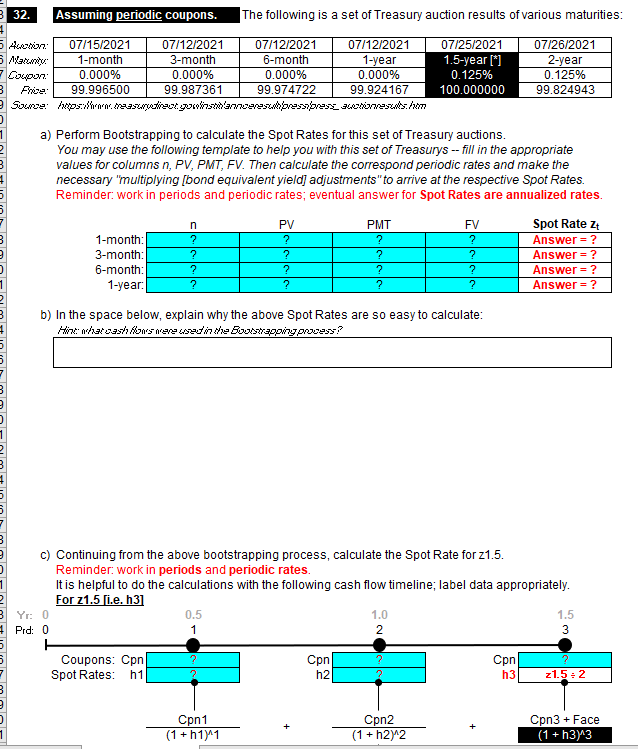

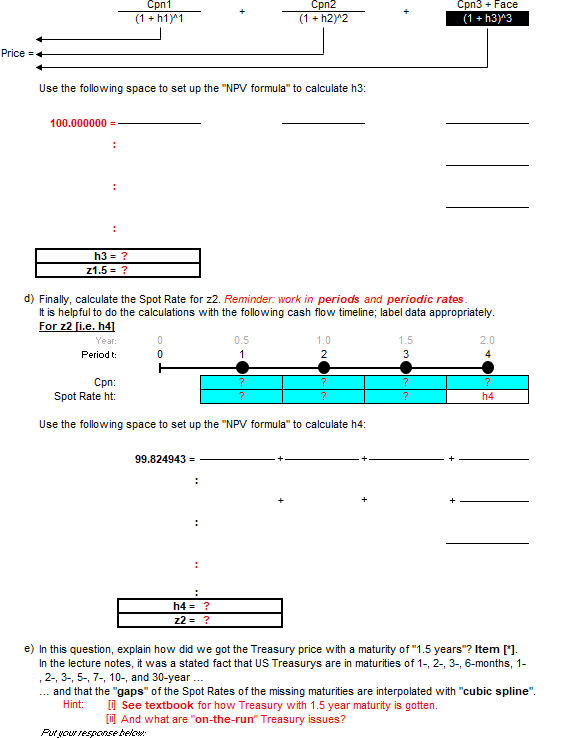

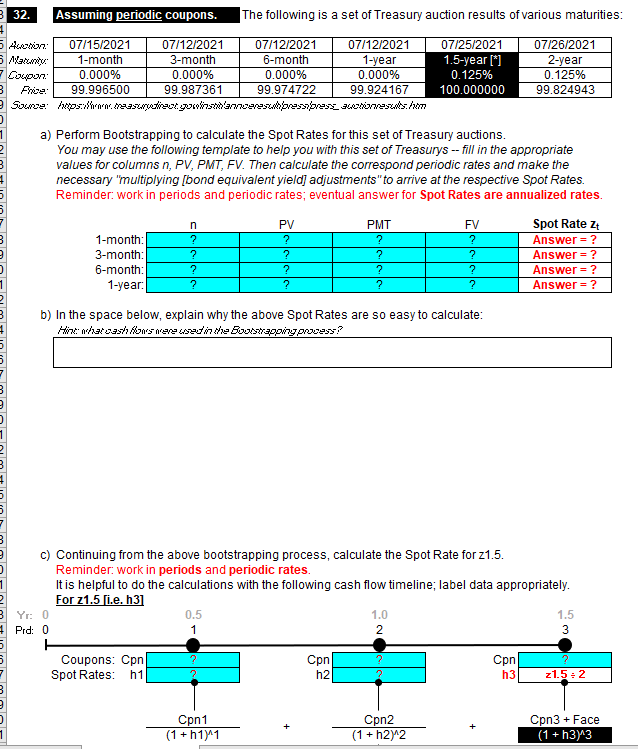

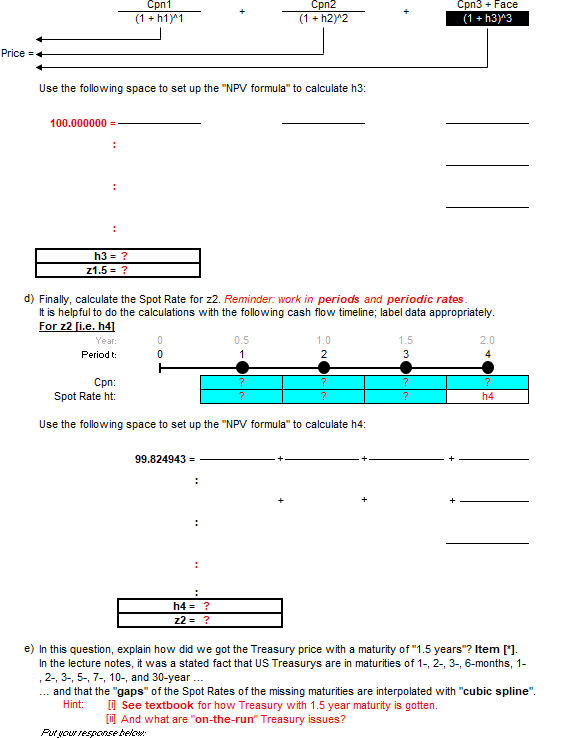

B 32. Assuming periodic coupons. The following is a set of Treasury auction results of various maturities: Awaz 07/15/2021 07/12/2021 07/12/2021 07/12/2021 Axarunt 1-month 3-month 6-month 1-year Coupon 0.000% 0.000% 0.000% 0.000% B Free 99.996500 99.987361 99.974722 99.924167 Suwe: ww.treasurvetisex. guwist'ancrash bressoress_swesents:om 07/25/2021 1.5-year [*] 0.125% 100.000000 07/26/2021 2-year 0.125% 99.824943 a) Perform Bootstrapping to calculate the Spot Rates for this set of Treasury auctions. You may use the following template to help you with this set of Treasurys -- fill in the appropriate values for columns n, PV, PMT, FV. Then calculate the correspond periodic rates and make the necessary "multiplying [bond equivalent yield] adjustments"to arrive at the respective Spot Rates. Reminder: work in periods and periodic rates; eventual answer for Spot Rates are annualized rates. PV PMT FV Spot Rate zt 1-month ? ? ? ? Answer = ? 3-month: ? ? ? Answer ? 6-month: ? ? Answer = ? 1-year: ? ? Answer = ? n ? ? ? ? ? b) In the space below, explain why the above Spot Rates are so easy to calculate: Atire: nenattasi fonts interested in the formapping pre? c) Continuing from the above bootstrapping process, calculate the Spot Rate for z1.5. Reminder: work in periods and periodic rates. It is helpful to do the calculations with the following cash flow timeline; label data appropriately. For 21.5 [i.e. h31 Yr: 0 0.5 1.0 1.5 Prd: 0 3 - Coupons: Con Cpn Cpn Spot Rates: h1 h2 h3 z1.52 1 2 Cpn1 (1 + h11 Cpn2 (1 + h22 Cpn3 + Face (1 +h313 Cpn1 (1 + h1) 1 2 (1 + h2) 2 Cpn3 + Face (1 + h3)^3 Price = + Use the following space to set up the "NPV formula" to calculate h3: 100.000000 =- : h3 = ? z1.5 = ? d) Finally, calculate the Spot Rate for 22. Reminder work in periods and periodic rates. It is helpful to do the calculations with the following cash flow timeline; label data appropriately. For 22 [i.e. h4] Year: 0.5 1.0 1.5 2.0 Period: 1 2 3 4 pn: : Spot Rate ht: h4 Use the following space to set up the "NPV formula" to calculate h4: 99.824943 = . h4 = ? z2 = ? e) In this question, explain how did we got the Treasury price with a maturity of "1.5 years"? Item [*]. In the lecture notes, it was a stated fact that US Treasurys are in maturities of 1-, 2-, 3-, 6-months, 1- , 2-, 3-, 5-,7-, 10-, and 30-year ... ... and that the "gaps" of the Spot Rates of the missing maturities are interpolated with "cubic spline". Hint: [] See textbook for how Treasury with 1.5 year maturity is gotten. [i] And what are "on-the-run" Treasury issues? Puryow response few B 32. Assuming periodic coupons. The following is a set of Treasury auction results of various maturities: Awaz 07/15/2021 07/12/2021 07/12/2021 07/12/2021 Axarunt 1-month 3-month 6-month 1-year Coupon 0.000% 0.000% 0.000% 0.000% B Free 99.996500 99.987361 99.974722 99.924167 Suwe: ww.treasurvetisex. guwist'ancrash bressoress_swesents:om 07/25/2021 1.5-year [*] 0.125% 100.000000 07/26/2021 2-year 0.125% 99.824943 a) Perform Bootstrapping to calculate the Spot Rates for this set of Treasury auctions. You may use the following template to help you with this set of Treasurys -- fill in the appropriate values for columns n, PV, PMT, FV. Then calculate the correspond periodic rates and make the necessary "multiplying [bond equivalent yield] adjustments"to arrive at the respective Spot Rates. Reminder: work in periods and periodic rates; eventual answer for Spot Rates are annualized rates. PV PMT FV Spot Rate zt 1-month ? ? ? ? Answer = ? 3-month: ? ? ? Answer ? 6-month: ? ? Answer = ? 1-year: ? ? Answer = ? n ? ? ? ? ? b) In the space below, explain why the above Spot Rates are so easy to calculate: Atire: nenattasi fonts interested in the formapping pre? c) Continuing from the above bootstrapping process, calculate the Spot Rate for z1.5. Reminder: work in periods and periodic rates. It is helpful to do the calculations with the following cash flow timeline; label data appropriately. For 21.5 [i.e. h31 Yr: 0 0.5 1.0 1.5 Prd: 0 3 - Coupons: Con Cpn Cpn Spot Rates: h1 h2 h3 z1.52 1 2 Cpn1 (1 + h11 Cpn2 (1 + h22 Cpn3 + Face (1 +h313 Cpn1 (1 + h1) 1 2 (1 + h2) 2 Cpn3 + Face (1 + h3)^3 Price = + Use the following space to set up the "NPV formula" to calculate h3: 100.000000 =- : h3 = ? z1.5 = ? d) Finally, calculate the Spot Rate for 22. Reminder work in periods and periodic rates. It is helpful to do the calculations with the following cash flow timeline; label data appropriately. For 22 [i.e. h4] Year: 0.5 1.0 1.5 2.0 Period: 1 2 3 4 pn: : Spot Rate ht: h4 Use the following space to set up the "NPV formula" to calculate h4: 99.824943 = . h4 = ? z2 = ? e) In this question, explain how did we got the Treasury price with a maturity of "1.5 years"? Item [*]. In the lecture notes, it was a stated fact that US Treasurys are in maturities of 1-, 2-, 3-, 6-months, 1- , 2-, 3-, 5-,7-, 10-, and 30-year ... ... and that the "gaps" of the Spot Rates of the missing maturities are interpolated with "cubic spline". Hint: [] See textbook for how Treasury with 1.5 year maturity is gotten. [i] And what are "on-the-run" Treasury issues? Puryow response few