Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please help me with this question? The majority of business operations in the United States have rebounded since the Covid-19 pandemic, with significant

Can you please help me with this question?

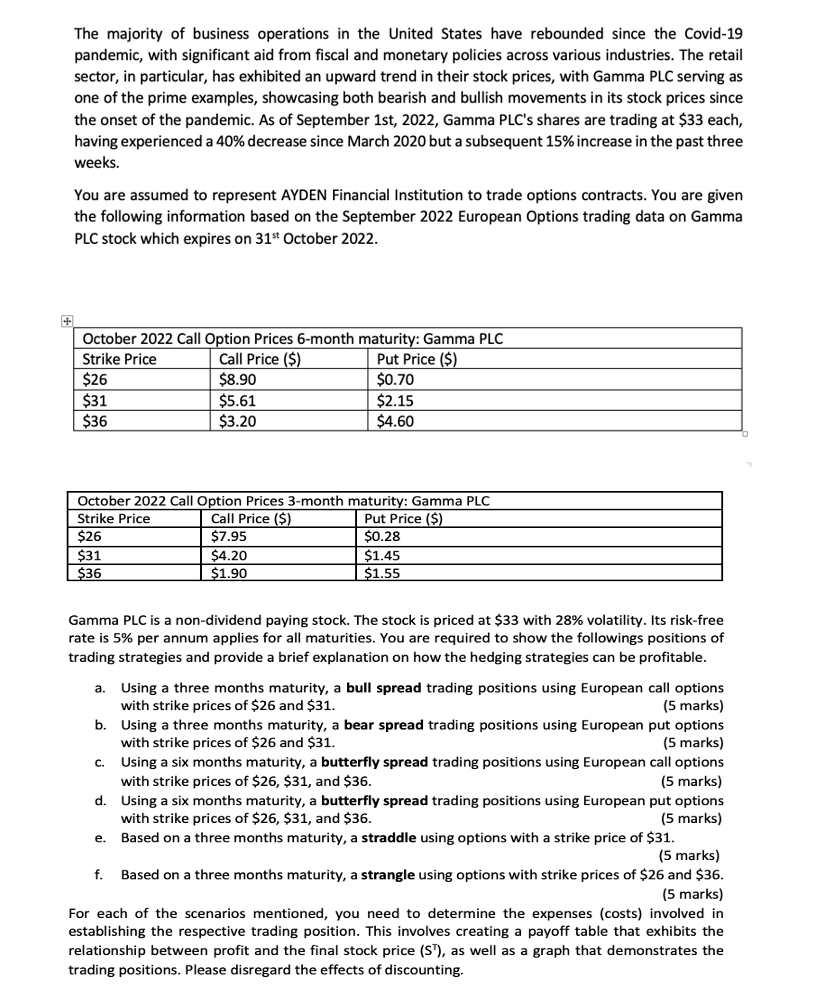

The majority of business operations in the United States have rebounded since the Covid-19 pandemic, with significant aid from fiscal and monetary policies across various industries. The retail sector, in particular, has exhibited an upward trend in their stock prices, with Gamma PLC serving as one of the prime examples, showcasing both bearish and bullish movements in its stock prices since the onset of the pandemic. As of September 1st, 2022, Gamma PLC's shares are trading at $33 each, having experienced a 40% decrease since March 2020 but a subsequent 15% increase in the past three weeks. You are assumed to represent AYDEN Financial Institution to trade options contracts. You are given the following information based on the September 2022 European Options trading data on Gamma PLC stock which expires on 31st October 2022. Gamma PLC is a non-dividend paying stock. The stock is priced at $33 with 28% volatility. Its risk-free rate is 5% per annum applies for all maturities. You are required to show the followings positions of trading strategies and provide a brief explanation on how the hedging strategies can be profitable. a. Using a three months maturity, a bull spread trading positions using European call options with strike prices of $26 and $31. (5 marks) b. Using a three months maturity, a bear spread trading positions using European put options with strike prices of $26 and $31. (5 marks) c. Using a six months maturity, a butterfly spread trading positions using European call options with strike prices of $26,$31, and $36. (5 marks) d. Using a six months maturity, a butterfly spread trading positions using European put options with strike prices of $26,$31, and $36. (5 marks) e. Based on a three months maturity, a straddle using options with a strike price of $31. (5 marks) f. Based on a three months maturity, a strangle using options with strike prices of $26 and $36. (5 marks) For each of the scenarios mentioned, you need to determine the expenses (costs) involved in establishing the respective trading position. This involves creating a payoff table that exhibits the relationship between profit and the final stock price (S), as well as a graph that demonstrates the trading positions. Please disregard the effects of discounting. The majority of business operations in the United States have rebounded since the Covid-19 pandemic, with significant aid from fiscal and monetary policies across various industries. The retail sector, in particular, has exhibited an upward trend in their stock prices, with Gamma PLC serving as one of the prime examples, showcasing both bearish and bullish movements in its stock prices since the onset of the pandemic. As of September 1st, 2022, Gamma PLC's shares are trading at $33 each, having experienced a 40% decrease since March 2020 but a subsequent 15% increase in the past three weeks. You are assumed to represent AYDEN Financial Institution to trade options contracts. You are given the following information based on the September 2022 European Options trading data on Gamma PLC stock which expires on 31st October 2022. Gamma PLC is a non-dividend paying stock. The stock is priced at $33 with 28% volatility. Its risk-free rate is 5% per annum applies for all maturities. You are required to show the followings positions of trading strategies and provide a brief explanation on how the hedging strategies can be profitable. a. Using a three months maturity, a bull spread trading positions using European call options with strike prices of $26 and $31. (5 marks) b. Using a three months maturity, a bear spread trading positions using European put options with strike prices of $26 and $31. (5 marks) c. Using a six months maturity, a butterfly spread trading positions using European call options with strike prices of $26,$31, and $36. (5 marks) d. Using a six months maturity, a butterfly spread trading positions using European put options with strike prices of $26,$31, and $36. (5 marks) e. Based on a three months maturity, a straddle using options with a strike price of $31. (5 marks) f. Based on a three months maturity, a strangle using options with strike prices of $26 and $36. (5 marks) For each of the scenarios mentioned, you need to determine the expenses (costs) involved in establishing the respective trading position. This involves creating a payoff table that exhibits the relationship between profit and the final stock price (S), as well as a graph that demonstrates the trading positions. Please disregard the effects of discountingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started