Answered step by step

Verified Expert Solution

Question

1 Approved Answer

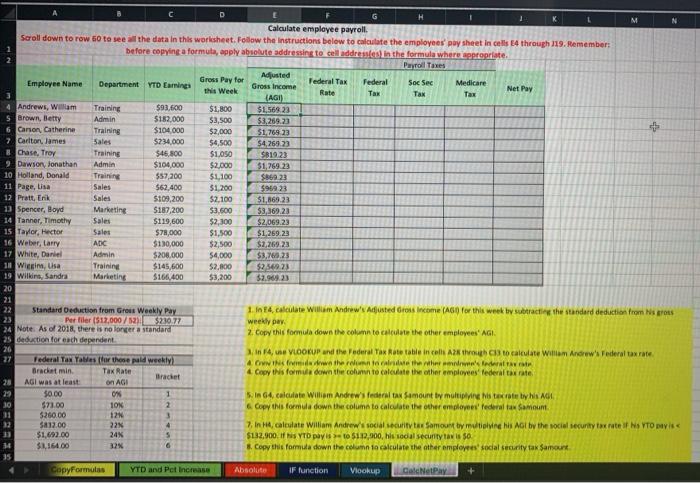

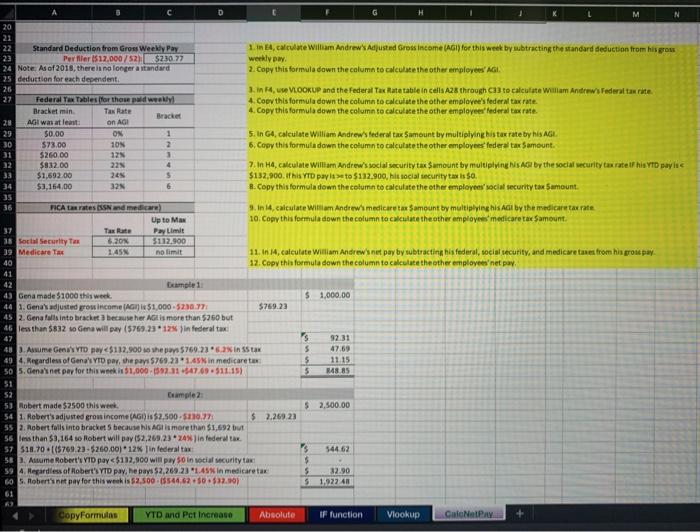

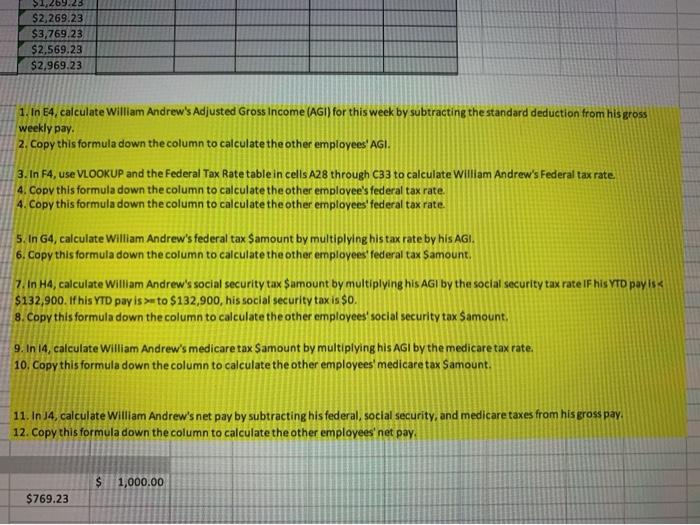

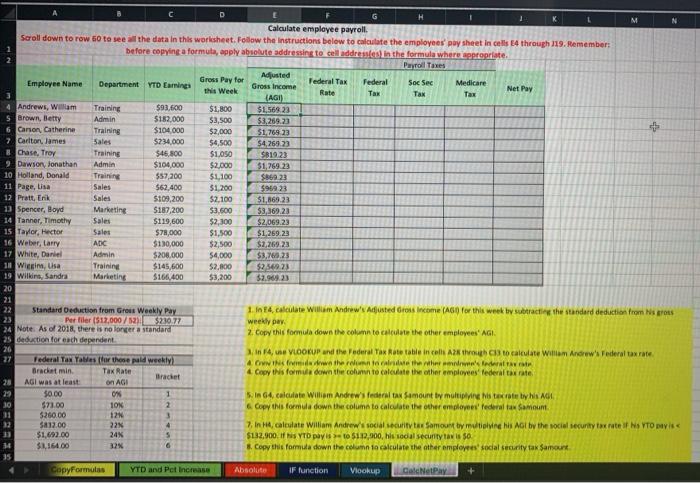

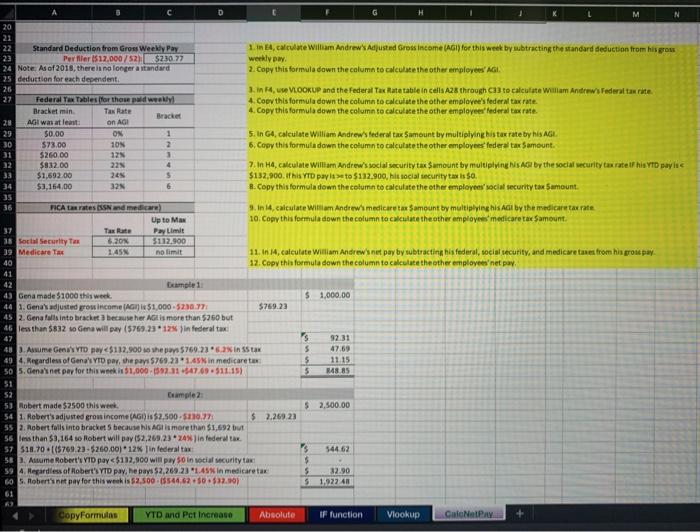

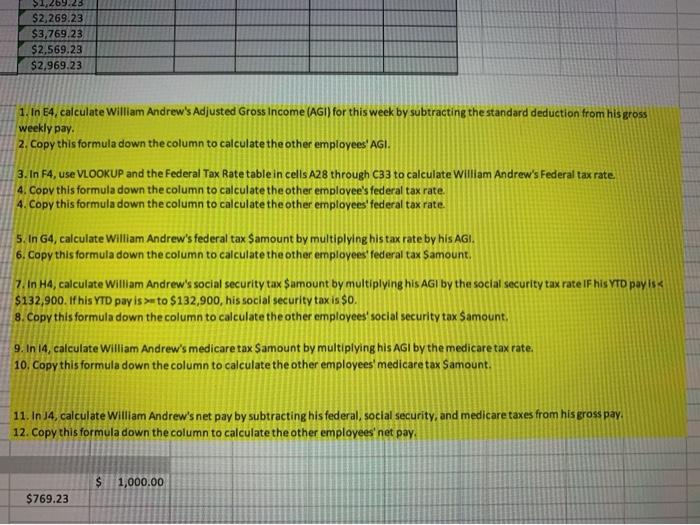

Can you please inlcude the steps and formulas used! thank you! I've completed step 1 and 2. C D M Calculate employee payroll Scroll down

Can you please inlcude the steps and formulas used! thank you! I've completed step 1 and 2.

C D M Calculate employee payroll Scroll down to row 50 to see the data in this worksheet. Follow the instructions below to calculate the employees pay sheet in cells E4 through 119. Remember: before copying a formula, apply absolute addressing to cell addresses in the formula where appropriate Payroll Taxes Adjusted Employee Name Department YTD Laming Gross Pay for Tederal Tax Federal Gross income Soc Sec Medicare This Week Net Pay Tax Tax Tax (AGI) 4 Andrews, Wam Training $93.600 $1,800 $1,568,23 s Brown, Betty Admin 5182,000 $3,500 $3,269.23 6 Canon Catherine Training $104.000 $2,000 51.76923 7. Carlton, James Sales $234.000 $4,500 $4,269.23 Chase, Troy Training $46,800 $1.050 $81923 9 Dawson, Jonathan Admin $100,000 $2,000 $1,769.23 10 Holland, Donald Training $57,200 $1,100 $869.23 11 Page, Lisa Sales $62,400 $1,200 $969 23 12 Pratt, Erik Sales $109,200 $2,100 $1,863.23 13 Spencer, Boyd Marketing 5187,200 $3,500 $3,369.23 14 Tanner, Timothy Sales $119,600 $2,300 $2,069.23 15 Taylor, Hector Sales $78,000 $1.500 $1,269.23 16 Weber, Larry ADC $130,000 $2,500 $2,269.23 17 White, Daniel Admin $200.000 $4,000 $3,76.23 11 Wiegim, Usa Training $145,600 $2,000 $2369 23 19 Wilkins, Sandra Marketing $166,400 $3,200 $2.909.23 20 21 22 Standard Deduction from Grous Weekly Pay 1. in 14, calculate William Andrew's Adjusted Gross income (AGO for this week by subtract the standard deduction from Nero 23 Per filer (512.000 / $280.77 weekly pay. 24 Note. As of 2018, there is no longer a standard 2. Copy this formula down the column to calculate the other employees' AGI. 25 deduction for each dependent 26 3, 14, WE VLOOKUP and the Federal Tax Rate table incelik his to calculate William Antwederalne 27 Federal Tax Yates for these pad weekly 4. Om die water to calidate the there's death Bradat min Tax Rate 4. Copy this formule down the column to calculate the other employees' federal tax rate 28 AGI was at least Bracket O AGI 29 $0.00 0% 1 Sin G4, calculate William Andrew's federal tax amount by multiplying to rate this 30 $71.00 10% 2 6. Copy this formula down the column to calculate the other employees' federal tax Samount $260.00 12 3 $$12.00 223 4 7. In calculate William Andrew's social security tax Samount by multiling his Act by the social security trate if NS YTO DIVIS $1,692.00 24 5 $132.900. If his YTD pays $112,000, his social security tavis 50 14 $1,164.00 32 8. Copy this formula down the column to calculate the other employees' social security tax Samount 35 CopyFormulas YTD and Pet Increase Absolute IF function Vuoi dep CaldNPAY M N 20 1.1 A calculate William Andrews Adjusted Gross income (AGI) for this week by wbtracting the standard deduction from his grow weekly pay 2. Copy this formula down the column to calculate the other employees' AGI. 3. in , US VLOOKUP and the Federal Tax Rate table in cells A28 through 13 to calculate wimam Andrews Federaitancate 4. Copy this formula down the column to calculate the other employee's federal tax rate. 4. Copy this formula down the column to calculate the other employees' federal tax rate. 10 21 22 Standard Deduction from Gross Weekly Pay 23 Perfiler $17.000 752) $230.77 24 Note: As of 2018, there is no longer a standard 25 deduction for each dependent 26 27 Federal Tex Tables for those pad weekly Bracket min Tax Rate Bracket 28 AGI was at least on AGI 29 $0.00 ON 1 30 $73.00 2 11 $260.00 12N 3 32 $832.00 225 4 33 $1,692.00 245 5 34 $3,164.00 32 6 35 36 RICA tax rates and medicare Up to Max 97 Tax Pay Limit 18 Social Security Tax 6.20N $112.900 39 Medicare Tax 1.45 no limit 40 41 42 Example 1 43 Gena made $1000 this week. 44 1. Gena's adjusted grow income (AGI) Is51,000 - 5280.77 45 2. Genfalls into bracket because her Al is more than $260 but 16 less than 5832 to Gena will pay (5769.23 125 in federal tax 5. In G4, calculate William Andrew's federal tax Sumount by multiplying his tax rate by his AGI. 6. Copy this formula down the column to calculate the other employees federal tax amount 7. In H4, calculate William Andrew's social security tax Samount by multiplying his by the social security tax rate of his YTD payin $132,900. If his YTD pay is to $112.900, hit social security tax isso. 8. Copy this formula down the column to calculate the other employees' social security tax Sumount. in l. calculate William Andrew's medicaretas Samount by multiplying his Adi by the medicare tax rate 10. Copy this formula down the column to calculate the other employees medicare tax Samount 11. In 14, calculate William Andrew's net pay by subtracting his federal, social security, and medicare taxes from his groue pay. 12. Copy this formula down the column to calculate the other employees' net pay $ 1.000.00 $769.23 5 5 5 92.31 47.69 11.15 148.85 $ 2,500.00 4. Asume Gena YTD p

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started