Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please provide steps thank you Problem 5-27 (Algo) Expansion, break-even analysis, and leverage [LO5-2, 5-3, 5-4] Delsing Canning Company is considering an expansion

can you please provide steps thank you

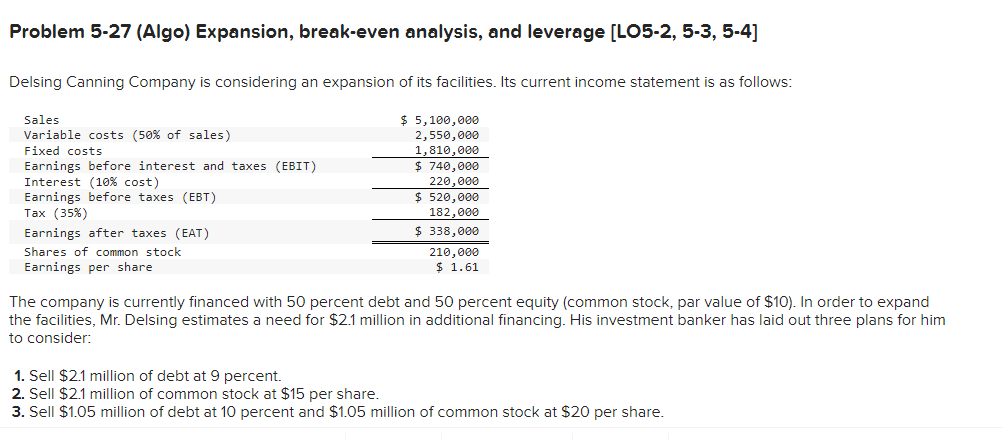

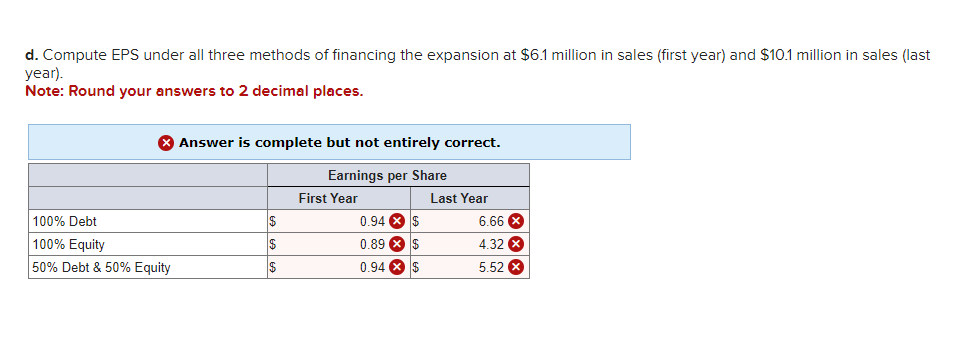

Problem 5-27 (Algo) Expansion, break-even analysis, and leverage [LO5-2, 5-3, 5-4] Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as follows: The company is currently financed with 50 percent debt and 50 percent equity (common stock, par value of $10). In order to expand the facilities, Mr. Delsing estimates a need for $2.1 million in additional financing. His investment banker has laid out three plans for him to consider: 1. Sell $2.1 million of debt at 9 percent. 2. Sell $2.1 million of common stock at $15 per share. 3. Sell $1.05 million of debt at 10 percent and $1.05 million of common stock at $20 per share. d. Compute EPS under all three methods of financing the expansion at $6.1 million in sales (first year) and $10.1 million in sales (last year). Note: Round your answers to 2 decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started