Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please provide the formula for how to solve this. Can you show the actual calculation so I can understand it. The information contained

Can you please provide the formula for how to solve this. Can you show the actual calculation so I can understand it.

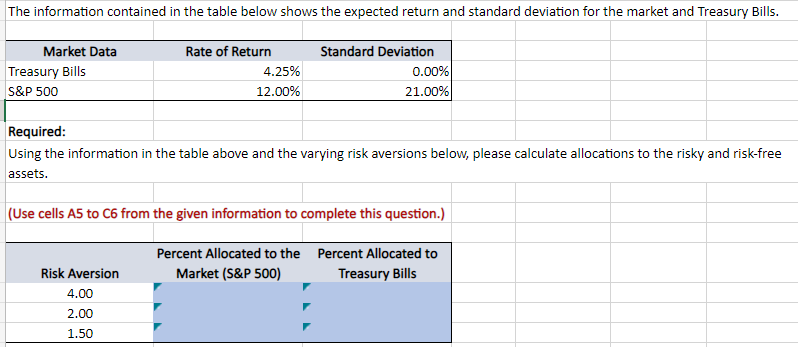

The information contained in the table below shows the expected return and standard deviation for the market and Treasury Bills. \begin{tabular}{|l|r|r|} \hline \multicolumn{1}{|c|}{ Market Data } & Rate of Return & Standard Deviation \\ \hline Treasury Bills & 4.25% & 0.00% \\ \hline S\&P 500 & 12.00% & 21.00% \\ \hline & & \\ \hline Required: & & \\ \hline \end{tabular} Using the information in the table above and the varying risk aversions below, please calculate allocations to the risky and risk-free assets. (Use cells A5 to C6 from the given information to complete this question.)

The information contained in the table below shows the expected return and standard deviation for the market and Treasury Bills. \begin{tabular}{|l|r|r|} \hline \multicolumn{1}{|c|}{ Market Data } & Rate of Return & Standard Deviation \\ \hline Treasury Bills & 4.25% & 0.00% \\ \hline S\&P 500 & 12.00% & 21.00% \\ \hline & & \\ \hline Required: & & \\ \hline \end{tabular} Using the information in the table above and the varying risk aversions below, please calculate allocations to the risky and risk-free assets. (Use cells A5 to C6 from the given information to complete this question.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started