Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please show working out and explaintion to why for each answer if possible Question C2 (Monitoring Your Position). Let's use the following information

Can you please show working out and explaintion to why for each answer if possible

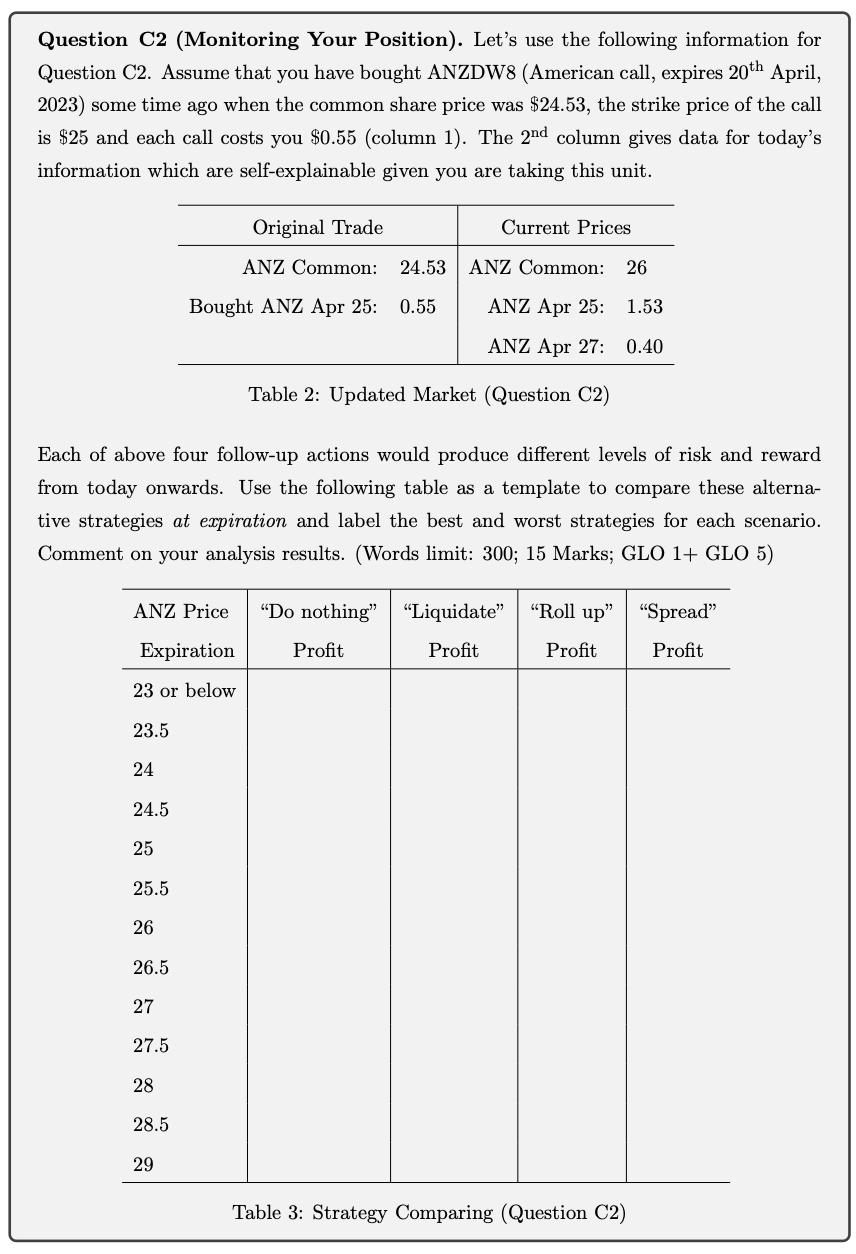

Question C2 (Monitoring Your Position). Let's use the following information for Question C2. Assume that you have bought ANZDW8 (American call, expires 20th April, 2023) some time ago when the common share price was $24.53, the strike price of the call is $25 and each call costs you $0.55 (column 1). The 2nd column gives data for today's information which are self-explainable given you are taking this unit. Table 2: Updated Market (Question C2) Each of above four follow-up actions would produce different levels of risk and reward from today onwards. Use the following table as a template to compare these alternative strategies at expiration and label the best and worst strategies for each scenario. Comment on your analysis results. (Words limit: 300; 15 Marks; GLO 1+ GLO 5) I'able 3: Strategy Comparing (Question C"2)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started