can you please solve all three question, im trying to conserve my questions

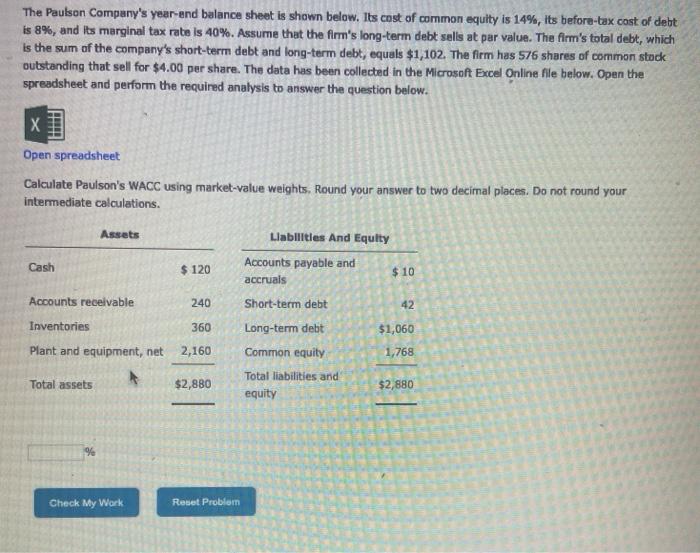

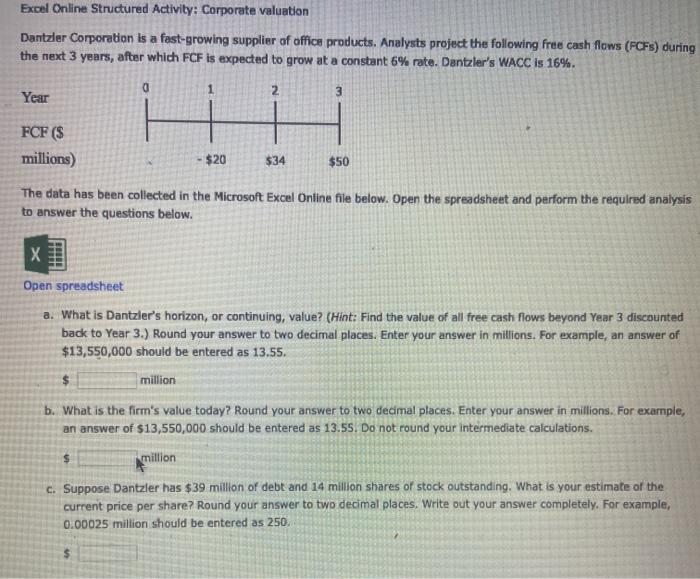

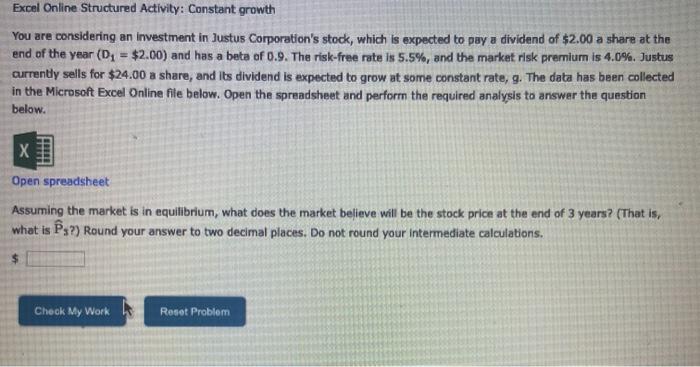

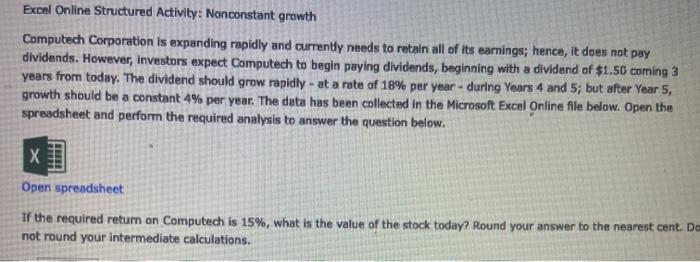

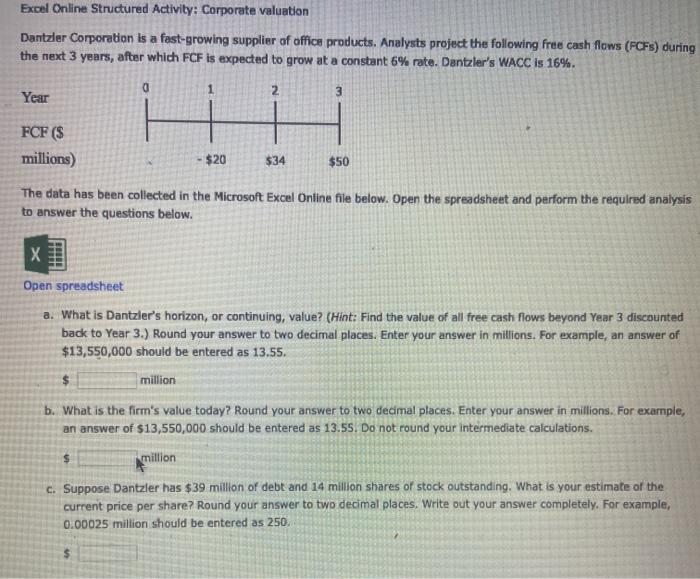

Excel Online Structured Activity: Nonconstant growth Computech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $1.50 coming 3 years from today. The dividend should grow rapidly - at a rate of 18% per year - during Years 4 and 5; but after Year 5, growth should be a constant 4% per year. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet If the required return on Computech is 15%, what is the value of the stock today? Round your answer to the nearest cent. De not round your intermediate calculations. Excel Online Structured Activity: Corporate valuation Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFs) during the next 3 years, after which FCF is expected to grow at a constant 6% rate. Dantzler's WACC is 16%. 0 2 3 Year FCF ($ millions) $20 $34 $50 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. X Open spreadsheet a. What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. $ million $ b. What is the firm's value today? Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round your intermediate calculations. million C. Suppose Dantzler has $39 million of debt and 14 million shares of stock outstanding. What is your estimate of the current price per share? Round your answer to two decimal places. Write out your answer completely. For example, 0.00025 million should be entered as 250. The Paulson Company's year and balance sheet is shown below. Its cost of common equity is 14%, its before-tax cost of debt is 8%, and its marginal tax rate is 40%. Assume that the firm's long-term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1,102. The firm has 576 shares of common stock outstanding that sell for $4.00 per share. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet Calculate Paulson's WACC using market value weights, Round your answer to two decimal places. Do not round your intermediate calculations. Assets Llabilities And Equity Cash $ 120 Accounts payable and accruals $ 10 240 42 Accounts receivable Inventories Plant and equipment, net 360 $1,060 2,160 Short-term debt Long-term debt Common equity Total liabilities and equity 1,768 Total assets $2,880 $2,880 94 Check My Work Reset

can you please solve all three question, im trying to conserve my questions

can you please solve all three question, im trying to conserve my questions