Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please solve question 7 and 8? Cost of capital 1. Five years ago. Ponsonic Ltd issued a 20-year, 12% coupon bond. The bonds

Can you please solve question 7 and 8?

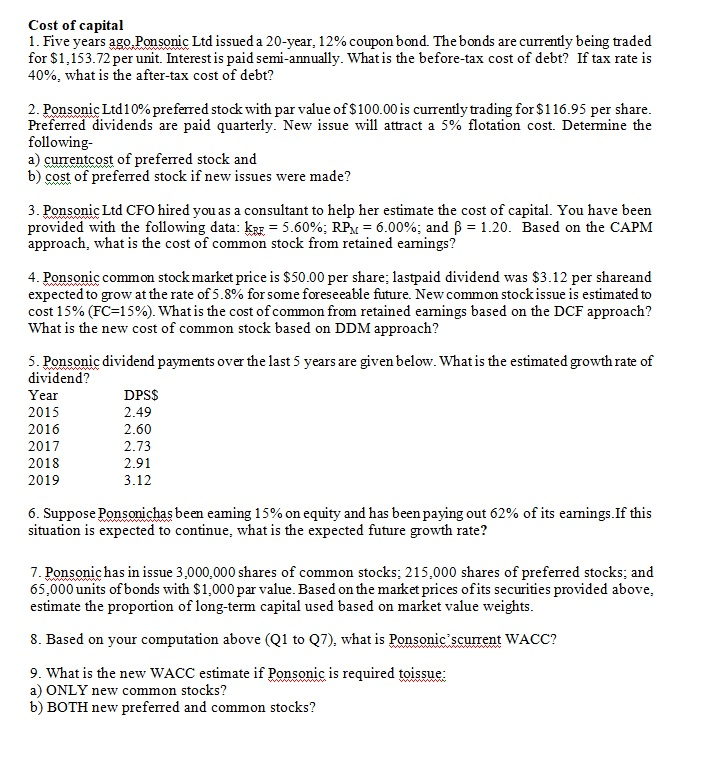

Cost of capital 1. Five years ago. Ponsonic Ltd issued a 20-year, 12% coupon bond. The bonds are currently being traded for $1.153.72 per unit. Interest is paid semi-annually. What is the before-tax cost of debt? If tax rate is 40%, what is the after-tax cost of debt? 2. Ponsonic Ltd 10% preferred stock with par value of $100.00 is currently trading for $116.95 per share. Preferred dividends are paid quarterly. New issue will attract a 5% flotation cost. Determine the following- a) currentcost of preferred stock and b) cost of preferred stock if new issues were made? 3. Ponsonic Ltd CFO hired you as a consultant to help her estimate the cost of capital. You have been provided with the following data: krF = 5.60%; RPM = 6.00%; and B = 1.20. Based on the CAPM approach, what is the cost of common stock from retained earnings? 4. Ponsonic common stock market price is $50.00 per share: lastpaid dividend was $3.12 per shareand expected to grow at the rate of 5.8% for some foreseeable future. New common stock issue is estimated to cost 15% (FC=15%). What is the cost of common from retained earings based on the DCF approach? What is the new cost of common stock based on DDM approach? Year 5. Ponsonic dividend payments over the last 5 years are given below. What is the estimated growth rate of dividend? DPS$ 2015 2.49 2016 2.60 2017 2.73 2018 2.91 2019 3.12 6. Suppose Ponsonichas been eaming 15% on equity and has been paying out 62% of its earnings. If this situation is expected to continue, what is the expected future growth rate? 7. Ponsonic has in issue 3,000,000 shares of common stocks: 215,000 shares of preferred stocks; and 65,000 units of bonds with $1,000 par value. Based on the market prices of its securities provided above, estimate the proportion of long-term capital used based on market value weights. 8. Based on your computation above (Q1 to 27), what is Ponsonic scurrent WACC? 9. What is the new WACC estimate if Ponsonic is required toissue: a) ONLY new common stocks? b) BOTH new preferred and common stocks? Cost of capital 1. Five years ago. Ponsonic Ltd issued a 20-year, 12% coupon bond. The bonds are currently being traded for $1.153.72 per unit. Interest is paid semi-annually. What is the before-tax cost of debt? If tax rate is 40%, what is the after-tax cost of debt? 2. Ponsonic Ltd 10% preferred stock with par value of $100.00 is currently trading for $116.95 per share. Preferred dividends are paid quarterly. New issue will attract a 5% flotation cost. Determine the following- a) currentcost of preferred stock and b) cost of preferred stock if new issues were made? 3. Ponsonic Ltd CFO hired you as a consultant to help her estimate the cost of capital. You have been provided with the following data: krF = 5.60%; RPM = 6.00%; and B = 1.20. Based on the CAPM approach, what is the cost of common stock from retained earnings? 4. Ponsonic common stock market price is $50.00 per share: lastpaid dividend was $3.12 per shareand expected to grow at the rate of 5.8% for some foreseeable future. New common stock issue is estimated to cost 15% (FC=15%). What is the cost of common from retained earings based on the DCF approach? What is the new cost of common stock based on DDM approach? Year 5. Ponsonic dividend payments over the last 5 years are given below. What is the estimated growth rate of dividend? DPS$ 2015 2.49 2016 2.60 2017 2.73 2018 2.91 2019 3.12 6. Suppose Ponsonichas been eaming 15% on equity and has been paying out 62% of its earnings. If this situation is expected to continue, what is the expected future growth rate? 7. Ponsonic has in issue 3,000,000 shares of common stocks: 215,000 shares of preferred stocks; and 65,000 units of bonds with $1,000 par value. Based on the market prices of its securities provided above, estimate the proportion of long-term capital used based on market value weights. 8. Based on your computation above (Q1 to 27), what is Ponsonic scurrent WACC? 9. What is the new WACC estimate if Ponsonic is required toissue: a) ONLY new common stocks? b) BOTH new preferred and common stocksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started