Can you please solve the whole problem for this question please & thank you...!

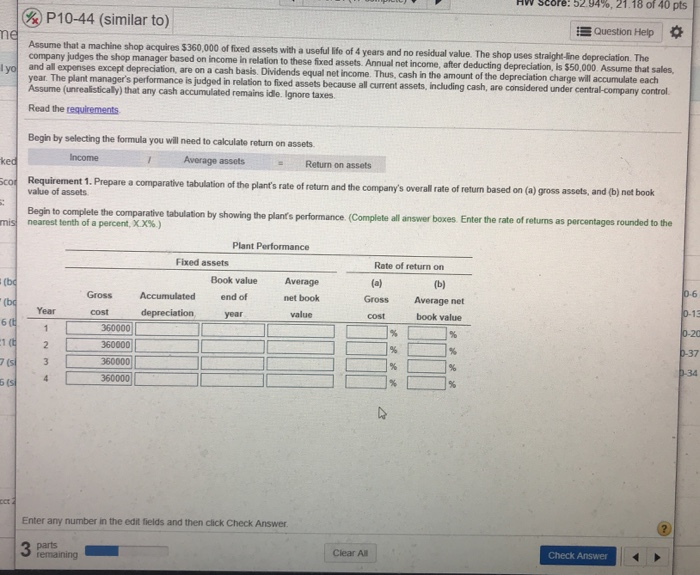

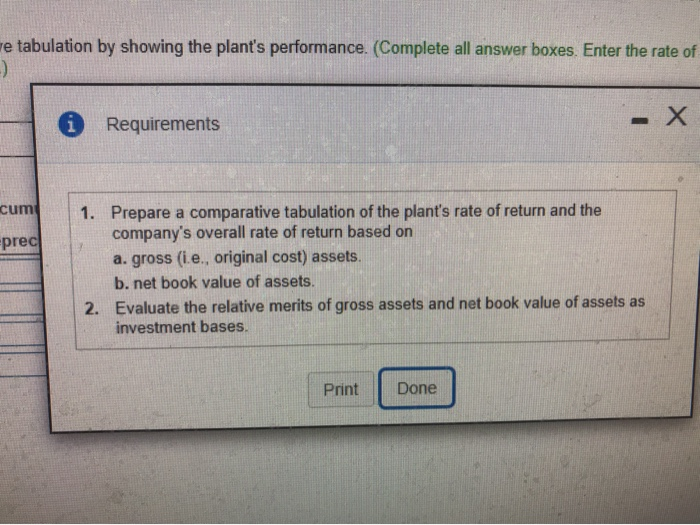

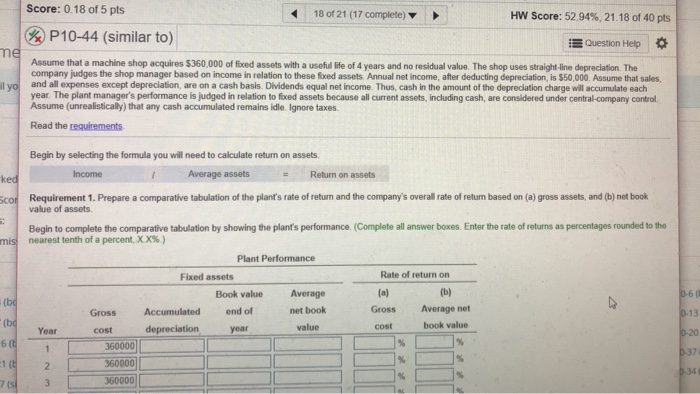

score: 52.94%, 21.18 of 40 pts VP10-44 (similar to) Question Help me Assume that a machine shop acquires $360,000 of fixed assets with a useful life of 4 years and no residual value. The shop uses straight-line depreciation. The company judges the shop manager based on income in relation to these fixed assets. Annual net income, after deducting depreciation, is $50,000 Assume that sales, and all expenses except depreciation, are on a cash basis. Dividends equal net income. Thus, cash in the amount of the depreciation charge will accumulate each l yo year. The plant manager's performance is judged in relation to fixed assets because all current assets, including cash, are considered under central-company control. Assume (unrealistically) that any cash accumulated remains idle. Ignore taxes Read the reguirements Begin by selecting the formula you will need to calculate return on assets Average Income ked assets Return on assets Sco Requirement 1. Prepare a comparative tabulation of the plant's rate of return and the company's overall rate of return based on (a) gross assets, and (b) net book value of assets Begin to complete the comparative tabulation by showing the plant's performance (Complete all answer boxes. Enter the rate of returns as percentages rounded to the mis nearest tenth of a percent, X.X %) Plant Performance Fixed assets Rate of return on (bc Book value Average (a) (b) 0-6 Accumulated Gross end of net book Gross Average net (b Year cost depreciation 0-13 value book value year cost 6 ( 360000 1 0-20 % % 1 ( 360000 2 9% % b-37 7 (sl 360000 3 % % -34 4 360000 s % % cct 2 Enter any number in the edit fields and then click Check Answer parts remaining Clear All Check Answer re tabulation by showing the plant's performance. (Complete all answer boxes. Enter the rate of - X i Requirements cum Prepare company's overall rate of return based on 1. a comparative tabulation of the plant's rate of return and the prec a. gross (i.e., original cost) assets b. net book value of assets. 2. Evaluate the relative merits of gross assets and net book value of assets as investment bases. Print Done Score: 0.18 of 5 pts 18 of 21 (17 complete) HW Score: 52.94%, 21.18 of 40 pts $P10-44 (similar to) EQuestion Help me Assume that a machine shop acquires $360,000 of foxed assets with a useful life of 4 years and no residual value. The shop uses straight-line depreciation. The company judges the shop manager based on income in relation to these fixed assets. Annual net income, after deducting depreciation, is $50,000. Assume that sales, and all expenses except depreciation, are on a cash basis. Dividends equal net income. Thus, cash in the amount of the depreciation charge will accumulate each year. The plant manager's performance is judged in relation to foxed assets because all current assets, including cash, are considered under central-company control. Assume (unrealistically) that any cash accumulated remains idle. Ignore taxes il vo Read the requirements Begin by selecting the formula you will need to calculate return on assets. Income Average assets Return on assets ked Sco Requirement 1. Prepare a comparative tabulation of the plant's rate of return and the company's overall rate of return based on (a) gross assets, and (b) net book value of assets. Begin to complete the comparative tabulation by showing the plant's performance. (Complete all answer boxes. Enter the rate of returns as percentages rounded to the nearest tenth of a percent, X.X % ) mis Plant Performance Rate of return on Fixed assets (b) 0-6( Average (a) Book value (bd Average net Gross Accumulated end of net book 0-13 Gross (bd book value value cost depreciation year Year cost 0-20 % 6 (t % 360000 b-37 1 (t 360000 2 b-34 % 360000 7 (sl 3