Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please solve these four multiple questions fast i need it urgently please answer all four of them Question 6 (1 point) A portfolio

can you please solve these four multiple questions fast i need it urgently please answer all four of them

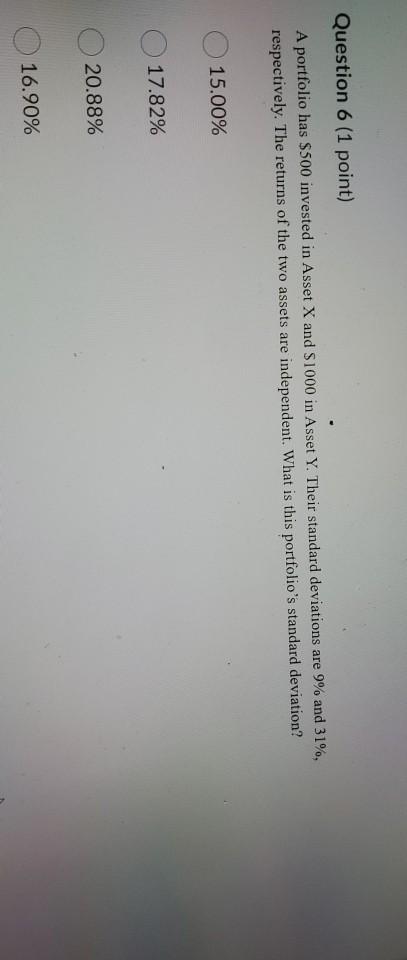

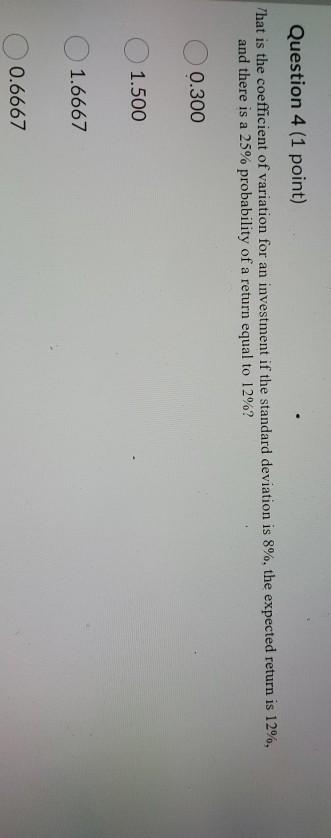

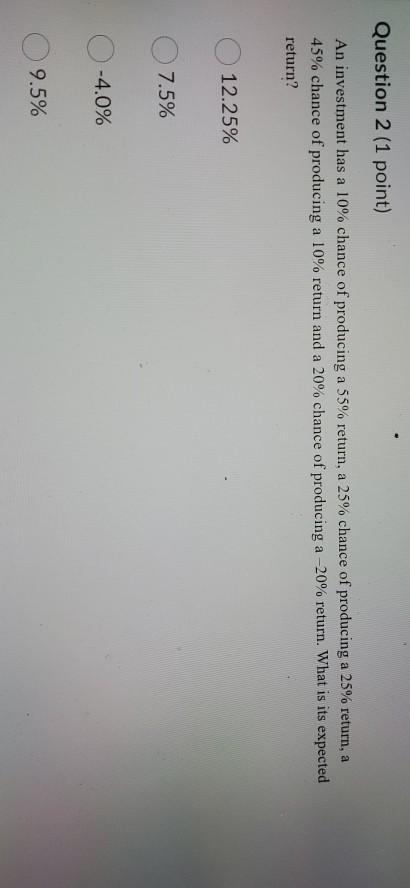

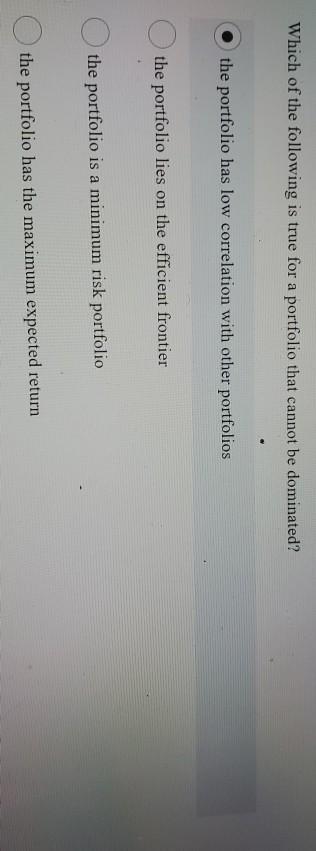

Question 6 (1 point) A portfolio has $500 invested in Asset X and S1000 in Asset Y. Their standard deviations are 9% and 31%, respectively. The returns of the two assets are independent. What is this portfolio's standard deviation? 15.00% 17.82% 20.88% 16.90% Question 4 (1 point) That is the coefficient of variation for an investment if the standard deviation is 8%, the expected return is 12%, and there is a 25% probability of a return equal to 12%? 0.300 1.500 1.6667 0.6667 Question 2 (1 point) An investment has a 10% chance of producing a 55% return, a 25% chance of producing a 25% return, a 45% chance of producing a 10% return and a 20% chance of producing a -20% return. What is its expected return? 12.25% 7.5% -4.0% 9.5% Which of the following is true for a portfolio that cannot be dominated? the portfolio has low correlation with other portfolios the portfolio lies on the efficient frontier the portfolio is a minimum risk portfolio the portfolio has the maximum expected returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started