Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please use an excel format and explain with notes and please also let me know how to book the entries. Thanks The following

can you please use an excel format and explain with notes and please also let me know how to book the entries.

Thanks

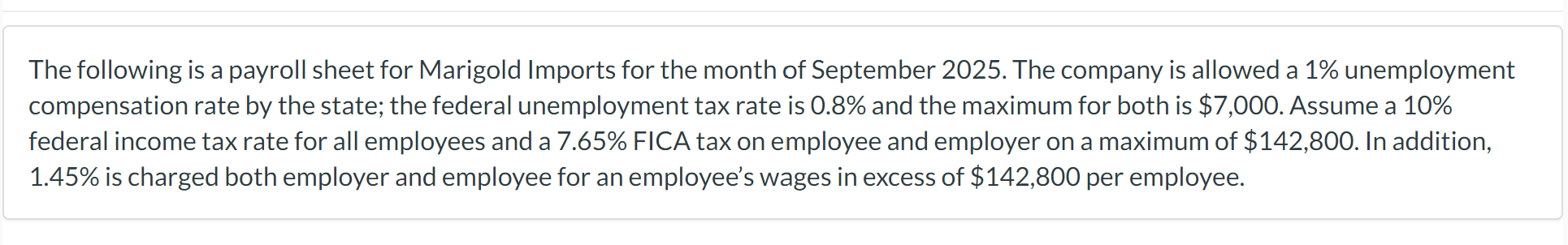

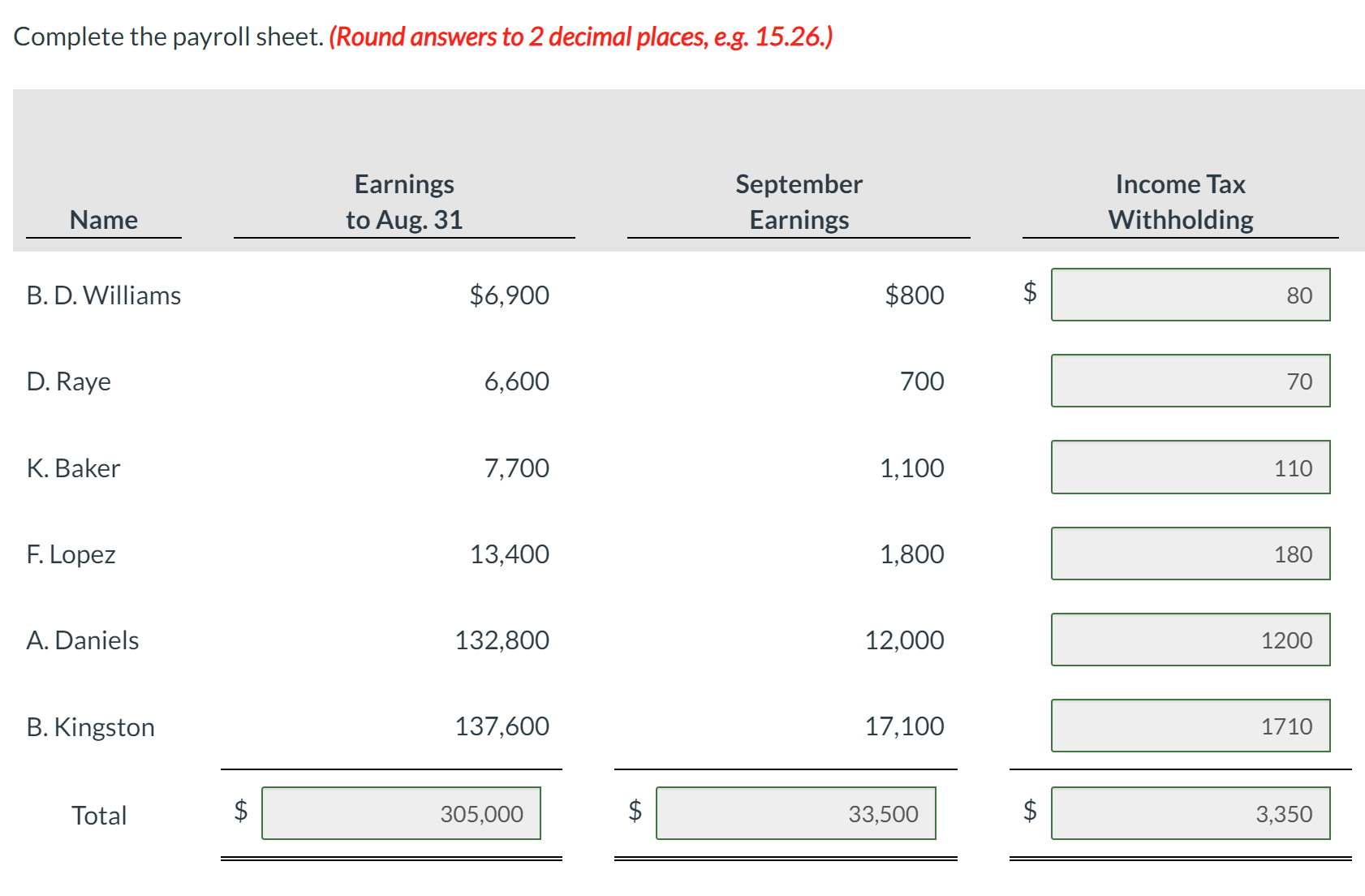

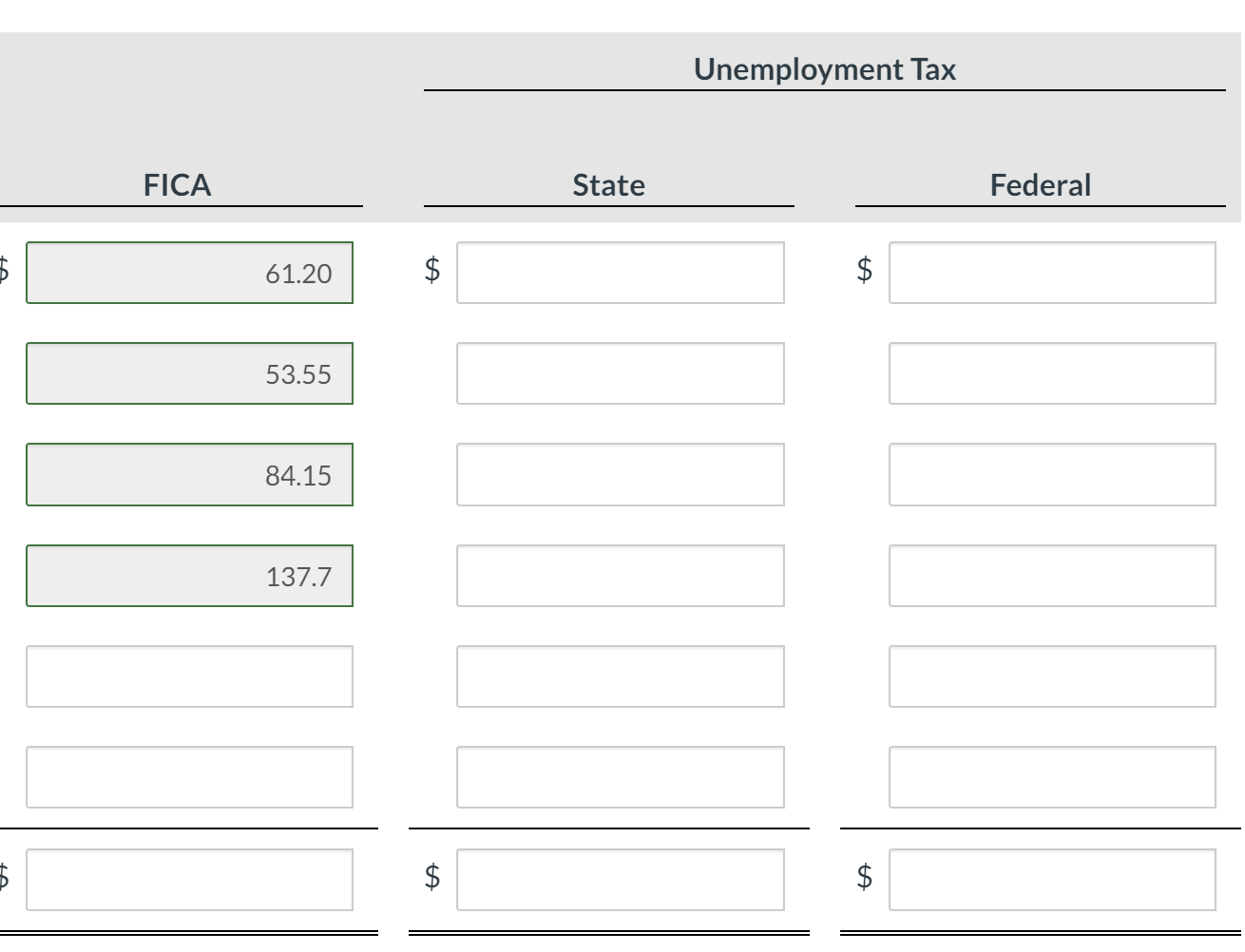

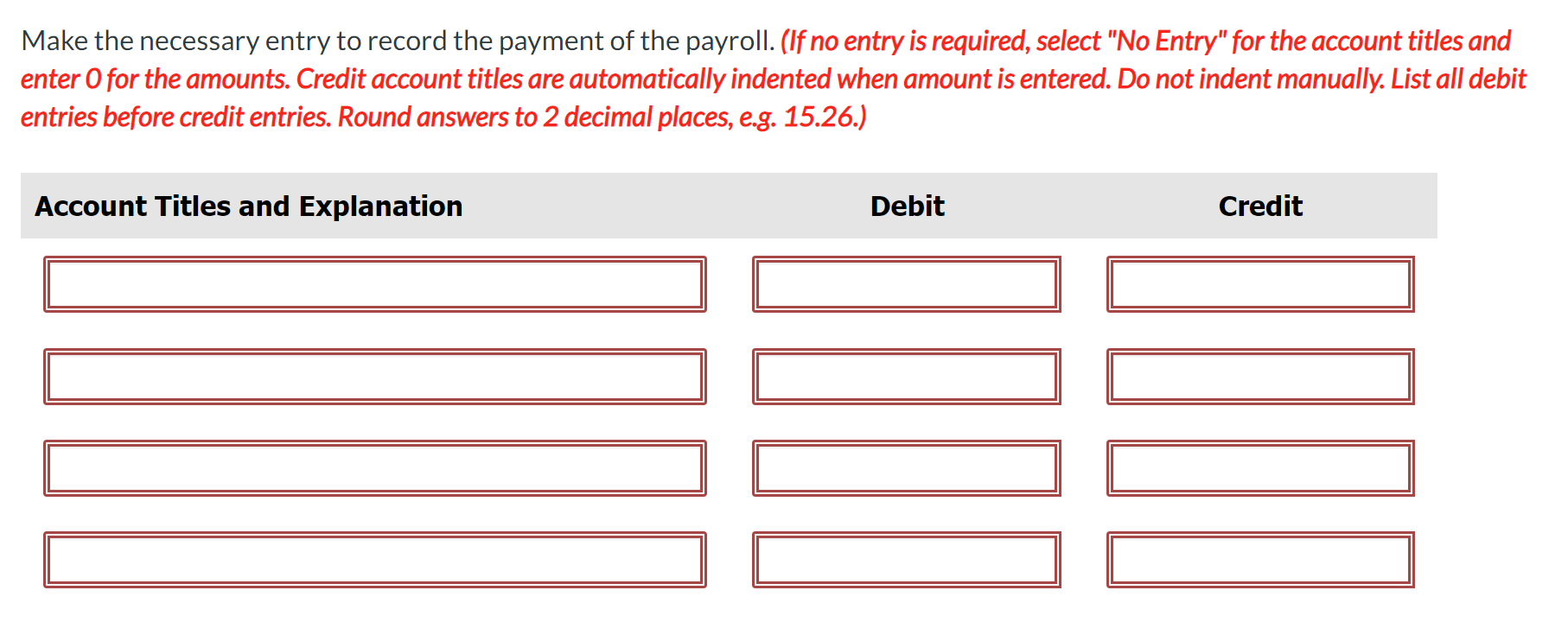

The following is a payroll sheet for Marigold Imports for the month of September 2025 . The company is allowed a 1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8% and the maximum for both is $7,000. Assume a 10% federal income tax rate for all employees and a 7.65\% FICA tax on employee and employer on a maximum of $142,800. In addition, 1.45% is charged both employer and employee for an employee's wages in excess of $142,800 per employee. Complete the payroll sheet. (Round answers to 2 decimal places, e.g. 15.26.) Unemployment Tax FICA \begin{tabular}{|r|} \hline 61.20 \\ \hline 53.55 \\ \hline 84.15 \\ \hline 137.7 \\ \hline \end{tabular} State Federal $ $ Make the necessary entry to record the payment of the payroll. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries. Round answers to 2 decimal places, e.g. 15.26.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started