Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you pls focus on showing the excel calculation formula for the expected return of the portfolios and the Standard deviation of the portfolios? 2.

Can you pls focus on showing the excel calculation formula for the expected return of the portfolios and the Standard deviation of the portfolios?

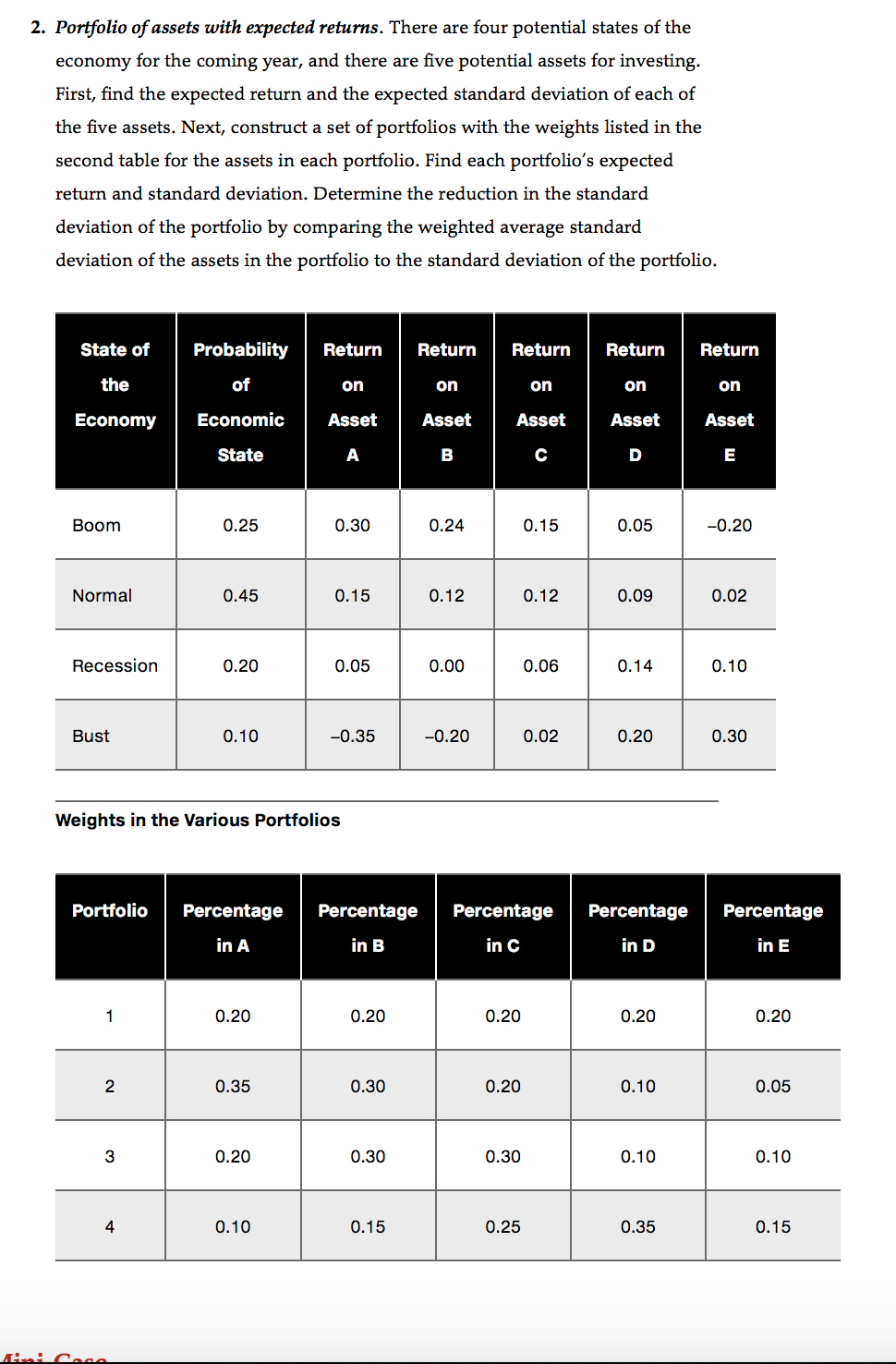

2. Portfolio of assets with expected returns. There are four potential states of the economy for the coming year, and there are five potential assets for investing. First, find the expected return and the expected standard deviation of each of the five assets. Next, construct a set of portfolios with the weights listed in the second table for the assets in each portfolio. Find each portfolio's expected return and standard deviation. Determine the reduction in the standard deviation of the portfolio by comparing the weighted average standard deviation of the assets in the portfolio to the standard deviation of the portfolio. State of Probability Return Return Return Return Return the of on on on on on Economy Economic Asset Asset Asset Asset Asset State A B D E Boom 0.25 0.30 0.24 0.15 0.05 -0.20 Normal 0.45 0.15 0.12 0.12 0.09 0.02 Recession 0.20 0.05 0.00 0.06 0.14 0.10 Bust 0.10 -0.35 -0.20 0.02 0.20 0.30 Weights in the various Portfolios Portfolio Percentage Percentage Percentage Percentage Percentage in A in B in C in D in E 1 0.20 0.20 0.20 0.20 0.20 2 0.35 0.30 0.20 0.10 0.05 3 0.20 0.30 0.30 0.10 0.10 4 0.10 0.15 0.25 0.35 0.15 odcStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started