Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you pls solve every question step by step Q2 from L3: If the Canadian dollar appreciate by 5% relative to the British pound, what

can you pls solve every question step by step

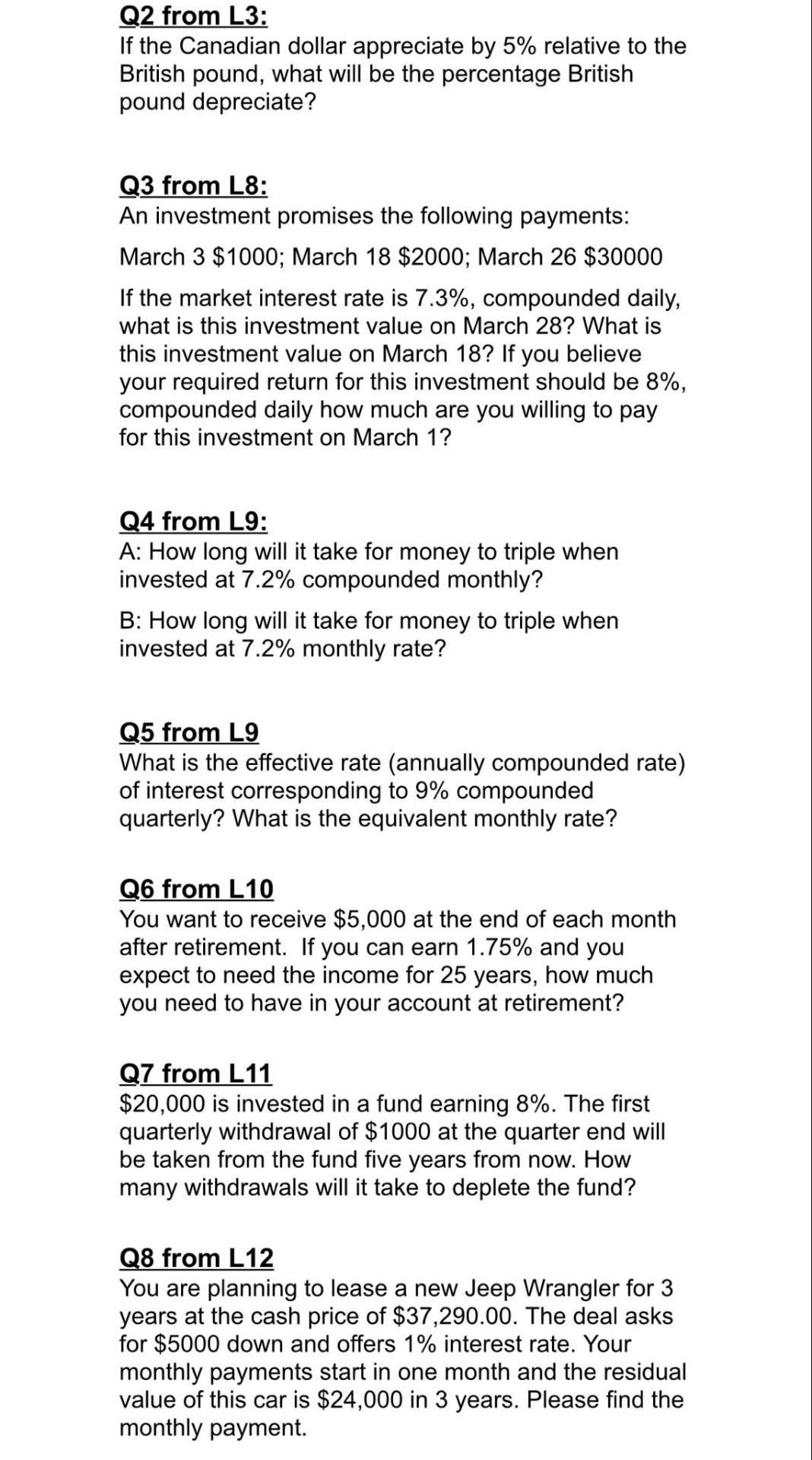

Q2 from L3: If the Canadian dollar appreciate by 5% relative to the British pound, what will be the percentage British pound depreciate? Q3 from L8: An investment promises the following payments: March 3 $1000; March 18 $2000; March 26 $30000 If the market interest rate is 7.3%, compounded daily, what is this investment value on March 28? What is this investment value on March 18? If you believe your required return for this investment should be 8%, compounded daily how much are you willing to pay for this investment on March 1? Q4 from L9: A: How long will it take for money to triple when invested at 7.2% compounded monthly? B: How long will it take for money to triple when invested at 7.2% monthly rate? Q5 from L9 What is the effective rate (annually compounded rate) of interest corresponding to 9% compounded quarterly? What is the equivalent monthly rate? Q6 from L10 You want to receive $5,000 at the end of each month after retirement. If you can earn 1.75% and you expect to need the income for 25 years, how much you need to have in your account at retirement? Q7 from L11 $20,000 is invested in a fund earning 8%. The first quarterly withdrawal of $1000 at the quarter end will be taken from the fund five years from now. How many withdrawals will it take to deplete the fund? Q8 from L12 You are planning to lease a new Jeep Wrangler for 3 years at the cash price of $37,290.00. The deal asks for $5000 down and offers 1% interest rate. Your monthly payments start in one month and the residual value of this car is $24,000 in 3 years. Please find the monthly paymentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started