Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you show the working and explanation please Nancy Lim a financial analyst, is looking for your guidance regarding her new investment portfolio, which is

can you show the working and explanation please

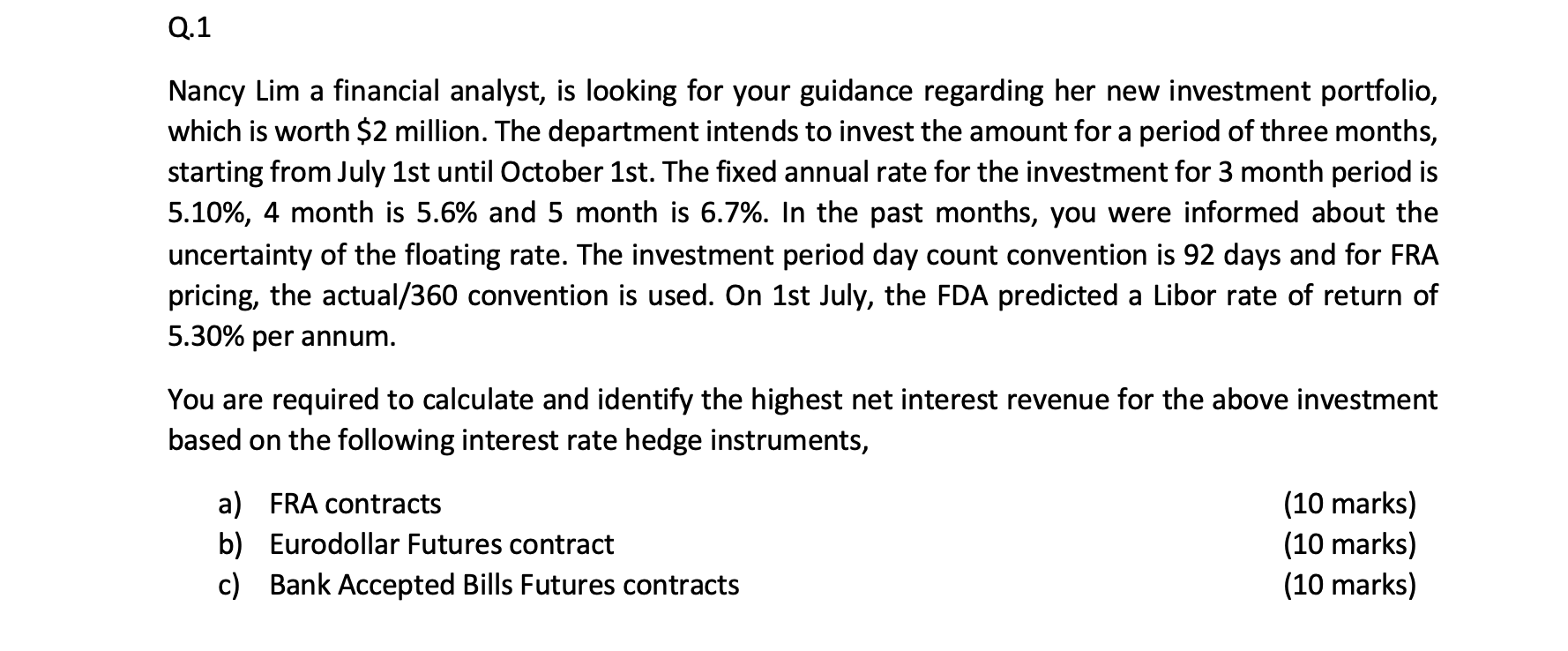

Nancy Lim a financial analyst, is looking for your guidance regarding her new investment portfolio, which is worth $2 million. The department intends to invest the amount for a period of three months, starting from July 1st until October 1st. The fixed annual rate for the investment for 3 month period is 5.10\%, 4 month is 5.6% and 5 month is 6.7%. In the past months, you were informed about the uncertainty of the floating rate. The investment period day count convention is 92 days and for FRA pricing, the actual/360 convention is used. On 1st July, the FDA predicted a Libor rate of return of 5.30% per annum. You are required to calculate and identify the highest net interest revenue for the above investment based on the following interest rate hedge instruments, a) FRA contracts (10 marks) b) Eurodollar Futures contract (10 marks) c) Bank Accepted Bills Futures contracts (10 marks) Nancy Lim a financial analyst, is looking for your guidance regarding her new investment portfolio, which is worth $2 million. The department intends to invest the amount for a period of three months, starting from July 1st until October 1st. The fixed annual rate for the investment for 3 month period is 5.10\%, 4 month is 5.6% and 5 month is 6.7%. In the past months, you were informed about the uncertainty of the floating rate. The investment period day count convention is 92 days and for FRA pricing, the actual/360 convention is used. On 1st July, the FDA predicted a Libor rate of return of 5.30% per annum. You are required to calculate and identify the highest net interest revenue for the above investment based on the following interest rate hedge instruments, a) FRA contracts (10 marks) b) Eurodollar Futures contract (10 marks) c) Bank Accepted Bills Futures contracts (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started