Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you solve this for auditing Which of the following accurately describes vouching? involves testing information not necessarily recorded in the accounting records ensures balances

Can you solve this for auditing

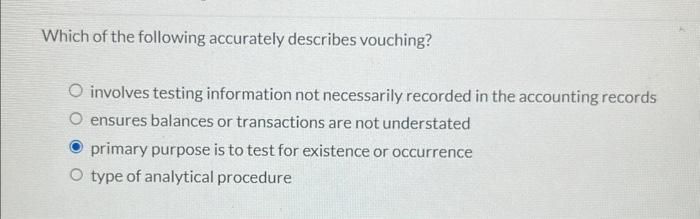

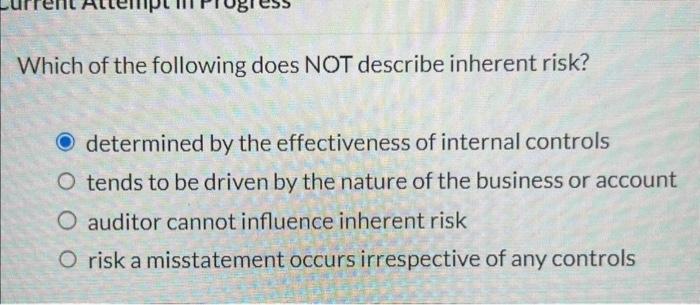

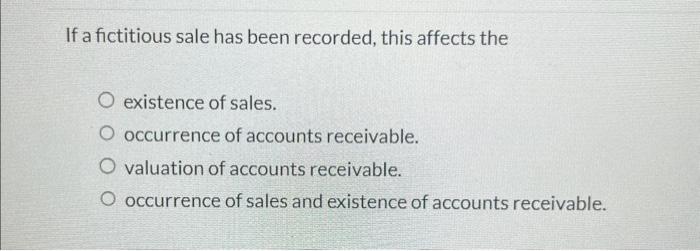

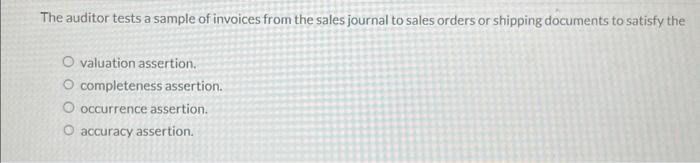

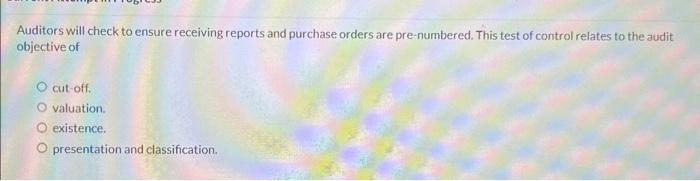

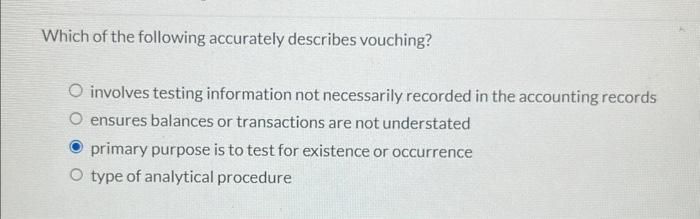

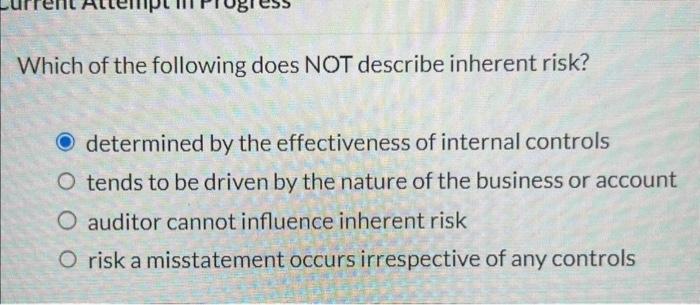

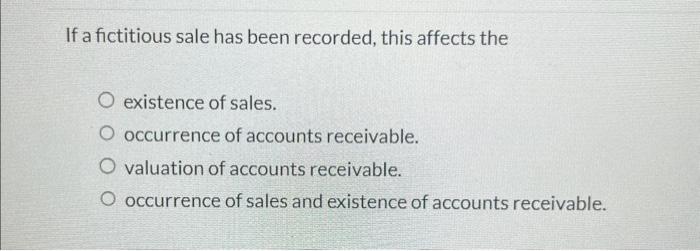

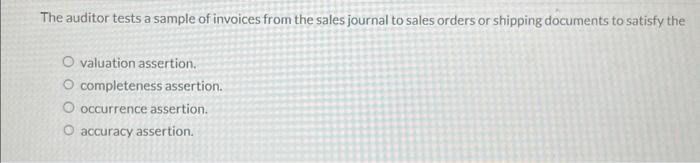

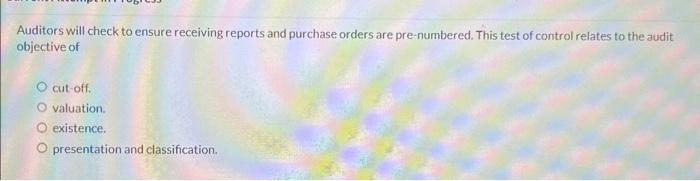

Which of the following accurately describes vouching? involves testing information not necessarily recorded in the accounting records ensures balances or transactions are not understated primary purpose is to test for existence or occurrence type of analytical procedure Which of the following does NOT describe inherent risk? determined by the effectiveness of internal controls tends to be driven by the nature of the business or account auditor cannot influence inherent risk risk a misstatement occurs irrespective of any controls Auditors will check to ensure receiving reports and purchase orders are pre-numbered. This test of control relates to the audit objective of cut-off. valuation. existence. presentation and classification. The auditor tests a sample of invoices from the sales journal to sales orders or shipping documents to satisfy the valuation assertion. completeness assertion. occurrence assertion. accuracy assertion. If a fictitious sale has been recorded, this affects the existence of sales. occurrence of accounts receivable. valuation of accounts receivable. occurrence of sales and existence of accounts receivable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started