Question: Can you write Investment policy statement using this format Return objectives Risk tolerance Ability Willingness Tax Time Horizon Legal and Regulatory Environment Unique Circumstances The

Can you write Investment policy statement using this format

- Return objectives

- Risk tolerance

- Ability

- Willingness

- Tax

- Time Horizon

- Legal and Regulatory Environment

- Unique Circumstances

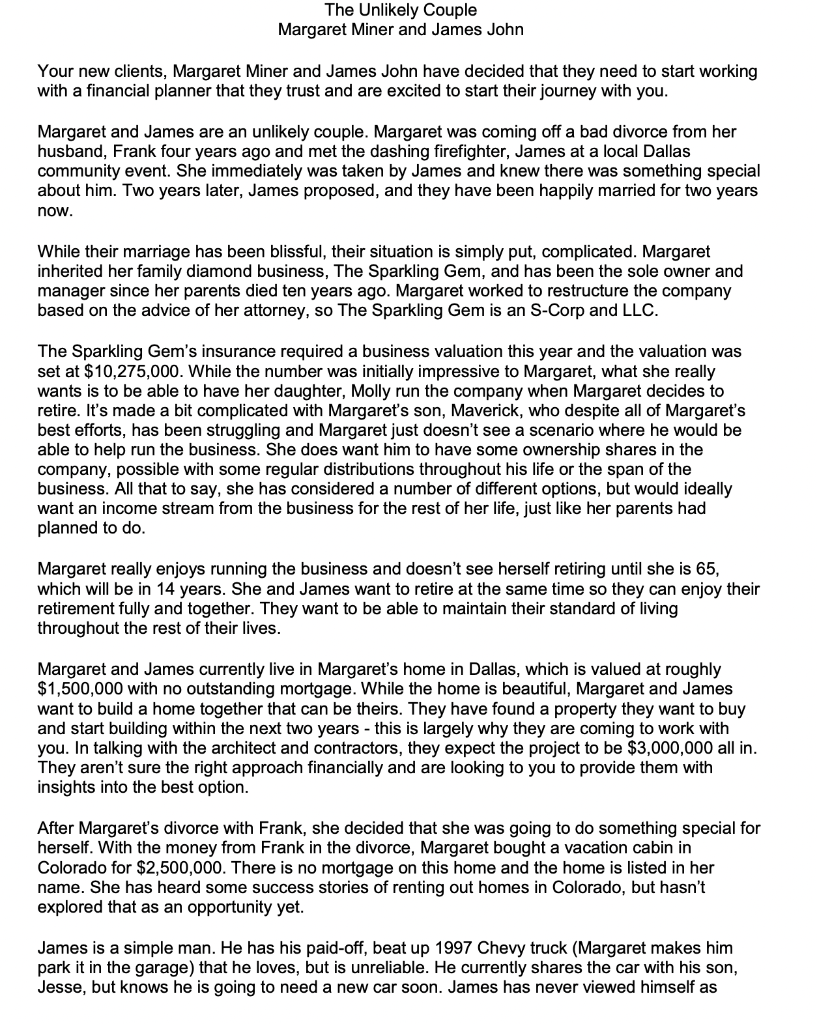

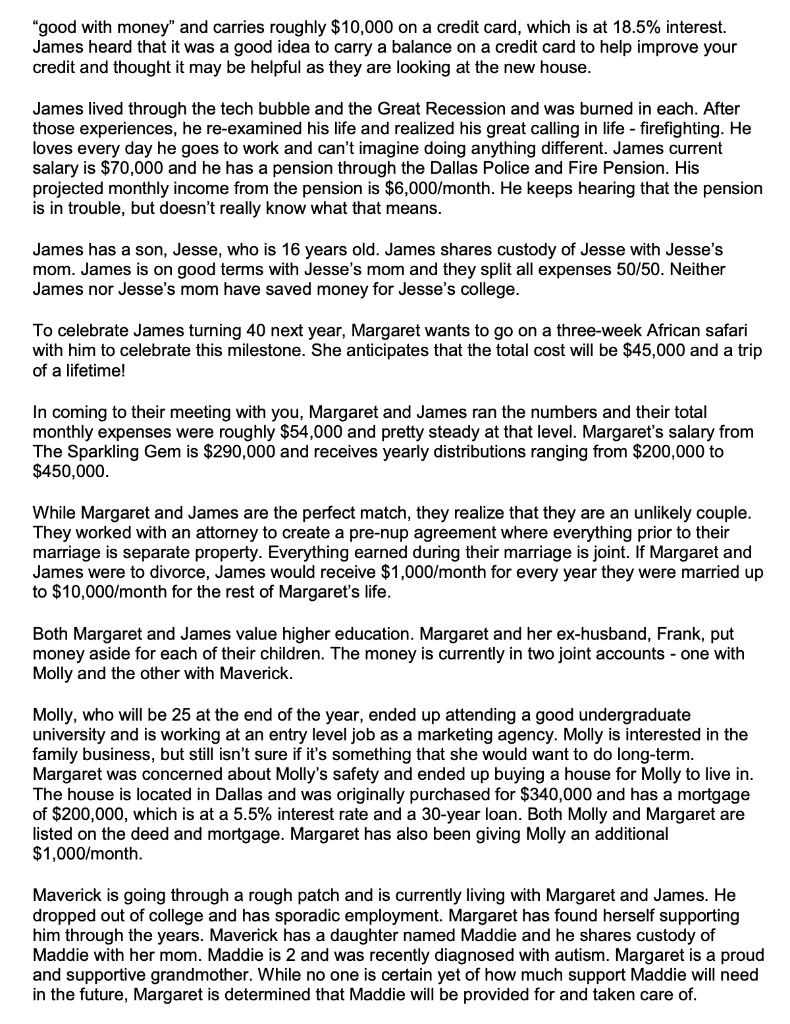

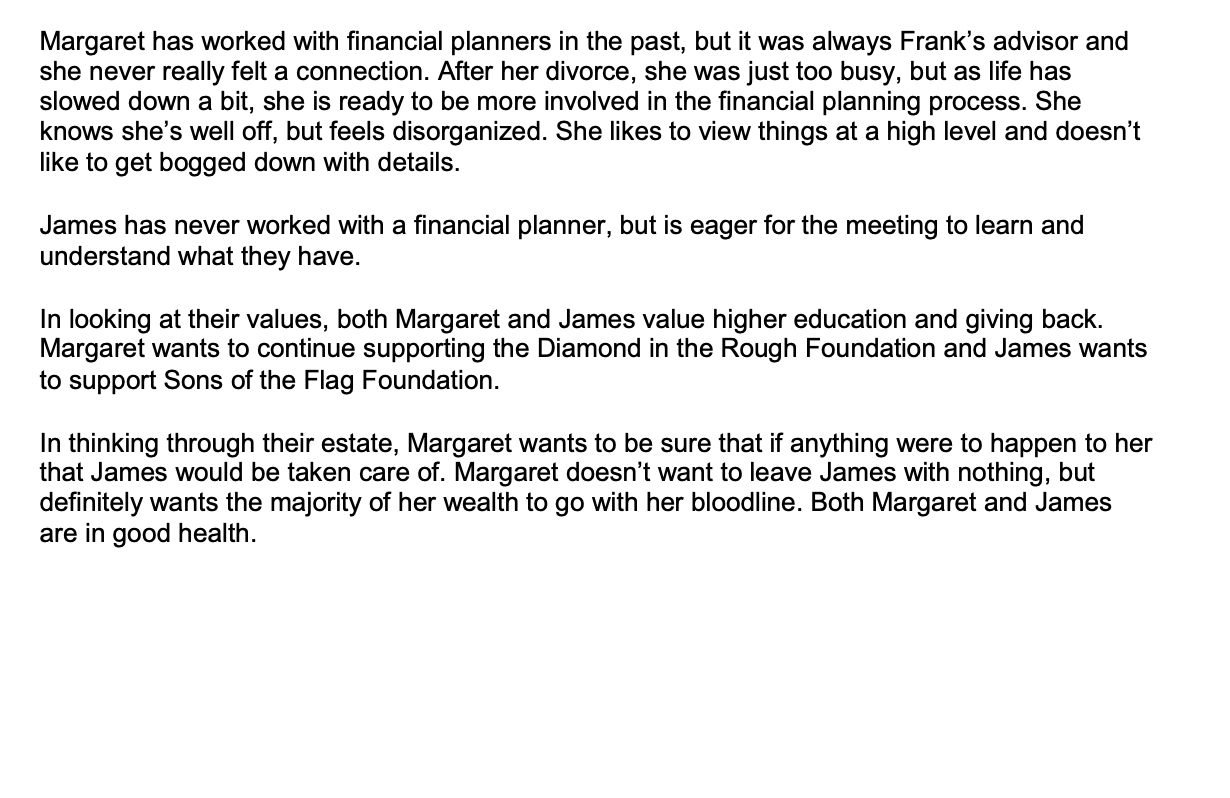

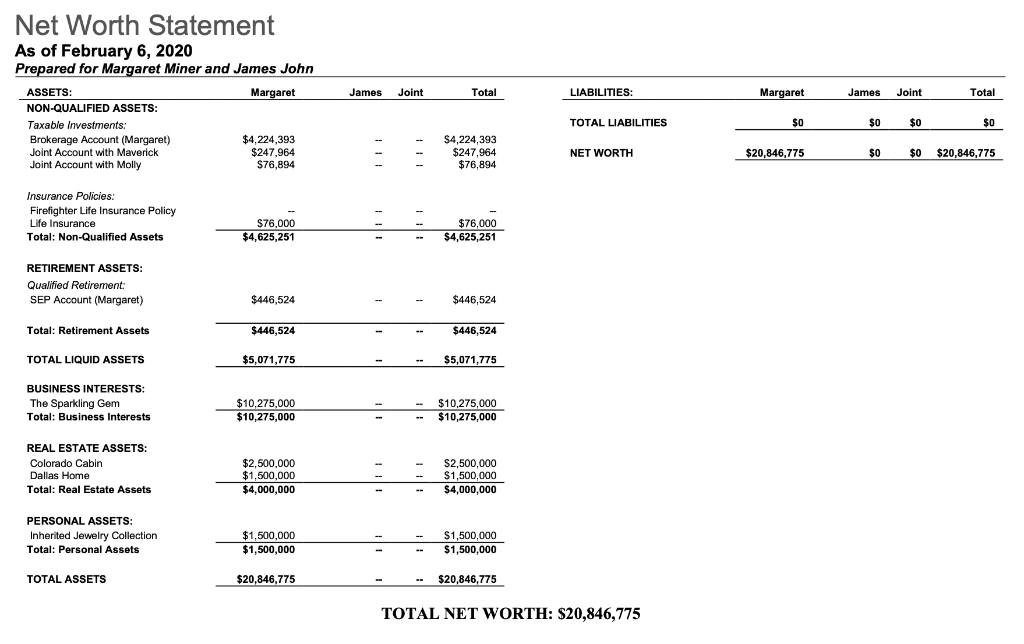

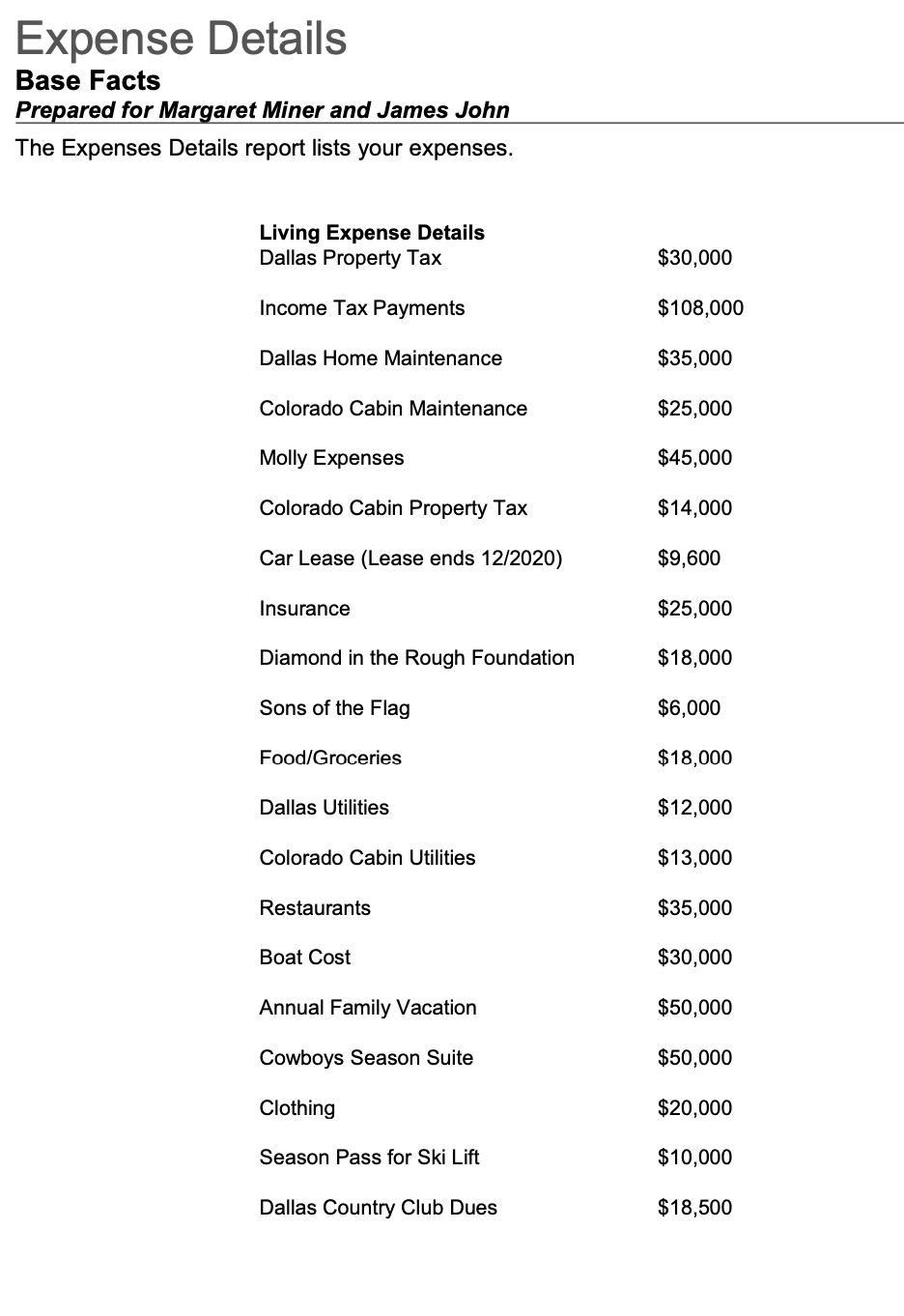

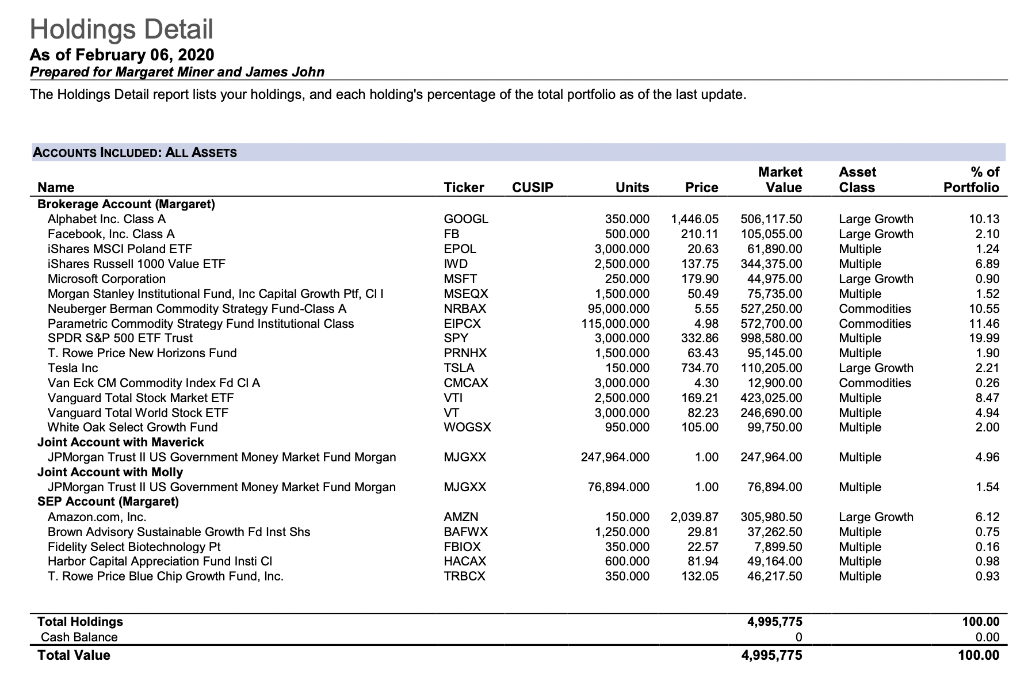

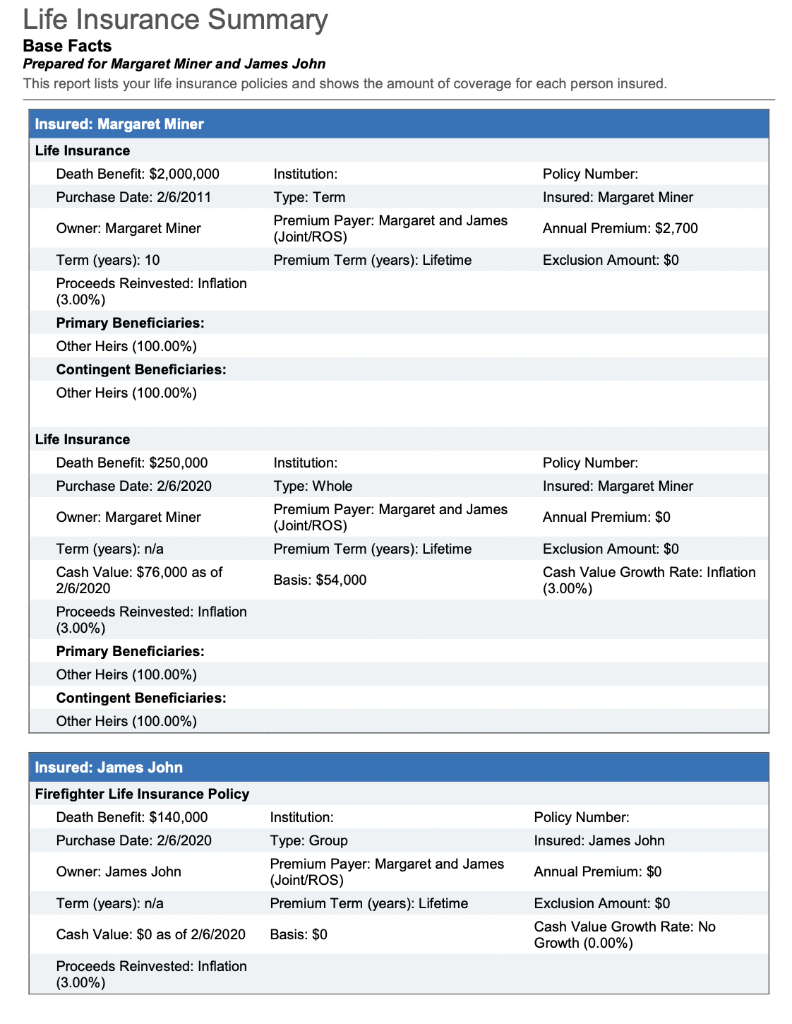

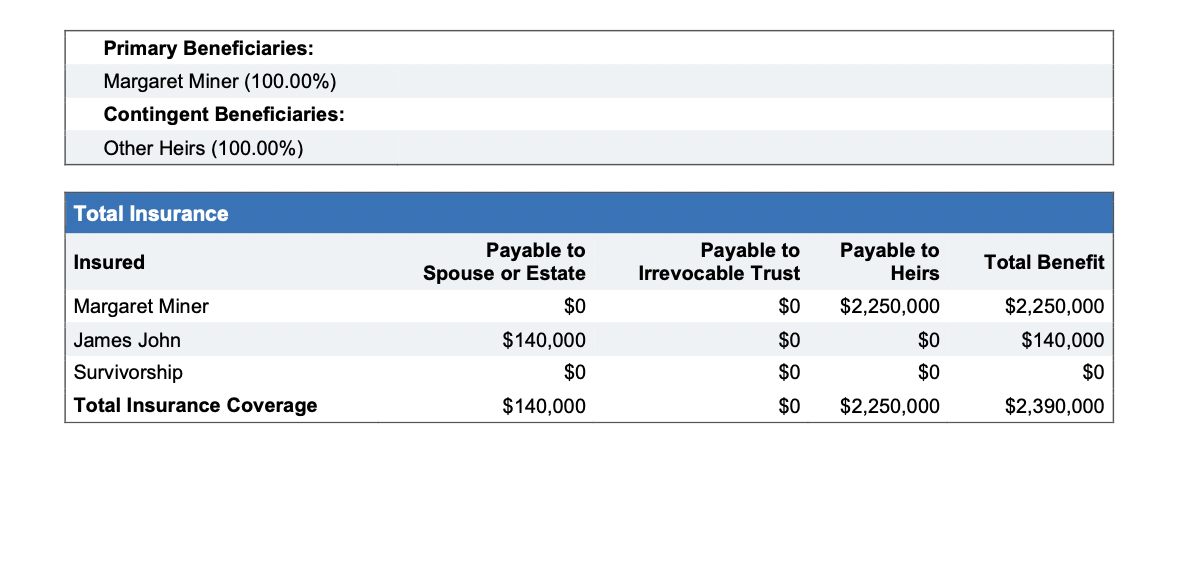

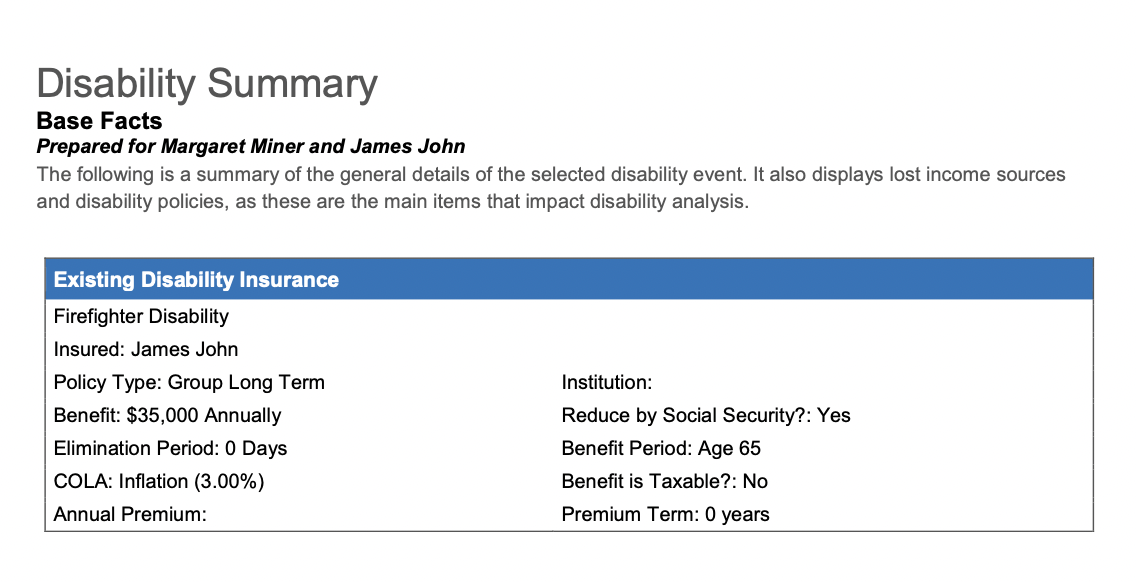

The Unlikely Couple Margaret Miner and James John Your new clients, Margaret Miner and James John have decided that they need to start working with a financial planner that they trust and are excited to start their journey with you. Margaret and James are an unlikely couple. Margaret was coming off a bad divorce from her husband, Frank four years ago and met the dashing firefighter, James at a local Dallas community event. She immediately was taken by James and knew there was something special about him. Two years later, James proposed, and they have been happily married for two years now. While their marriage has been blissful, their situation is simply put, complicated. Margaret inherited her family diamond business, The Sparkling Gem, and has been the sole owner and manager since her parents died ten years ago. Margaret worked to restructure the company based on the advice of her attorney, so The Sparkling Gem is an S-Corp and LLC. The Sparkling Gem's insurance required a business valuation this year and the valuation was set at $10,275,000. While the number was initially impressive to Margaret, what she really wants is to be able to have her daughter, Molly run the company when Margaret decides to retire. It's made a bit complicated with Margaret's son, Maverick, who despite all of Margaret's best efforts, has been struggling and Margaret just doesn't see a scenario where he would be able to help run the business. She does want him to have some ownership shares in the company, possible with some regular distributions throughout his life or the span of the business. All that to say, she has considered a number of different options, but would ideally want an income stream from the business for the rest of her life, just like her parents had planned to do. Margaret really enjoys running the business and doesn't see herself retiring until she is 65, which will be in 14 years. She and James want to retire at the same time so they can enjoy their retirement fully and together. They want to be able to maintain their standard of living throughout the rest of their lives. Margaret and James currently live in Margaret's home in Dallas, which is valued at roughly $1,500,000 with no outstanding mortgage. While the home is beautiful, Margaret and James want to build a home together that can be theirs. They have found a property they want to buy and start building within the next two years - this is largely why they are coming to work with you. In talking with the architect and contractors, they expect the project to be $3,000,000 all in. They aren't sure the right approach financially and are looking to you to provide them with insights into the best option. After Margaret's divorce with Frank, she decided that she was going to do something special for herself. With the money from Frank in the divorce, Margaret bought a vacation cabin in Colorado for $2,500,000. There is no mortgage on this home and the home is listed in her name. She has heard some success stories of renting out homes in Colorado, but hasn't explored that as an opportunity yet. James is a simple man. He has his paid-off, beat up 1997 Chevy truck (Margaret makes him park it in the garage) that he loves, but is unreliable. He currently shares the car with his son, Jesse, but knows he is going to need a new car soon. James has never viewed himself as "good with money" and carries roughly $10,000 on a credit card, which is at 18.5% interest. James heard that it was a good idea to carry a balance on a credit card to help improve your credit and thought it may be helpful as they are looking at the new house. James lived through the tech bubble and the Great Recession and was burned in each. After those experiences, he re-examined his life and realized his great calling in life - firefighting. He loves every day he goes to work and can't imagine doing anything different. James current salary is $70,000 and he has a pension through the Dallas Police and Fire Pension. His projected monthly income from the pension is $6,000/month. He keeps hearing that the pension is in trouble, but doesn't really know what that means. James has a son, Jesse, who is 16 years old. James shares custody of Jesse with Jesse's mom. James is on good terms with Jesse's mom and they split all expenses 50/50. Neither James nor Jesse's mom have saved money for Jesse's college. To celebrate James turning 40 next year, Margaret wants to go on a three-week African safari with him to celebrate this milestone. She anticipates that the total cost will be $45,000 and a trip of a lifetime! In coming to their meeting with you, Margaret and James ran the numbers and their total monthly expenses were roughly $54,000 and pretty steady at that level. Margaret's salary from The Sparkling Gem is $290,000 and receives yearly distributions ranging from $200,000 to $450,000. While Margaret and James are the perfect match, they realize that they are an unlikely couple. They worked with an attorney to create a pre-nup agreement where everything prior to their marriage is separate property. Everything earned during their marriage is joint. If Margaret and James were to divorce, James would receive $1,000/month for every year they were married up to $10,000/month for the rest of Margaret's life. Both Margaret and James value higher education. Margaret and her ex-husband, Frank, put money aside for each of their children. The money is currently in two joint accounts - one with Molly and the other with Maverick. Molly, who will be 25 at the end of the year, ended up attending a good undergraduate university and is working at an entry level job as a marketing agency. Molly is interested in the family business, but still isn't sure if it's something that she would want to do long-term. Margaret was concerned about Molly's safety and ended up buying a house for Molly to live in. The house is located in Dallas and was originally purchased for $340,000 and has a mortgage of $200,000, which is at a 5.5% interest rate and a 30-year loan. Both Molly and Margaret are listed on the deed and mortgage. Margaret has also been giving Molly an additional $1,000/month. Maverick is going through a rough patch and is currently living with Margaret and James. He dropped out of college and has sporadic employment. Margaret has found herself supporting him through the years. Maverick has a daughter named Maddie and he shares custody of Maddie with her mom. Maddie is 2 and was recently diagnosed with autism. Margaret is a proud and supportive grandmother. While no one is certain yet of how much support Maddie will need in the future, Margaret is determined that Maddie will be provided for and taken care of. Margaret has worked with financial planners in the past, but it was always Frank's advisor and she never really felt a connection. After her divorce, she was just too busy, but as life has slowed down a bit, she is ready to be more involved in the financial planning process. She knows she's well off, but feels disorganized. She likes to view things at a high level and doesn't like to get bogged down with details. James has never worked with a financial planner, but is eager for the meeting to learn and understand what they have. In looking at their values, both Margaret and James value higher education and giving back. Margaret wants to continue supporting the Diamond in the Rough Foundation and James wants to support Sons of the Flag Foundation. In thinking through their estate, Margaret wants to be sure that if anything were to happen to her that James would be taken care of. Margaret doesn't want to leave James with nothing, but definitely wants the majority of her wealth to go with her bloodline. Both Margaret and James are in good health. Net Worth Statement As of February 6, 2020 Prepared for Margaret Miner and James John ASSETS: Margaret NON-QUALIFIED ASSETS: : Taxable Investments: Brokerage Account (Margaret) $4,224,393 Joint Account with Maverick $247,964 Joint Account with Molly $76,894 James Joint Total LIABILITIES: Margaret James Joint Total TOTAL LIABILITIES $0 SO $0 $O $4,224,393 $247,964 $76,894 NET WORTH $20,846,775 $0 $0 $ $0 $20,846,775 Insurance Policies: Firefighter Life Insurance Policy Life Insurance Total: Non-Qualified Assets - $76,000 $4,625,251 $76,000 $4,625, 251 RETIREMENT ASSETS: Qualified Retirement: SEP Account (Margaret) $446,524 $446,524 Total: Retirement Assets $446,524 $ $446,524 TOTAL LIQUID ASSETS $5,071,775 $5,071,775 BUSINESS INTERESTS: The Sparkling Gem Total: Business Interests $10,275,000 $10,275,000 $10,275,000 $10,275,000 REAL ESTATE ASSETS: Colorado Cabin Dallas Home Total: Real Estate Assets $2,500,000 $1,500,000 $4,000,000 $2,500,000 $1,500,000 $4,000,000 -- PERSONAL ASSETS: Inherited Jewelry Collection Total: Personal Assets $1,500,000 $1,500,000 $1,500,000 $1,500,000 TOTAL ASSETS $20,846,775 $20,846,775 TOTAL NET WORTH: $20,846,775 Expense Details Base Facts Prepared for Margaret Miner and James John The Expenses Details report lists your expenses. Living Expense Details Dallas Property Tax $30,000 Income Tax Payments $108,000 Dallas Home Maintenance $35,000 Colorado Cabin Maintenance $25,000 Molly Expenses $45,000 Colorado Cabin Property Tax $14,000 Car Lease (Lease ends 12/2020) $9,600 Insurance $25,000 Diamond in the Rough Foundation $18,000 Sons of the Flag $6,000 Food/Groceries $18,000 Dallas Utilities $12,000 Colorado Cabin Utilities $13,000 Restaurants $35,000 Boat Cost $30,000 Annual Family Vacation $50,000 Cowboys Season Suite $50,000 Clothing $20,000 Season Pass for Ski Lift $10,000 Dallas Country Club Dues $18,500 Holdings Detail As of February 06, 2020 Prepared for Margaret Miner and James John The Holdings Detail report lists your holdings, and each holding's percentage of the total portfolio as of the last update. ACCOUNTS INCLUDED: ALL ASSETS Market Value Asset Class % of Portfolio Ticker CUSIP Units Price 10.13 2.10 1.24 6.89 Name Brokerage Account (Margaret) Alphabet Inc. Class A Facebook, Inc. Class A iShares MSCI Poland ETF iShares Russell 1000 Value ETF Microsoft Corporation Morgan Stanley Institutional Fund, Inc Capital Growth Plf, CII Neuberger Berman Commodity Strategy Fund-Class A Parametric Commodity Strategy Fund Institutional Class SPDR S&P 500 ETF Trust T. Rowe Price New Horizons Fund Tesla Inc Van Eck CM Commodity Index Fd CI A Vanguard Total Stock Market ETF Vanguard Total World Stock ETF White Oak Select Growth Fund Joint Account with Maverick JPMorgan Trust II US Government Money Market Fund Morgan Joint Account with Molly JPMorgan Trust II US Government Money Market Fund Morgan SEP Account (Margaret) Amazon.com, Inc. Brown Advisory Sustainable Growth Fd Inst Shs Fidelity Select Biotechnology Pt Harbor Capital Appreciation Fund Insti CI T. Rowe Price Blue Chip Growth Fund, Inc. GOOGL FB EPOL IWD MSFT MSEQX NRBAX EIPCX SPY PRNHX TSLA CMCAX VTI VT WOGSX 350.000 500.000 3,000.000 2,500,000 250.000 1,500.000 95,000.000 115,000.000 3,000.000 1,500.000 150.000 3,000.000 2,500.000 3,000.000 950.000 1,446.05 210.11 20.63 137.75 179.90 50.49 5.55 4.98 332.86 63.43 734.70 4.30 169.21 82.23 105.00 506,117.50 105,055.00 61,890.00 344,375.00 44,975.00 75.735.00 527,250.00 572,700.00 998,580.00 95,145.00 110,205.00 12,900.00 423,025.00 246,690.00 99,750.00 Large Growth Large Growth Multiple Multiple Large Growth Multiple Commodities Commodities Multiple Multiple Large Growth Commodities Multiple Multiple Multiple 0.90 1.52 10.55 11.46 19.99 1.90 2.21 0.26 8.47 4.94 2.00 MJGXX 247,964.000 1.00 247,964.00 Multiple 4.96 MJGXX 76,894.000 1.00 76,894.00 Multiple 1.54 AMZN BAFWX FBIOX HACAX TRBCX 150.000 2,039.87 1,250.000 29.81 350.000 22.57 600.000 81.94 350.000 132.05 305,980.50 37,262.50 7,899.50 49,164.00 46,217.50 Large Growth Multiple Multiple Multiple Multiple 6.12 0.75 0.16 0.98 0.93 Total Holdings Cash Balance Total Value 4,995,775 0 4,995,775 100.00 0.00 100.00 Life Insurance Summary Base Facts Prepared for Margaret Miner and James John This report lists your life insurance policies and shows the amount of coverage for each person insured. Insured: Margaret Miner Life Insurance Death Benefit: $2,000,000 Purchase Date: 2/6/2011 Policy Number: Insured: Margaret Miner Institution: Type: Term Premium Payer: Margaret and James (Joint/ROS) Premium Term (years): Lifetime Owner: Margaret Miner Annual Premium: $2,700 Exclusion Amount: $0 Term (years): 10 Proceeds Reinvested: Inflation (3.00%) Primary Beneficiaries: Other Heirs (100.00%) Contingent Beneficiaries: Other Heirs (100.00%) Life Insurance Death Benefit: $250,000 Policy Insured: Margaret Miner Purchase Date: 2/6/2020 Owner: Margaret Miner Type: Whole Premium Payer: Margaret and James (Joint/ROS) Premium Term (years): Lifetime Annual Premium: $0 Exclusion Amount: $0 Cash Value Growth Rate: Inflation (3.00%) Basis: $54,000 Term (years): n/a Cash Value: $76,000 as of 2/6/2020 Proceeds Reinvested: Inflation (3.00%) Primary Beneficiaries: Other Heirs (100.00%) Contingent Beneficiaries: Other Heirs (100.00%) Insured: James John Firefighter Life Insurance Policy Death Benefit: $140,000 Purchase Date: 2/6/2020 Policy Number: Insured: James John Institution: Type: Group Premium Payer: Margaret and James (Joint/ROS) Premium Term (years): Lifetime Owner: James John Annual Premium: $0 Term (years): n/a Exclusion Amount: $0 Cash Value Growth Rate: No Growth (0.00%) Cash Value: $0 as of 2/6/2020 Basis: $0 Proceeds Reinvested: Inflation (3.00%) Primary Beneficiaries: Margaret Miner (100.00%) Contingent Beneficiaries: Other Heirs (100.00%) Total Insurance Insured Payable to Spouse or Estate $0 Payable to Irrevocable Trust Total Benefit Payable to Heirs $2,250,000 $0 $2,250,000 $140,000 $0 $0 Margaret Miner James John Survivorship Total Insurance Coverage $140,000 $0 $140,000 $0 $0 $0 $0 $2,250,000 $2,390,000 Disability Summary Base Facts Prepared for Margaret Miner and James John The following is a summary of the general details of the selected disability event. It also displays lost income sources and disability policies, as these are the main items that impact disability analysis. Existing Disability Insurance Firefighter Disability Insured: James John Policy Type: Group Long Term Benefit: $35,000 Annually Elimination Period: 0 Days COLA: Inflation (3.00%) Annual Premium: Institution: Reduce by Social Security?: Yes Benefit Period: Age 65 Benefit is Taxable?: No Premium Term: 0 years The Unlikely Couple Margaret Miner and James John Your new clients, Margaret Miner and James John have decided that they need to start working with a financial planner that they trust and are excited to start their journey with you. Margaret and James are an unlikely couple. Margaret was coming off a bad divorce from her husband, Frank four years ago and met the dashing firefighter, James at a local Dallas community event. She immediately was taken by James and knew there was something special about him. Two years later, James proposed, and they have been happily married for two years now. While their marriage has been blissful, their situation is simply put, complicated. Margaret inherited her family diamond business, The Sparkling Gem, and has been the sole owner and manager since her parents died ten years ago. Margaret worked to restructure the company based on the advice of her attorney, so The Sparkling Gem is an S-Corp and LLC. The Sparkling Gem's insurance required a business valuation this year and the valuation was set at $10,275,000. While the number was initially impressive to Margaret, what she really wants is to be able to have her daughter, Molly run the company when Margaret decides to retire. It's made a bit complicated with Margaret's son, Maverick, who despite all of Margaret's best efforts, has been struggling and Margaret just doesn't see a scenario where he would be able to help run the business. She does want him to have some ownership shares in the company, possible with some regular distributions throughout his life or the span of the business. All that to say, she has considered a number of different options, but would ideally want an income stream from the business for the rest of her life, just like her parents had planned to do. Margaret really enjoys running the business and doesn't see herself retiring until she is 65, which will be in 14 years. She and James want to retire at the same time so they can enjoy their retirement fully and together. They want to be able to maintain their standard of living throughout the rest of their lives. Margaret and James currently live in Margaret's home in Dallas, which is valued at roughly $1,500,000 with no outstanding mortgage. While the home is beautiful, Margaret and James want to build a home together that can be theirs. They have found a property they want to buy and start building within the next two years - this is largely why they are coming to work with you. In talking with the architect and contractors, they expect the project to be $3,000,000 all in. They aren't sure the right approach financially and are looking to you to provide them with insights into the best option. After Margaret's divorce with Frank, she decided that she was going to do something special for herself. With the money from Frank in the divorce, Margaret bought a vacation cabin in Colorado for $2,500,000. There is no mortgage on this home and the home is listed in her name. She has heard some success stories of renting out homes in Colorado, but hasn't explored that as an opportunity yet. James is a simple man. He has his paid-off, beat up 1997 Chevy truck (Margaret makes him park it in the garage) that he loves, but is unreliable. He currently shares the car with his son, Jesse, but knows he is going to need a new car soon. James has never viewed himself as "good with money" and carries roughly $10,000 on a credit card, which is at 18.5% interest. James heard that it was a good idea to carry a balance on a credit card to help improve your credit and thought it may be helpful as they are looking at the new house. James lived through the tech bubble and the Great Recession and was burned in each. After those experiences, he re-examined his life and realized his great calling in life - firefighting. He loves every day he goes to work and can't imagine doing anything different. James current salary is $70,000 and he has a pension through the Dallas Police and Fire Pension. His projected monthly income from the pension is $6,000/month. He keeps hearing that the pension is in trouble, but doesn't really know what that means. James has a son, Jesse, who is 16 years old. James shares custody of Jesse with Jesse's mom. James is on good terms with Jesse's mom and they split all expenses 50/50. Neither James nor Jesse's mom have saved money for Jesse's college. To celebrate James turning 40 next year, Margaret wants to go on a three-week African safari with him to celebrate this milestone. She anticipates that the total cost will be $45,000 and a trip of a lifetime! In coming to their meeting with you, Margaret and James ran the numbers and their total monthly expenses were roughly $54,000 and pretty steady at that level. Margaret's salary from The Sparkling Gem is $290,000 and receives yearly distributions ranging from $200,000 to $450,000. While Margaret and James are the perfect match, they realize that they are an unlikely couple. They worked with an attorney to create a pre-nup agreement where everything prior to their marriage is separate property. Everything earned during their marriage is joint. If Margaret and James were to divorce, James would receive $1,000/month for every year they were married up to $10,000/month for the rest of Margaret's life. Both Margaret and James value higher education. Margaret and her ex-husband, Frank, put money aside for each of their children. The money is currently in two joint accounts - one with Molly and the other with Maverick. Molly, who will be 25 at the end of the year, ended up attending a good undergraduate university and is working at an entry level job as a marketing agency. Molly is interested in the family business, but still isn't sure if it's something that she would want to do long-term. Margaret was concerned about Molly's safety and ended up buying a house for Molly to live in. The house is located in Dallas and was originally purchased for $340,000 and has a mortgage of $200,000, which is at a 5.5% interest rate and a 30-year loan. Both Molly and Margaret are listed on the deed and mortgage. Margaret has also been giving Molly an additional $1,000/month. Maverick is going through a rough patch and is currently living with Margaret and James. He dropped out of college and has sporadic employment. Margaret has found herself supporting him through the years. Maverick has a daughter named Maddie and he shares custody of Maddie with her mom. Maddie is 2 and was recently diagnosed with autism. Margaret is a proud and supportive grandmother. While no one is certain yet of how much support Maddie will need in the future, Margaret is determined that Maddie will be provided for and taken care of. Margaret has worked with financial planners in the past, but it was always Frank's advisor and she never really felt a connection. After her divorce, she was just too busy, but as life has slowed down a bit, she is ready to be more involved in the financial planning process. She knows she's well off, but feels disorganized. She likes to view things at a high level and doesn't like to get bogged down with details. James has never worked with a financial planner, but is eager for the meeting to learn and understand what they have. In looking at their values, both Margaret and James value higher education and giving back. Margaret wants to continue supporting the Diamond in the Rough Foundation and James wants to support Sons of the Flag Foundation. In thinking through their estate, Margaret wants to be sure that if anything were to happen to her that James would be taken care of. Margaret doesn't want to leave James with nothing, but definitely wants the majority of her wealth to go with her bloodline. Both Margaret and James are in good health. Net Worth Statement As of February 6, 2020 Prepared for Margaret Miner and James John ASSETS: Margaret NON-QUALIFIED ASSETS: : Taxable Investments: Brokerage Account (Margaret) $4,224,393 Joint Account with Maverick $247,964 Joint Account with Molly $76,894 James Joint Total LIABILITIES: Margaret James Joint Total TOTAL LIABILITIES $0 SO $0 $O $4,224,393 $247,964 $76,894 NET WORTH $20,846,775 $0 $0 $ $0 $20,846,775 Insurance Policies: Firefighter Life Insurance Policy Life Insurance Total: Non-Qualified Assets - $76,000 $4,625,251 $76,000 $4,625, 251 RETIREMENT ASSETS: Qualified Retirement: SEP Account (Margaret) $446,524 $446,524 Total: Retirement Assets $446,524 $ $446,524 TOTAL LIQUID ASSETS $5,071,775 $5,071,775 BUSINESS INTERESTS: The Sparkling Gem Total: Business Interests $10,275,000 $10,275,000 $10,275,000 $10,275,000 REAL ESTATE ASSETS: Colorado Cabin Dallas Home Total: Real Estate Assets $2,500,000 $1,500,000 $4,000,000 $2,500,000 $1,500,000 $4,000,000 -- PERSONAL ASSETS: Inherited Jewelry Collection Total: Personal Assets $1,500,000 $1,500,000 $1,500,000 $1,500,000 TOTAL ASSETS $20,846,775 $20,846,775 TOTAL NET WORTH: $20,846,775 Expense Details Base Facts Prepared for Margaret Miner and James John The Expenses Details report lists your expenses. Living Expense Details Dallas Property Tax $30,000 Income Tax Payments $108,000 Dallas Home Maintenance $35,000 Colorado Cabin Maintenance $25,000 Molly Expenses $45,000 Colorado Cabin Property Tax $14,000 Car Lease (Lease ends 12/2020) $9,600 Insurance $25,000 Diamond in the Rough Foundation $18,000 Sons of the Flag $6,000 Food/Groceries $18,000 Dallas Utilities $12,000 Colorado Cabin Utilities $13,000 Restaurants $35,000 Boat Cost $30,000 Annual Family Vacation $50,000 Cowboys Season Suite $50,000 Clothing $20,000 Season Pass for Ski Lift $10,000 Dallas Country Club Dues $18,500 Holdings Detail As of February 06, 2020 Prepared for Margaret Miner and James John The Holdings Detail report lists your holdings, and each holding's percentage of the total portfolio as of the last update. ACCOUNTS INCLUDED: ALL ASSETS Market Value Asset Class % of Portfolio Ticker CUSIP Units Price 10.13 2.10 1.24 6.89 Name Brokerage Account (Margaret) Alphabet Inc. Class A Facebook, Inc. Class A iShares MSCI Poland ETF iShares Russell 1000 Value ETF Microsoft Corporation Morgan Stanley Institutional Fund, Inc Capital Growth Plf, CII Neuberger Berman Commodity Strategy Fund-Class A Parametric Commodity Strategy Fund Institutional Class SPDR S&P 500 ETF Trust T. Rowe Price New Horizons Fund Tesla Inc Van Eck CM Commodity Index Fd CI A Vanguard Total Stock Market ETF Vanguard Total World Stock ETF White Oak Select Growth Fund Joint Account with Maverick JPMorgan Trust II US Government Money Market Fund Morgan Joint Account with Molly JPMorgan Trust II US Government Money Market Fund Morgan SEP Account (Margaret) Amazon.com, Inc. Brown Advisory Sustainable Growth Fd Inst Shs Fidelity Select Biotechnology Pt Harbor Capital Appreciation Fund Insti CI T. Rowe Price Blue Chip Growth Fund, Inc. GOOGL FB EPOL IWD MSFT MSEQX NRBAX EIPCX SPY PRNHX TSLA CMCAX VTI VT WOGSX 350.000 500.000 3,000.000 2,500,000 250.000 1,500.000 95,000.000 115,000.000 3,000.000 1,500.000 150.000 3,000.000 2,500.000 3,000.000 950.000 1,446.05 210.11 20.63 137.75 179.90 50.49 5.55 4.98 332.86 63.43 734.70 4.30 169.21 82.23 105.00 506,117.50 105,055.00 61,890.00 344,375.00 44,975.00 75.735.00 527,250.00 572,700.00 998,580.00 95,145.00 110,205.00 12,900.00 423,025.00 246,690.00 99,750.00 Large Growth Large Growth Multiple Multiple Large Growth Multiple Commodities Commodities Multiple Multiple Large Growth Commodities Multiple Multiple Multiple 0.90 1.52 10.55 11.46 19.99 1.90 2.21 0.26 8.47 4.94 2.00 MJGXX 247,964.000 1.00 247,964.00 Multiple 4.96 MJGXX 76,894.000 1.00 76,894.00 Multiple 1.54 AMZN BAFWX FBIOX HACAX TRBCX 150.000 2,039.87 1,250.000 29.81 350.000 22.57 600.000 81.94 350.000 132.05 305,980.50 37,262.50 7,899.50 49,164.00 46,217.50 Large Growth Multiple Multiple Multiple Multiple 6.12 0.75 0.16 0.98 0.93 Total Holdings Cash Balance Total Value 4,995,775 0 4,995,775 100.00 0.00 100.00 Life Insurance Summary Base Facts Prepared for Margaret Miner and James John This report lists your life insurance policies and shows the amount of coverage for each person insured. Insured: Margaret Miner Life Insurance Death Benefit: $2,000,000 Purchase Date: 2/6/2011 Policy Number: Insured: Margaret Miner Institution: Type: Term Premium Payer: Margaret and James (Joint/ROS) Premium Term (years): Lifetime Owner: Margaret Miner Annual Premium: $2,700 Exclusion Amount: $0 Term (years): 10 Proceeds Reinvested: Inflation (3.00%) Primary Beneficiaries: Other Heirs (100.00%) Contingent Beneficiaries: Other Heirs (100.00%) Life Insurance Death Benefit: $250,000 Policy Insured: Margaret Miner Purchase Date: 2/6/2020 Owner: Margaret Miner Type: Whole Premium Payer: Margaret and James (Joint/ROS) Premium Term (years): Lifetime Annual Premium: $0 Exclusion Amount: $0 Cash Value Growth Rate: Inflation (3.00%) Basis: $54,000 Term (years): n/a Cash Value: $76,000 as of 2/6/2020 Proceeds Reinvested: Inflation (3.00%) Primary Beneficiaries: Other Heirs (100.00%) Contingent Beneficiaries: Other Heirs (100.00%) Insured: James John Firefighter Life Insurance Policy Death Benefit: $140,000 Purchase Date: 2/6/2020 Policy Number: Insured: James John Institution: Type: Group Premium Payer: Margaret and James (Joint/ROS) Premium Term (years): Lifetime Owner: James John Annual Premium: $0 Term (years): n/a Exclusion Amount: $0 Cash Value Growth Rate: No Growth (0.00%) Cash Value: $0 as of 2/6/2020 Basis: $0 Proceeds Reinvested: Inflation (3.00%) Primary Beneficiaries: Margaret Miner (100.00%) Contingent Beneficiaries: Other Heirs (100.00%) Total Insurance Insured Payable to Spouse or Estate $0 Payable to Irrevocable Trust Total Benefit Payable to Heirs $2,250,000 $0 $2,250,000 $140,000 $0 $0 Margaret Miner James John Survivorship Total Insurance Coverage $140,000 $0 $140,000 $0 $0 $0 $0 $2,250,000 $2,390,000 Disability Summary Base Facts Prepared for Margaret Miner and James John The following is a summary of the general details of the selected disability event. It also displays lost income sources and disability policies, as these are the main items that impact disability analysis. Existing Disability Insurance Firefighter Disability Insured: James John Policy Type: Group Long Term Benefit: $35,000 Annually Elimination Period: 0 Days COLA: Inflation (3.00%) Annual Premium: Institution: Reduce by Social Security?: Yes Benefit Period: Age 65 Benefit is Taxable?: No Premium Term: 0 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts