Answered step by step

Verified Expert Solution

Question

1 Approved Answer

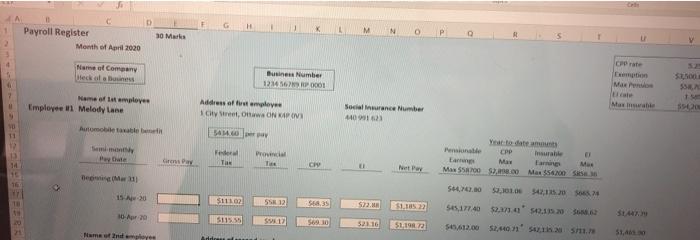

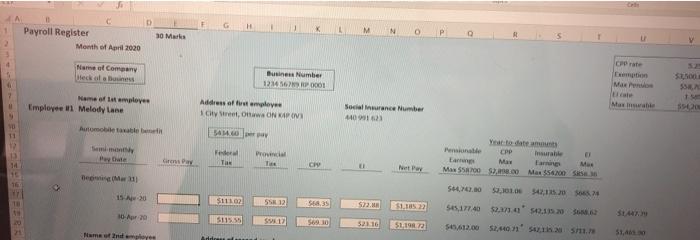

Canadian payroll. can someone check if my answers are correct please? note: the gross pay i put it all the way on the right first

Canadian payroll. can someone check if my answers are correct please? note: the gross pay i put it all the way on the right first perios is $1,447.79

Semi monthly pay date (24 pmt)

G M A Payroll Register Morth of April 2020 N 30 Maks Corte Name of Company Deck of a bus Business Number 1236 69 0001 Max Pene Name of employee Employee 1 Melody Lane Address of temployee City Street, ON KAPOVI Narwa Social Insurance Number 140913 NO Automobile talebi Fe Pey Pro Te Pensionale CPP Insurable May Lang MOSO Max $54.100 14 chy TI M wy DeM 564,100 1,101.0542,115024 15.20 $111.02 558 12 SE35 522 10 Apr $115.55 54517740 2,714 59.52 54.12.00 52.440 n205 563.10 52116 $1192 Name on player G M A Payroll Register Morth of April 2020 N 30 Maks Corte Name of Company Deck of a bus Business Number 1236 69 0001 Max Pene Name of employee Employee 1 Melody Lane Address of temployee City Street, ON KAPOVI Narwa Social Insurance Number 140913 NO Automobile talebi Fe Pey Pro Te Pensionale CPP Insurable May Lang MOSO Max $54.100 14 chy TI M wy DeM 564,100 1,101.0542,115024 15.20 $111.02 558 12 SE35 522 10 Apr $115.55 54517740 2,714 59.52 54.12.00 52.440 n205 563.10 52116 $1192 Name on player Automobile taxable benefit = 434.60

15- April-20:

Gross pay?

Federal Tax?

Provincial Tax?

CPP?

EI?

Net Pay?

pensionable earnings: 44,742.80

CPP: 2,303.06

Insurable Earnings: 42,135.20

EI: 665.74

the employee works 40 hours a week

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started