canadian

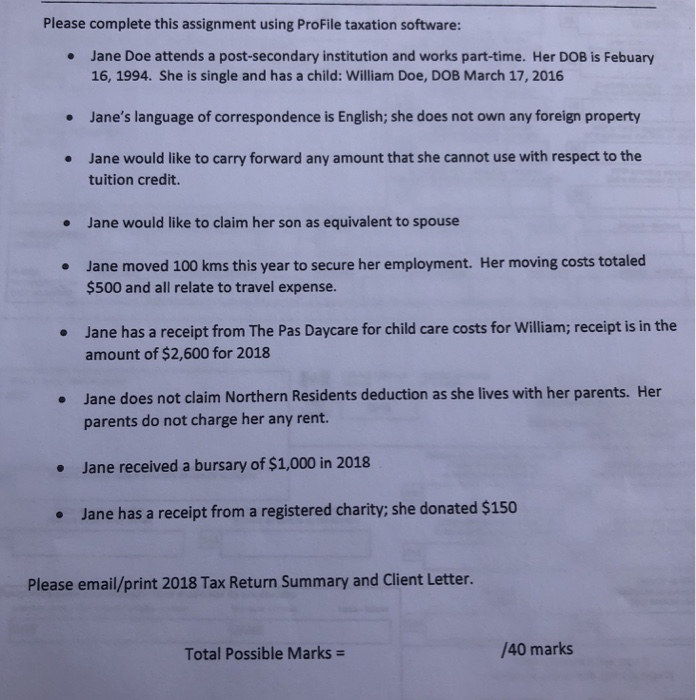

Please complete this assignment using ProFile taxation software: . Jane Doe attends a post-secondary institution and works part-time. Her DOB is Febuary 16, 1994. She is single and has a child: William Doe, DOB March 17, 2016 Jane's language of correspondence is English; she does not own any foreign property Jane would like to carry forward any amount that she cannot use with respect to the tuition credit. Jane would like to claim her son as equivalent to spouse . Jane moved 100 kms this year to secure her employment. Her moving costs totaled $500 and all relate to travel expense. Jane has a receipt from The Pas Daycare for child care costs for william; receipt is in the amount of $2,600 for 2018 Jane does not claim Northern Residents deduction as she lives with her parents. Her Jane received a bursary of $1,000 in 2018 Jane has a receipt from a registered charity; she donated $150 parents do not charge her any rent. Please email/print 2018 Tax Return Summary and Client Letter. /40 marks Total Possible Marks- Box 990 The Pas, MB TA Anle2018 527 000 129 DOE Box 1181 Pas, Manitoba d 9 its f t R nd T4A Statement of Pension, Retrement, Annuly re he Other intormation (see page 2 Please complete this assignment using ProFile taxation software: . Jane Doe attends a post-secondary institution and works part-time. Her DOB is Febuary 16, 1994. She is single and has a child: William Doe, DOB March 17, 2016 Jane's language of correspondence is English; she does not own any foreign property Jane would like to carry forward any amount that she cannot use with respect to the tuition credit. Jane would like to claim her son as equivalent to spouse . Jane moved 100 kms this year to secure her employment. Her moving costs totaled $500 and all relate to travel expense. Jane has a receipt from The Pas Daycare for child care costs for william; receipt is in the amount of $2,600 for 2018 Jane does not claim Northern Residents deduction as she lives with her parents. Her Jane received a bursary of $1,000 in 2018 Jane has a receipt from a registered charity; she donated $150 parents do not charge her any rent. Please email/print 2018 Tax Return Summary and Client Letter. /40 marks Total Possible Marks- Box 990 The Pas, MB TA Anle2018 527 000 129 DOE Box 1181 Pas, Manitoba d 9 its f t R nd T4A Statement of Pension, Retrement, Annuly re he Other intormation (see page 2