Question

Canberra Ltd, an Australian company, acquired all the issued shares of Washington Ltd, a US company, on 1 January 2020. At this date, the net

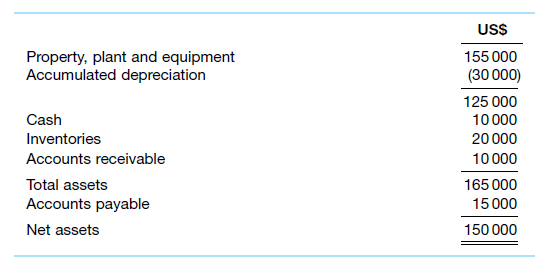

Canberra Ltd, an Australian company, acquired all the issued shares of Washington Ltd, a US company, on 1 January 2020. At this date, the net assets of Washington Ltd are shown below.

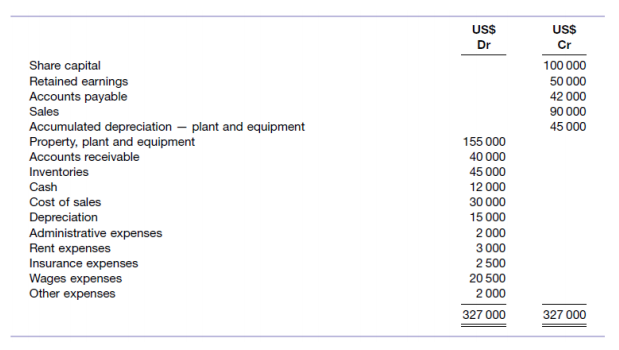

The trial balance prepared by the US company, Washington Ltd, at 31 December 2020 contained the following information:

Additional information

No property, plant and equipment were acquired in the period ended 31 December 2020.

All sales and expenses were acquired evenly throughout the period. The inventories on hand at the end of the year were acquired during December 2020.

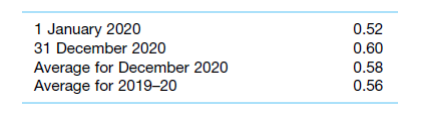

Exchange rates were (A$1 = US$):

The functional currency for Washington Ltd is the US dollar.

a) Prepare the financial statements of Washington Ltd at 31 December 2020 in the presentation currency of Australian dollars.

b) Verify the foreign currency translation adjustment.

c) Discuss the differences that would occur if the functional currency of Washington Ltd was the Australian dollar.

d) If the functional currency was the Australian dollar, calculate the foreign currency translation adjustment.

USS Property, plant and equipment Accumulated depreciation 155 000 (30 000) 125 000 10 000 20 000 10 000 Cash Inventories Accounts receivable Total assets Accounts payable Net assets 165 000 15 000 150 000 US$ Dr US$ Cr 100 000 50 000 42 000 90 000 45 000 Share capital Retained earnings Accounts payable Sales Accumulated depreciation - plant and equipment Property, plant and equipment Accounts receivable Inventories Cash Cost of sales Depreciation Administrative expenses Rent expenses Insurance expenses Wages expenses Other expenses 155 000 40 000 45 000 12 000 30 000 15 000 2 000 3 000 2 500 20 500 2000 327 000 327 000 1 January 2020 31 December 2020 Average for December 2020 Average for 2019-20 0.52 0.60 0.58 0.56Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started