Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Candel Company owned 10.000 shares of equity securities of XYZ Company with carrying amount of P90 per share. On October 31, 2020 Candel Company

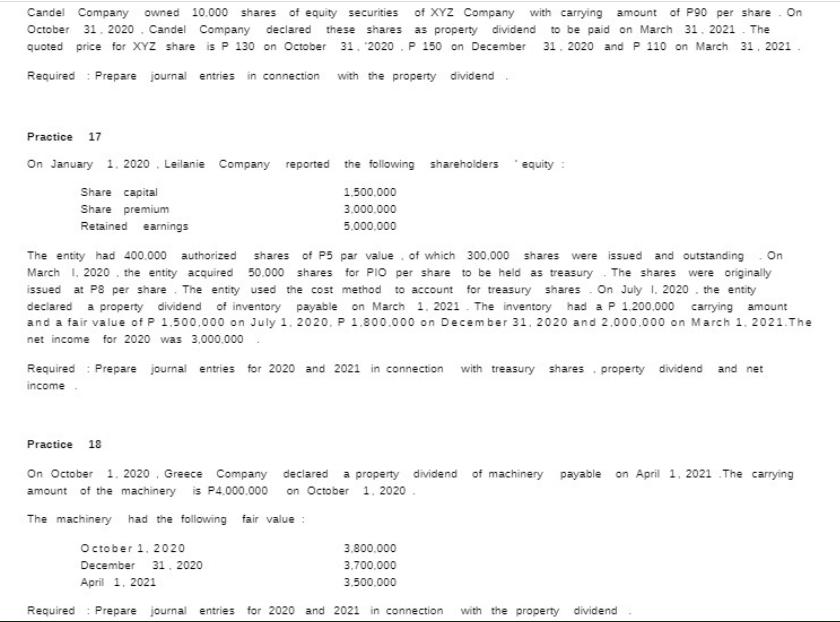

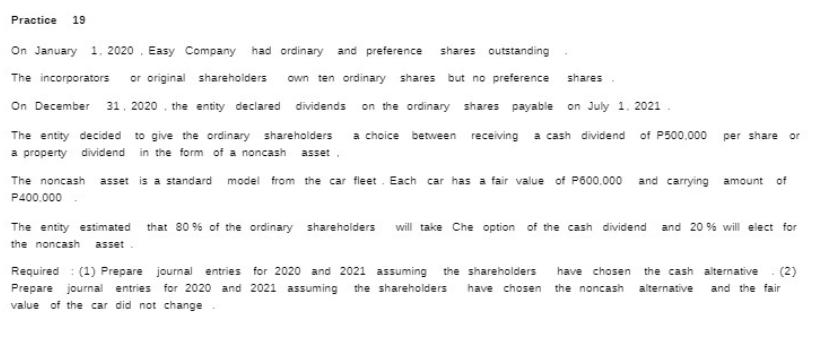

Candel Company owned 10.000 shares of equity securities of XYZ Company with carrying amount of P90 per share. On October 31, 2020 Candel Company declared these shares as property dividend to be paid on March 31, 2021. The quoted price for XYZ share is P 130 on October 31, 2020. P 150 on December 31, 2020 and P 110 on March 31, 2021 Required Prepare journal entries in connection with the property dividend Practice 17 On January 1, 2020 Leilanie Company reported the following shareholders Share capital Share premium Retained earnings 1.500,000 3.000.000 5,000,000 The entity had 400.000 authorized shares of P5 par value of which 300.000 shares were issued and outstanding. On March 1, 2020. the entity acquired 50.000 shares for PIO per share to be held as treasury The shares were originally issued at P8 per share. The entity used the cost method to account for treasury shares On July 1. 2020. the entity declared a property dividend of inventory payable on March 1, 2021 The inventory had a P 1.200.000 carrying amount and a fair value of P 1.500.000 on July 1, 2020, P 1.800.000 on December 31, 2020 and 2.000.000 on March 1, 2021.The net income for 2020 was 3,000,000 Practice equity : Required: Prepare journal entries for 2020 and 2021 in connection with treasury shares property dividend and net income 18 On October 1, 2020 Greece Company declared a property dividend of machinery payable on April 1, 2021 The carrying amount of the machinery is P4.000.000 on October 1. 2020. The machinery had the following fair value: October 1, 2020 December 31, 2020 3.800.000 3,700,000 3.500.000 April 1, 2021 Required: Prepare journal entries for 2020 and 2021 in connection with the property dividend Practice 19 On January 1, 2020 Easy Company had ordinary and preference shares outstanding The incorporators or original shareholders own ten ordinary shares but no preference shares On December 31, 2020 the entity declared dividends on the ordinary shares payable on July 1. 2021 The entity decided to give the ordinary shareholders a choice between receiving a cash dividend of P500,000 per share or a property dividend in the form of a noncash asset. The noncash asset is a standard model from the car fleet. Each car has a fair value of P600,000 and carrying amount of P400.000 The entity estimated that 80% of the ordinary shareholders will take Che option of the cash dividend and 20 % will elect for the noncash asset. Required: (1) Prepare journal entries for 2020 and 2021 assuming the shareholders have chosen the cash alternative (2) Prepare journal entries for 2020 and 2021 assuming the shareholders have chosen the noncash alternative and the fair value of the car did not change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

we can help you prepare the journal entries for the given scenarios Lets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started