Answered step by step

Verified Expert Solution

Question

1 Approved Answer

cannot firgure oht the missing questions The following information relates to the manufacturing operations of Julie Publishing Corporation for the year: Beginning Ending Raw Materials

cannot firgure oht the missing questions

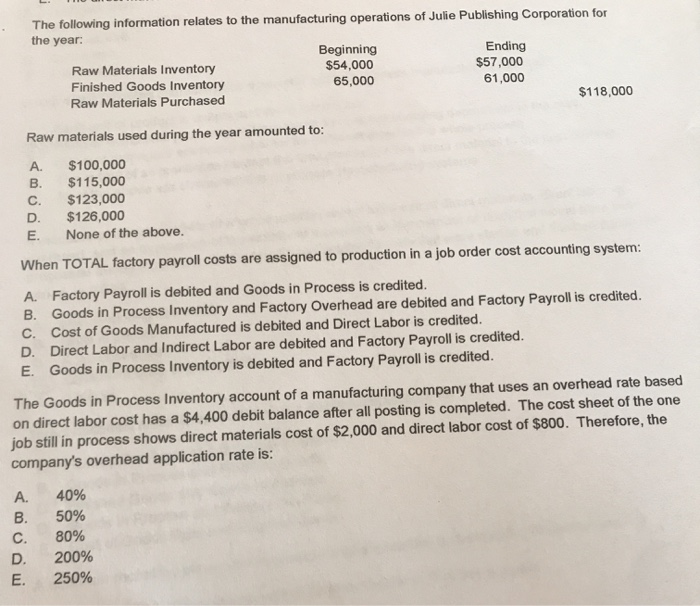

The following information relates to the manufacturing operations of Julie Publishing Corporation for the year: Beginning Ending Raw Materials Inventory $54,000 $57,000 Finished Goods Inventory 65,000 61,000 Raw Materials Purchased $118,000 Raw materials used during the year amounted to: A. B. C. D. $100,000 $115,000 $123,000 $126,000 None of the above. E. When TOTAL factory payroll costs are assigned to production in a job order cost accounting system: A. Factory Payroll is debited and Goods in Process is credited. B. Goods in Process Inventory and Factory Overhead are debited and Factory Payroll is credited. C. Cost of Goods Manufactured is debited and Direct Labor is credited. D. Direct Labor and Indirect Labor are debited and Factory Payroll is credited. E. Goods in Process Inventory is debited and Factory Payroll is credited. The Goods in Process Inventory account of a manufacturing company that uses an overhead rate based on direct labor cost has a $4,400 debit balance after all posting is completed. The cost sheet of the one job still in process shows direct materials cost of $2,000 and direct labor cost of $800. Therefore, the company's overhead application rate is: A. Oui 40% 50% 80% 200% 250% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started