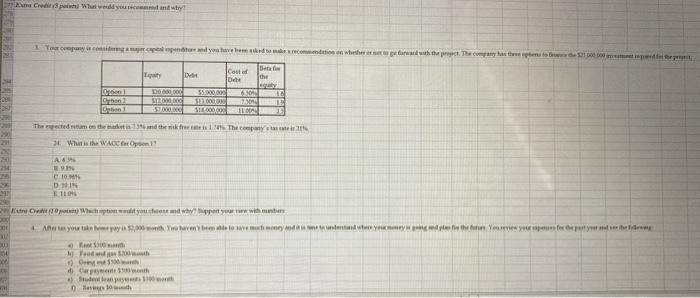

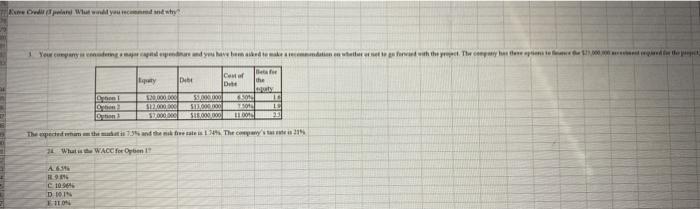

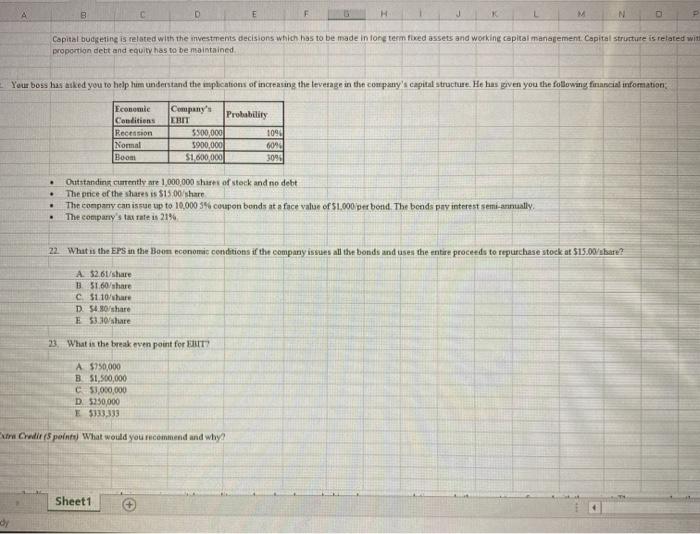

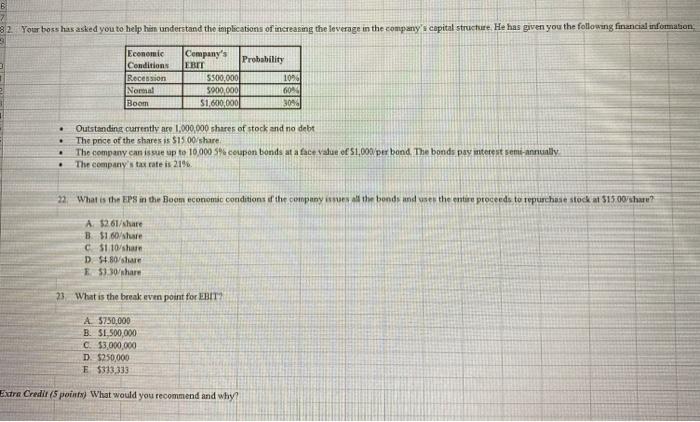

Capawh What wound Templatelet come with a great with the pot. The company has the phenom | HARIAN Beta Det [Cout Det the Dood 500,000 6.10 LIE SOAL STO SE 09.00 Threedom this 1.ad their the cost 34. Wat is the WACCO A. 10 DON ETI 04 undit Wachtwad youth and what you with me After you have the below and we were then you see . Food . Cerpent month Studenten 0 0 Olipa Wut will you need to 1 You can crestere pested and you have made me when with the propew copy themed top Bee the Com De Date 120.000 5000 SI 5700000 SH3,000 . The aspected on the mais 735 and the fees The Wu WACC for Oy 16.14 FEE C1001 DION 110 B D F H J M N Capital budgeting is related with the investments decisions which has to be made in fong term fored assets and working capital management Capital structure is related wit proportion debt and equity has to be maintained Your boss has asked you to help him understand the implications of increasing the leverage in the company's capital structure. He has given you the following financial information Economic Conditions Recession Normal Boom Company's ERIT Probability 5500,000 1094 5900,000 6094 $1,600,000 3094 . Outstanding currently are 1,000,000 shares of stock and no debt The price of the shares is $15.00/share The company can issue up to 10,000 3% coupon bonds at a face value of $1.000 per bond. The bonds pay interest semi-annually The company's tax rate is 21% . 22 What is the EPS in the Boom economic conditions if the company issues all the bonds and uses the entire proceeds to repurchase stock at $15.00/share? A $261/share 151 60/share CS1.10/share D. 54.80/share E 53.10/share 23. What is the break even point for ERIT A $750,000 B 51,500,000 50.000.000 D. 3250,000 E$333,333 Xtre Codi (5 polno What would you recommend and why? Sheet1 32. Your boss has asked you to help hin understand the implications of increasing the leverage in the company's capital structure. He has given you the following financial information, 3 Economic Company's Conditions EBIT Probability Recession 5500,000 1096 Normal $900.000 604 Boom 51.600.000 3044 . . Outstanding currently are 1,000,000 shares of stock and no debt The pnce of the shares is $15 00/share The company can issue up to 10,000 coupon bonds at a face value of $1,000 per bond. The bonds pay mterest semi-annually The company's tax rate is 219 . 22. What is the EPS in the Boom economic conditions of the company issues the bonds and uses the entire proceeds to repurchase stock at $150/share? A $261/share B $1.60/share C$110'sha D$4.80/share E53 30/share 23 What is the break even point for EBIT? A 5750,000 B. SI,500,000 C: $3,000,000 D. $250,000 E $313,333 Extra Credit (5 points) What would you recommend and why? Capawh What wound Templatelet come with a great with the pot. The company has the phenom | HARIAN Beta Det [Cout Det the Dood 500,000 6.10 LIE SOAL STO SE 09.00 Threedom this 1.ad their the cost 34. Wat is the WACCO A. 10 DON ETI 04 undit Wachtwad youth and what you with me After you have the below and we were then you see . Food . Cerpent month Studenten 0 0 Olipa Wut will you need to 1 You can crestere pested and you have made me when with the propew copy themed top Bee the Com De Date 120.000 5000 SI 5700000 SH3,000 . The aspected on the mais 735 and the fees The Wu WACC for Oy 16.14 FEE C1001 DION 110 B D F H J M N Capital budgeting is related with the investments decisions which has to be made in fong term fored assets and working capital management Capital structure is related wit proportion debt and equity has to be maintained Your boss has asked you to help him understand the implications of increasing the leverage in the company's capital structure. He has given you the following financial information Economic Conditions Recession Normal Boom Company's ERIT Probability 5500,000 1094 5900,000 6094 $1,600,000 3094 . Outstanding currently are 1,000,000 shares of stock and no debt The price of the shares is $15.00/share The company can issue up to 10,000 3% coupon bonds at a face value of $1.000 per bond. The bonds pay interest semi-annually The company's tax rate is 21% . 22 What is the EPS in the Boom economic conditions if the company issues all the bonds and uses the entire proceeds to repurchase stock at $15.00/share? A $261/share 151 60/share CS1.10/share D. 54.80/share E 53.10/share 23. What is the break even point for ERIT A $750,000 B 51,500,000 50.000.000 D. 3250,000 E$333,333 Xtre Codi (5 polno What would you recommend and why? Sheet1 32. Your boss has asked you to help hin understand the implications of increasing the leverage in the company's capital structure. He has given you the following financial information, 3 Economic Company's Conditions EBIT Probability Recession 5500,000 1096 Normal $900.000 604 Boom 51.600.000 3044 . . Outstanding currently are 1,000,000 shares of stock and no debt The pnce of the shares is $15 00/share The company can issue up to 10,000 coupon bonds at a face value of $1,000 per bond. The bonds pay mterest semi-annually The company's tax rate is 219 . 22. What is the EPS in the Boom economic conditions of the company issues the bonds and uses the entire proceeds to repurchase stock at $150/share? A $261/share B $1.60/share C$110'sha D$4.80/share E53 30/share 23 What is the break even point for EBIT? A 5750,000 B. SI,500,000 C: $3,000,000 D. $250,000 E $313,333 Extra Credit (5 points) What would you recommend and why