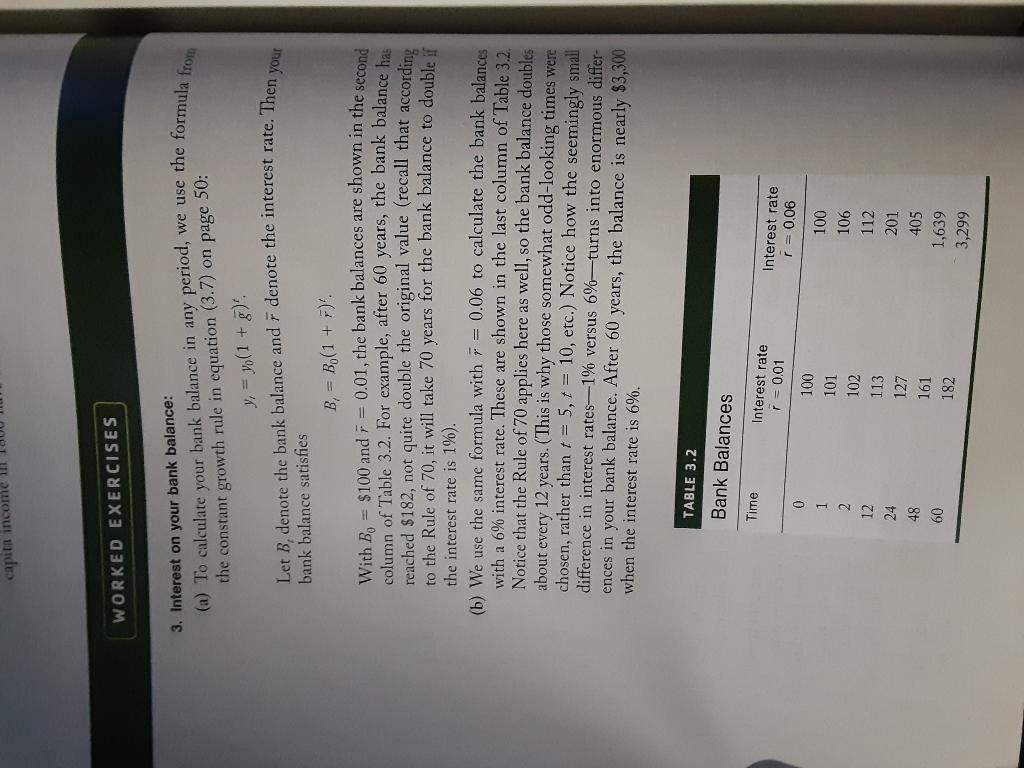

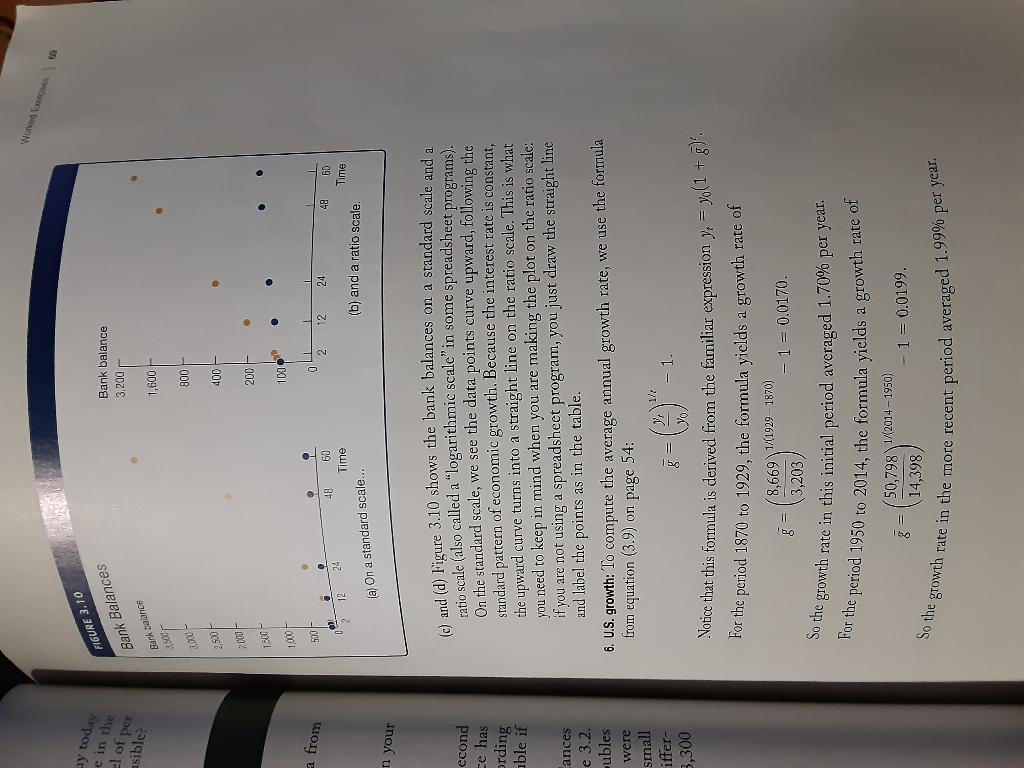

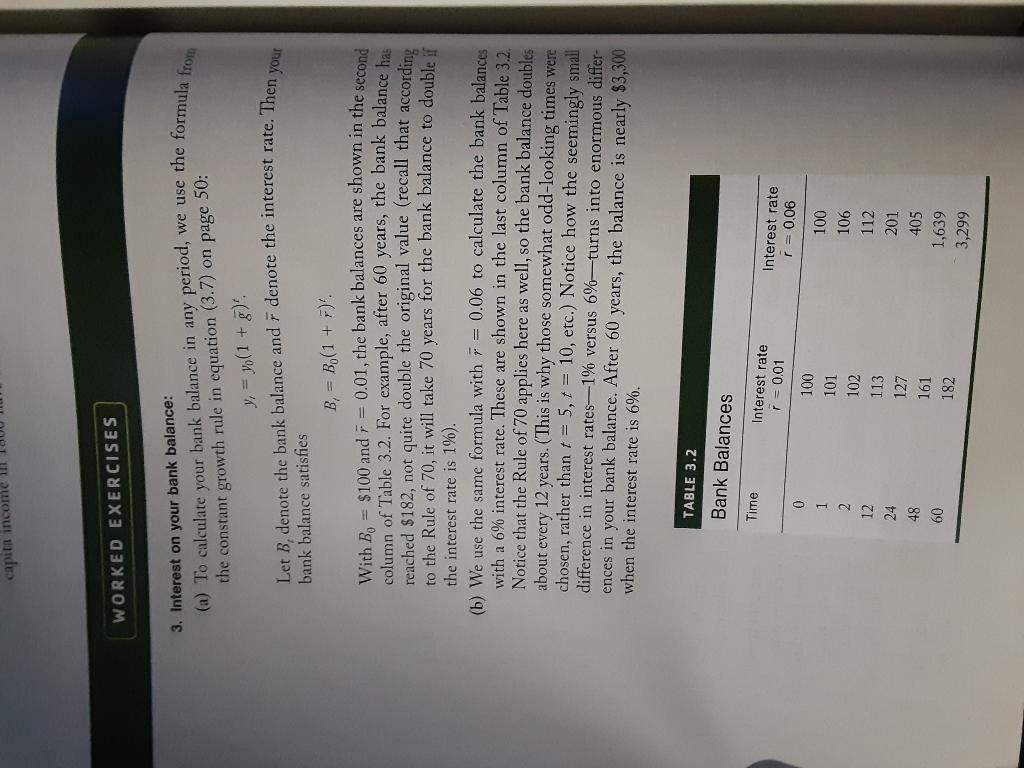

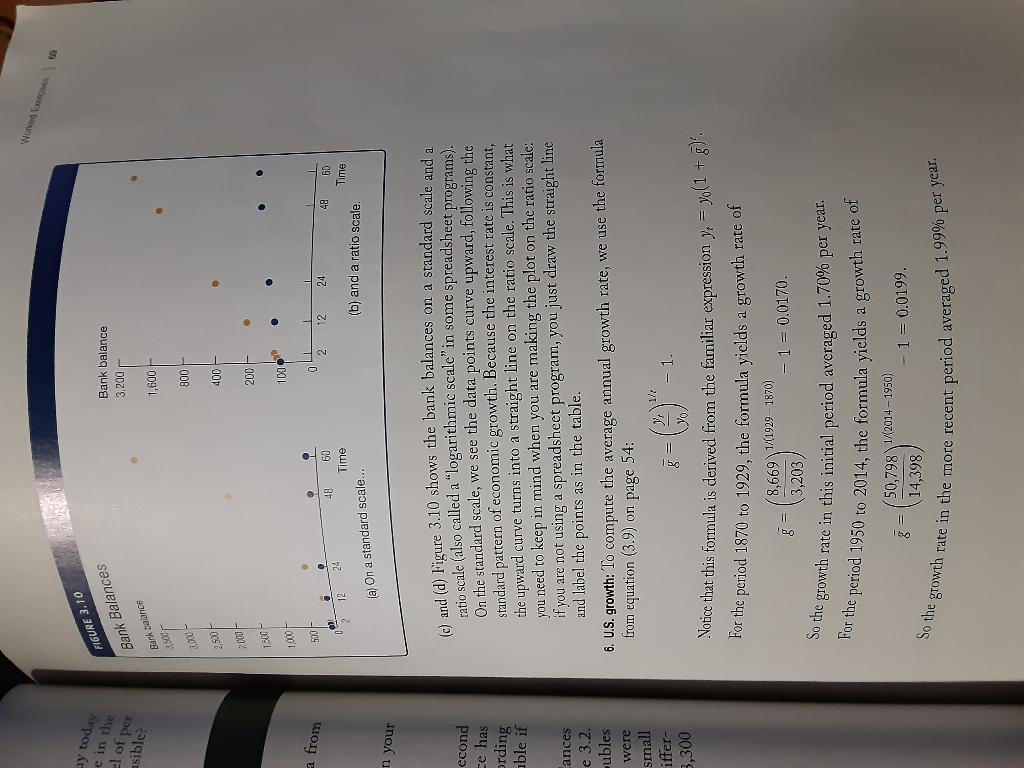

capita income il ill WORKED EXERCISES your 3. Interest on your bank balance: (a) To calculate your bank balance in any period, we use the formula from the constant growth rule in equation (3.7) on page 50: y = yo(1+3) Let B, denote the bank balance and F denote the interest rate. Then bank balance satisfies B, = Bo(1+F). With Bo = $100 and r = 0.01, the bank balances are shown in the second column of Table 3.2. For example, after 60 years, the bank balance has reached $182, not quite double the original value (recall that according to the Rule of 70, it will take 70 years for the bank balance to double if the interest rate is 1%). (b) We use the same formula with = 0.06 to calculate the bank balances with a 6% interest rate. These are shown in the last column of Table 3.2. Notice that the Rule of 70 applies here as well, so the bank balance doubles about every 12 years. (This is why those somewhat odd-looking times were chosen, rather than t = 5,1 = 10, etc.) Notice how the seemingly small difference in interest rates-1% versus 6%-turns into enormous differ- ences in your bank balance. After 60 years, the balance is nearly $3,300 when the interest rate is 6%. TABLE 3.2 Bank Balances Time Interest rate r = 0.01 Interest rate r = 0.06 0 1 2 12 24 100 101 102 113 127 161 182 100 106 112 201 405 1,639 3,299 48 60 WA FIGURE 3.10 y today e in the Bank Balances Bank balance 3,200 el of per asible Bank balance 1,600 800 BUT 300 2.500 2000 400 200 1510 - 100 1.000 o from 1 500 0 2 2 24 48 4d 60 Time 24 60 Time 2 12 (a) On a standard scale... (b) and a ratio scale. n your econd ce has ording able if (c) and (d) Figure 3.10 shows the bank balances on a standard scale and a ratio scale (also called a logarithmic scale" in some spreadsheet programs). On the standard scale, we see the data points curve upward, following the standard pattern of economic growth. Because the interest rate is constant, the upward curve turns into a straight line on the ratio scale. This is what you need to keep in mind when you are making the plot on the ratio scale: if you are not using a spreadsheet program, you just draw the straight line and label the points as in the table. 6. U.S. growth: To compute the average annual growth rate, we use the formula from equation (3.9) on page 54: ances e 3.2 ubles were small iffer- 3,300 8 1. Notice that this formula is derived from the familiar expression y = yo(1+5) For the period 1870 to 1929, the formula yields a growth rate of 8,669 (1929-1870) 3,203) - 1 = 0.0170. 8 So the growth rate in this initial period averaged 1.70% per year. For the period 1950 to 2014, the formula yields a growth rate of 50,798 1/2014 - 1950) 14,398 - 1 = 0.0199. So the growth rate in the more recent period averaged 1.99% per year. capita income il ill WORKED EXERCISES your 3. Interest on your bank balance: (a) To calculate your bank balance in any period, we use the formula from the constant growth rule in equation (3.7) on page 50: y = yo(1+3) Let B, denote the bank balance and F denote the interest rate. Then bank balance satisfies B, = Bo(1+F). With Bo = $100 and r = 0.01, the bank balances are shown in the second column of Table 3.2. For example, after 60 years, the bank balance has reached $182, not quite double the original value (recall that according to the Rule of 70, it will take 70 years for the bank balance to double if the interest rate is 1%). (b) We use the same formula with = 0.06 to calculate the bank balances with a 6% interest rate. These are shown in the last column of Table 3.2. Notice that the Rule of 70 applies here as well, so the bank balance doubles about every 12 years. (This is why those somewhat odd-looking times were chosen, rather than t = 5,1 = 10, etc.) Notice how the seemingly small difference in interest rates-1% versus 6%-turns into enormous differ- ences in your bank balance. After 60 years, the balance is nearly $3,300 when the interest rate is 6%. TABLE 3.2 Bank Balances Time Interest rate r = 0.01 Interest rate r = 0.06 0 1 2 12 24 100 101 102 113 127 161 182 100 106 112 201 405 1,639 3,299 48 60 WA FIGURE 3.10 y today e in the Bank Balances Bank balance 3,200 el of per asible Bank balance 1,600 800 BUT 300 2.500 2000 400 200 1510 - 100 1.000 o from 1 500 0 2 2 24 48 4d 60 Time 24 60 Time 2 12 (a) On a standard scale... (b) and a ratio scale. n your econd ce has ording able if (c) and (d) Figure 3.10 shows the bank balances on a standard scale and a ratio scale (also called a logarithmic scale" in some spreadsheet programs). On the standard scale, we see the data points curve upward, following the standard pattern of economic growth. Because the interest rate is constant, the upward curve turns into a straight line on the ratio scale. This is what you need to keep in mind when you are making the plot on the ratio scale: if you are not using a spreadsheet program, you just draw the straight line and label the points as in the table. 6. U.S. growth: To compute the average annual growth rate, we use the formula from equation (3.9) on page 54: ances e 3.2 ubles were small iffer- 3,300 8 1. Notice that this formula is derived from the familiar expression y = yo(1+5) For the period 1870 to 1929, the formula yields a growth rate of 8,669 (1929-1870) 3,203) - 1 = 0.0170. 8 So the growth rate in this initial period averaged 1.70% per year. For the period 1950 to 2014, the formula yields a growth rate of 50,798 1/2014 - 1950) 14,398 - 1 = 0.0199. So the growth rate in the more recent period averaged 1.99% per year