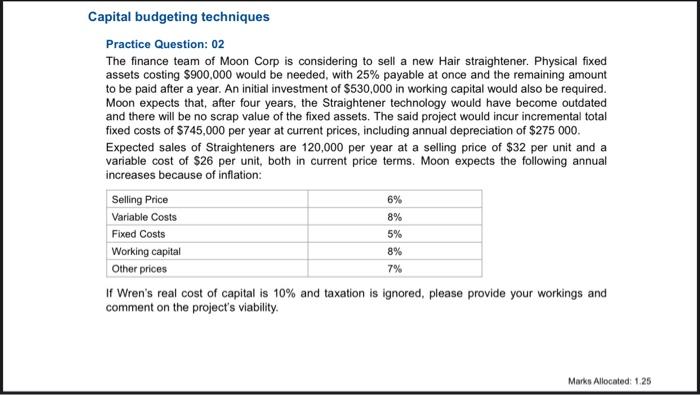

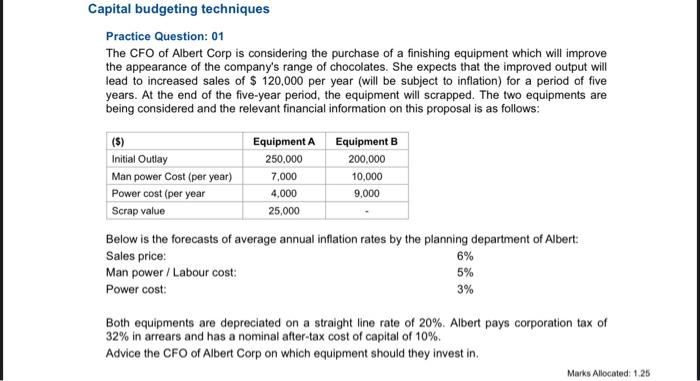

Capital budgeting techniques Practice Question: 02 The finance team of Moon Corp is considering to sell a new Hair straightener. Physical fixed assets costing $900,000 would be needed, with 25% payable at once and the remaining amount to be paid after a year. An initial investment of $530,000 in working capital would also be required. Moon expects that, after four years, the Straightener technology would have become outdated and there will be no scrap value of the fixed assets. The said project would incur incremental total fixed costs of $745,000 per year at current prices, including annual depreciation of $275 000 Expected sales of Straighteners are 120,000 per year at a selling price of $32 per unit and a variable cost of $26 per unit, both in current price terms. Moon expects the following annual increases because of inflation: Selling Price 6% Variable Costs Fixed Costs 5% Working capital 8% Other prices If Wren's real cost of capital is 10% and taxation is ignored, please provide your workings and comment on the project's viability. 8% 7% Marks Allocated: 1.25 Capital budgeting techniques Practice Question: 01 The CFO of Albert Corp is considering the purchase of a finishing equipment which will improve the appearance of the company's range of chocolates. She expects that the improved output will lead to increased sales of $ 120,000 per year (will be subject to inflation) for a period of five years. At the end of the five-year period, the equipment will scrapped. The two equipments are being considered and the relevant financial information on this proposal is as follows: (5) Equipment A Equipment B Initial Outlay 250,000 200,000 Man power Cost (per year) 7,000 10,000 Power cost (per year 4,000 9,000 Scrap value 25,000 Below is the forecasts of average annual inflation rates by the planning department of Albert: Sales price: 6% Man power / Labour cost: 5% Power cost: Both equipments are depreciated on a straight line rate of 20%. Albert pays corporation tax of 32% in arrears and has a nominal after-tax cost of capital of 10%. Advice the CFO of Albert Corp on which equipment should they invest in. Marks Allocated: 125 3%