Answered step by step

Verified Expert Solution

Question

1 Approved Answer

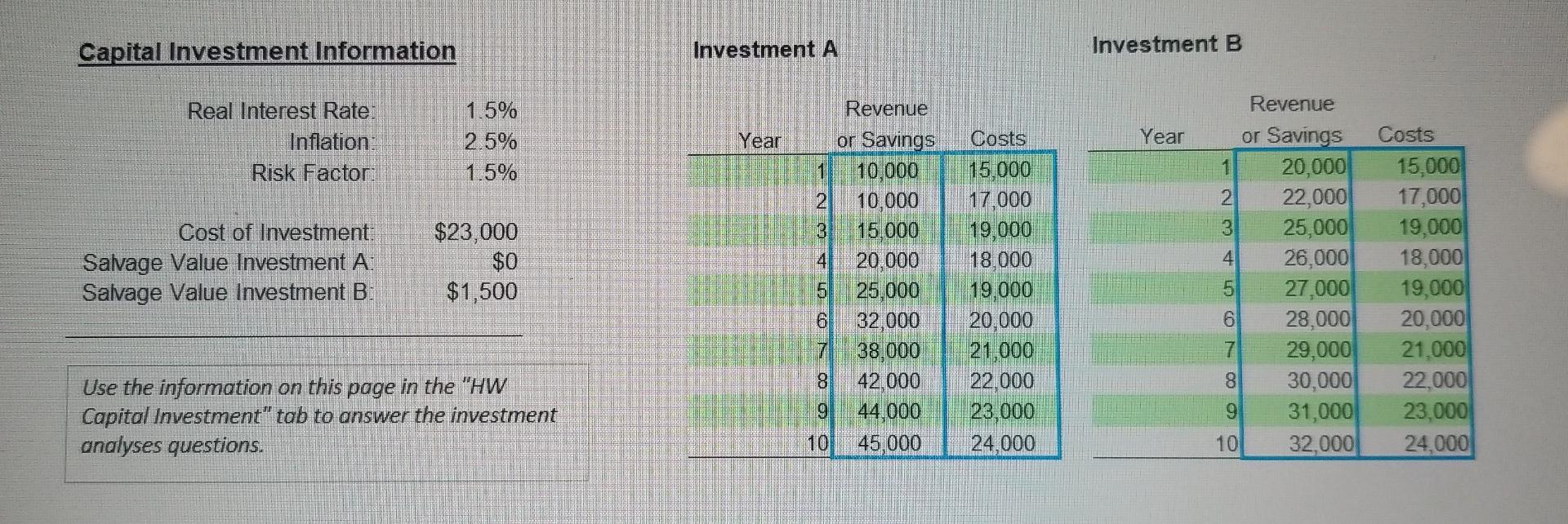

Capital Investment Information Investment A Investment B Real Interest Rate: Inflation: Risk Factor: 1.5% 2.5% 1.5% Year Year Costs Cost of Investment: Salvage Value Investment

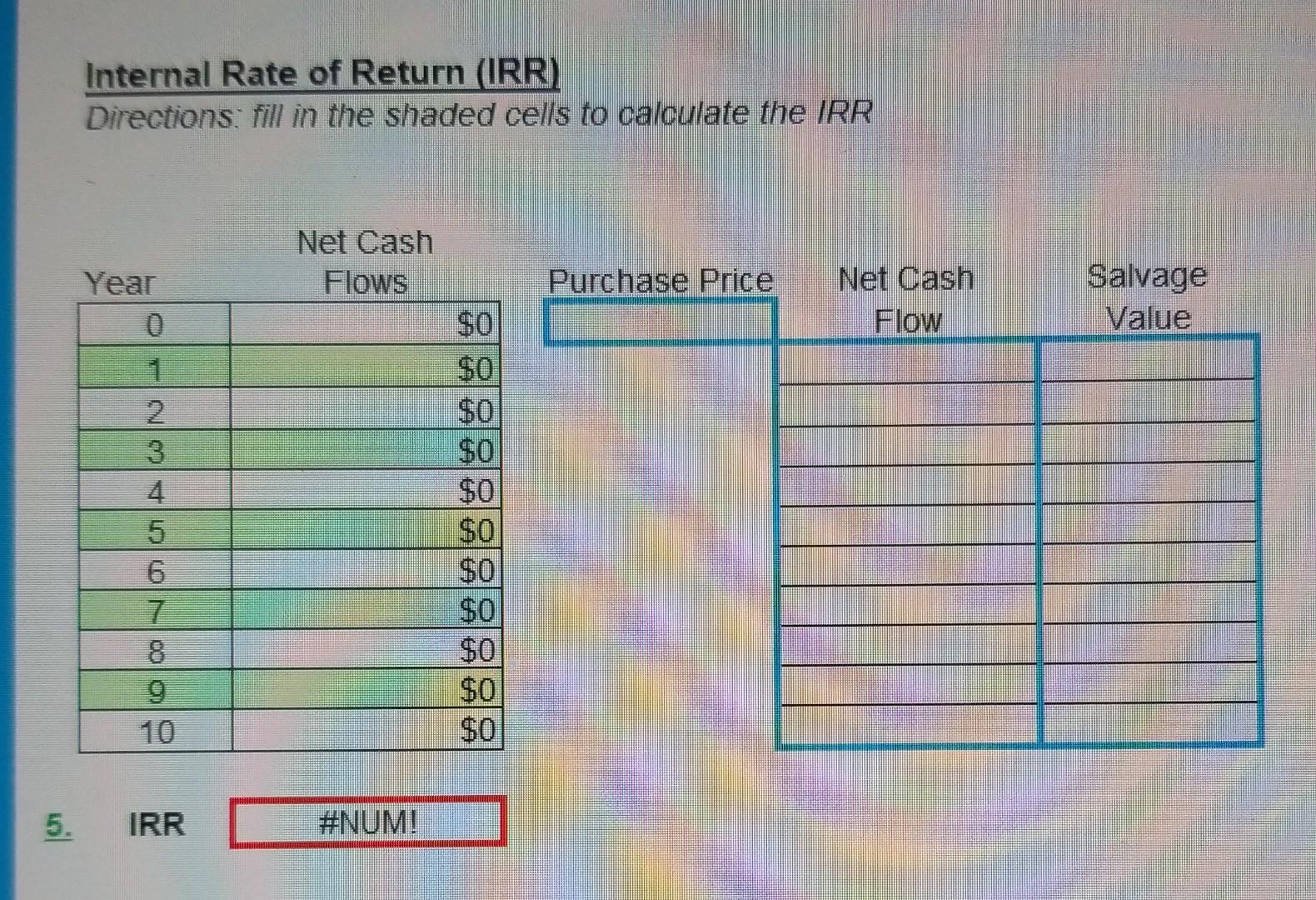

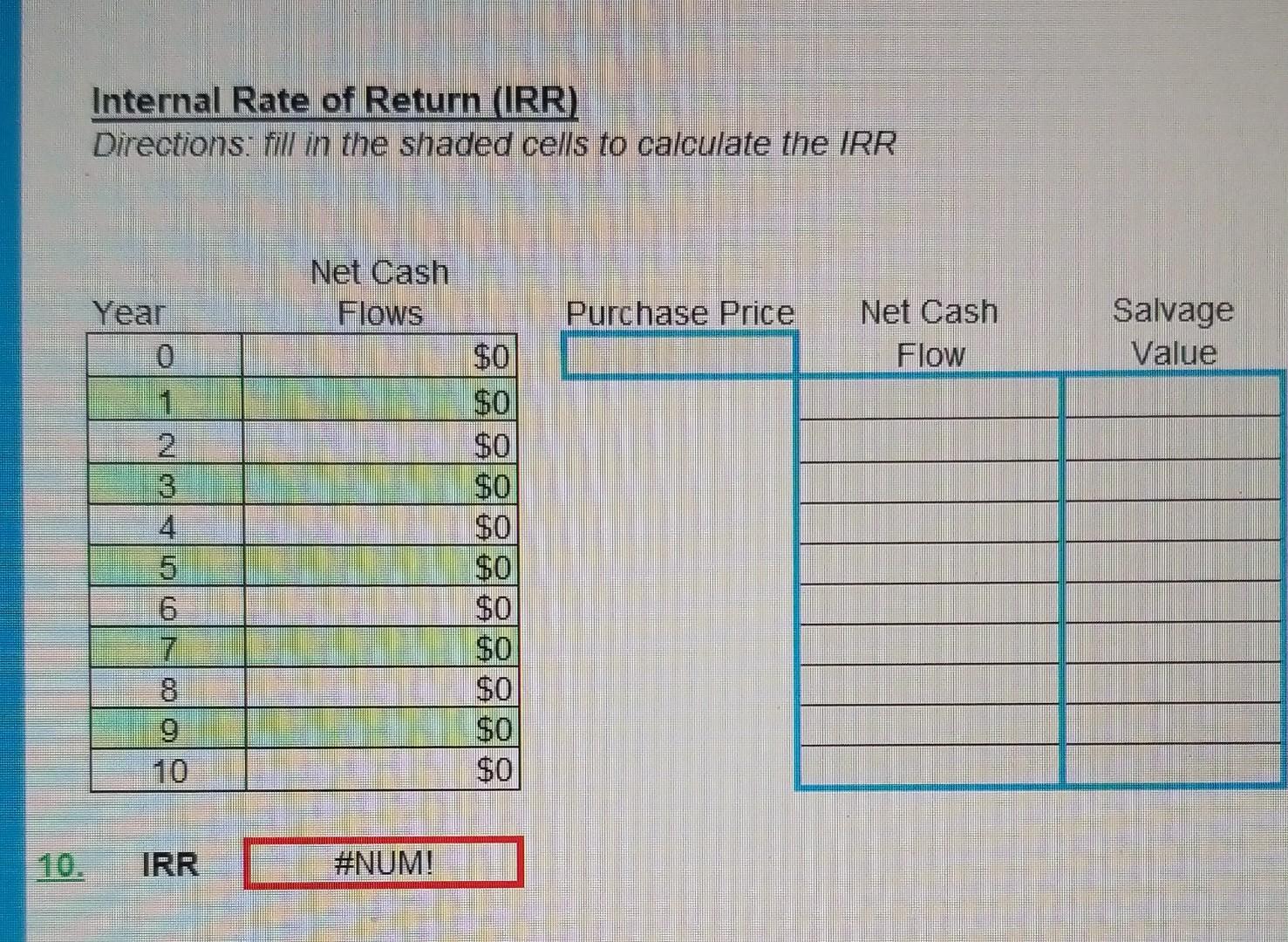

Capital Investment Information Investment A Investment B Real Interest Rate: Inflation: Risk Factor: 1.5% 2.5% 1.5% Year Year Costs Cost of Investment: Salvage Value Investment A: Salvage Value Investment B. $23,000 $0 $1,500 Revenue or Savings 1 10,000 2 2 10,000 3 15.000 41 20 000 5 25.000 6 32,000 7 38,000 8 42.000 9 44,000 10145,000 Costs 15,000 17.000 19,000 18.000 19.000 20.000 21,000 22.000 23,000 24.000 Revenue or Savings 1 20,000 2 22,000 3 25,000 41 4 26,000 5 27,000 6 28,000 729,000 8 30,000 9 31,000 10 32,000 15,000 17,000 19,000 18,000 19,000 20,000 21,000 22,000 23,000 24,000 Use the information on this page in the "HW Capital Investment" tab to answer the investment analyses questions. Internal Rate of Return (IRR) Directions. fill in the shaded cells to calculate the IRR Net Cash Flows Year Purchase Price Net Cash Flow Salvage Value $0 2 3 4 5 6 7 8 9 NOVO $0 $0 $0 $0 $0 $0 $0 $0 $0 5. IRR #NUM! Internal Rate of Return (IRR) Directions: fill in the shaded cells to calculate the IRR Net Cash Flows Purchase Price Year 0 1 Net Cash Flow Salvage Value $0 $0 13 MA N. 5 6 7 $0 $0 $0 $0 $0 $0 $0 $0 $0 | IRR #NUM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started