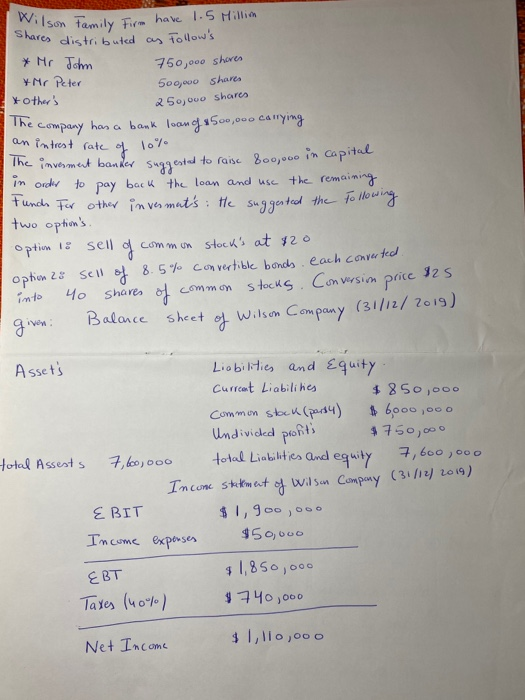

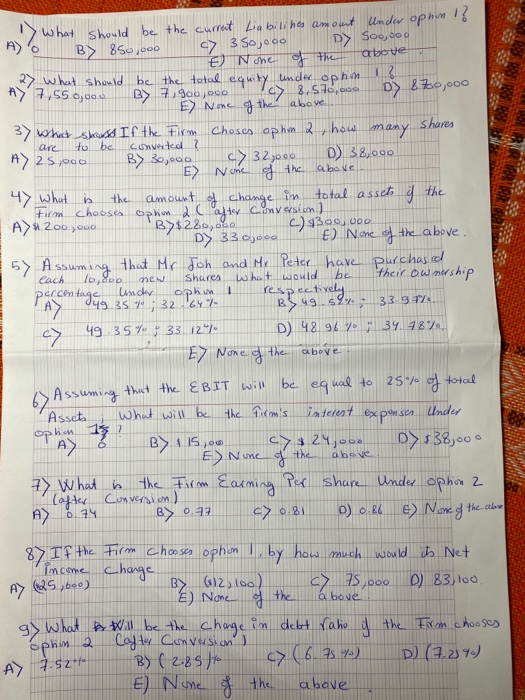

Shares distributed as follow's Wilson Family Firm have 1.5 Million * Mr John *Mr Peter xother's The company an interest rate 750,000 Sheres 50,00 Shares 250,000 shares in order to . has a bank loan of $500,000 carrying of The invernment bander suggested to raise 800,000 in capital pay back the loan and use the remaining Fundos For other in vermut's : He suggested the Following two option's. common stock's at 820 sell of 8.5% convertible bonds each converted, $25 into 40 shares of price common stocks. Conversion Balance sheet ( 31/12/2019) Wilson Company sell of option 1: option 25 Assets Liabilities and Equity Current Liabilities $ 850,000 common stock (part4) $ 6000,000 Undivided profits $750,000 total Assests 7,600,000 total Liabilities and equity 7,600,000 Income statement (31/12/2014) Wilson Company $1,900,000 Income exponses $50,000 $ 1,850,000 Taxes (40%) #740,000 $ 1,110,000 Net Income EBT 7.550,00 above are to be converted above the ophum ac Purchased "What should be the current Lia bilines amount Under ophon 1} B> 850,00 -> 350,000 D> Soo, ooo above E N one of the 27 What should be the total equity under ophon 12 B> 7.900,000 -> 8.576,co D> 870,000 Ey None of the 3) What should If the Firm choses ophm 2 , how many Shares A 25 1000 B> 30,000 c> 32060 D 38,000 E) None of the 47 what is Firm Choose amount of change in total asset y the after Conversion) A> 4 200,000 B>$220, c) 300,000 D> 33.000 ) Name of the above 57 Assuming that Mr Joh and Mr Peter have 1o, doo What would their ownership Parcentages Under phim respectively A> 049 35 32 ZY- B> 49 sly 33.97 cy 49 35% 33127 D) 48.967 34.8% Ey None of above that the EBIT will be equal to 25% of total Assets What will be the firm's Under ophin 7 B> 1 15,00 cys24,0 D> 138,000 E) None of 7 What is the Firm Earning Per share under ophion 2 Conversion) A) 874 cy 0.81 .) 0.26 E) None of each nen Shares be the 67 Assuming interest expose the JODO above (after the above B> 0.77 A> 625,650) above 87 If the firm chooses ophim by how much would its Net income change BZ 2) Noheloof the c) 75,000 D 83,100. g) What a will be the change in debt ratio the Firm chooses Coyle Cow version B) (2.85% D) (7.23%) E) None of the above 2 A 7.52% c> (695)