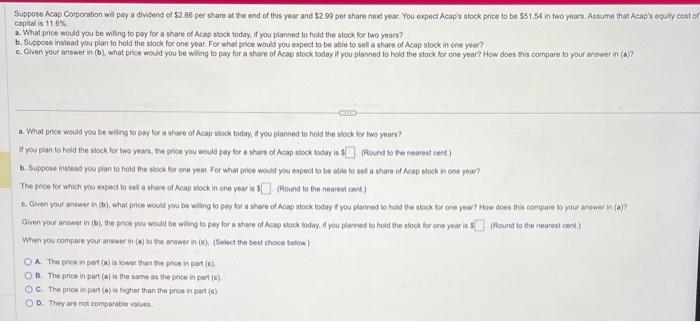

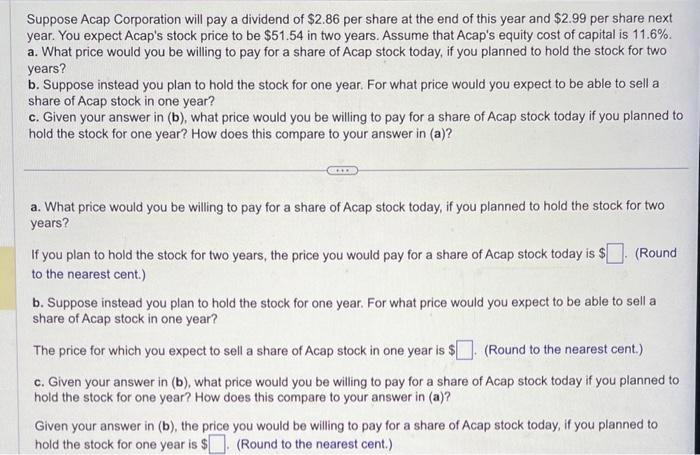

capital is 11 bes. a. What price would you be wiling to pay for a share of Acep tock today, if you planned to hold the stock for two years? b. Suppose instead you plan to hold the slock for one year. For what price would you expect to be able to setr a share of Acap stock in ere year? a. What price would you be Wiling to pay for a share of Mcap stock ioday, I you lanned to hoid the stock for two ynars? It you plan to hold the slock for two yean. the jrice you would pey for a share of Acap stock boday is I (Hound to the hearest cent) b. Suppose instesd you plan to held the tock iter one yoar. For what price would you expect to be able to sel a share of Acap stoch in one year? The fonce for which yeci espect io sell a thare of Acap tiock in one year is 1 (Reund to the nearest cenc) Given yout anwwer in (b), the price you would be wiling to pay for a shace of Acap stock today it you plaved to hold the atock for one year is if ithound to the nearest centh When you compare yout answer in (a) lo the onsaer in (c). (Seigct the best choice below) A. Tha price in part (a) ia lower than the phoe in paA (c). B. The price in part (a) in the syte as the brice in pat (c). c. The price in part (a) is tigher than the price in part (c). D. They are not oomparable values. Suppose Acap Corporation will pay a dividend of $2.86 per share at the end of this year and $2.99 per share next year. You expect Acap's stock price to be $51.54 in two years. Assume that Acap's equity cost of capital is 11.6%. a. What price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for two years? b. Suppose instead you plan to hold the stock for one year. For what price would you expect to be able to sell a share of Acap stock in one year? c. Given your answer in (b), what price would you be willing to pay for a share of Acap stock today if you planned to hold the stock for one year? How does this compare to your answer in (a)? a. What price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for two years? If you plan to hold the stock for two years, the price you would pay for a share of Acap stock today is $ (Round to the nearest cent.) b. Suppose instead you plan to hold the stock for one year. For what price would you expect to be able to sell a share of Acap stock in one year? The price for which you expect to sell a share of Acap stock in one year is $ (Round to the nearest cent.) c. Given your answer in (b), what price would you be willing to pay for a share of Acap stock today if you planned to hold the stock for one year? How does this compare to your answer in (a)? Given your answer in (b), the price you would be willing to pay for a share of Acap stock today, if you planned to hold the stock for one year is $ (Round to the nearest cent.)