Answered step by step

Verified Expert Solution

Question

1 Approved Answer

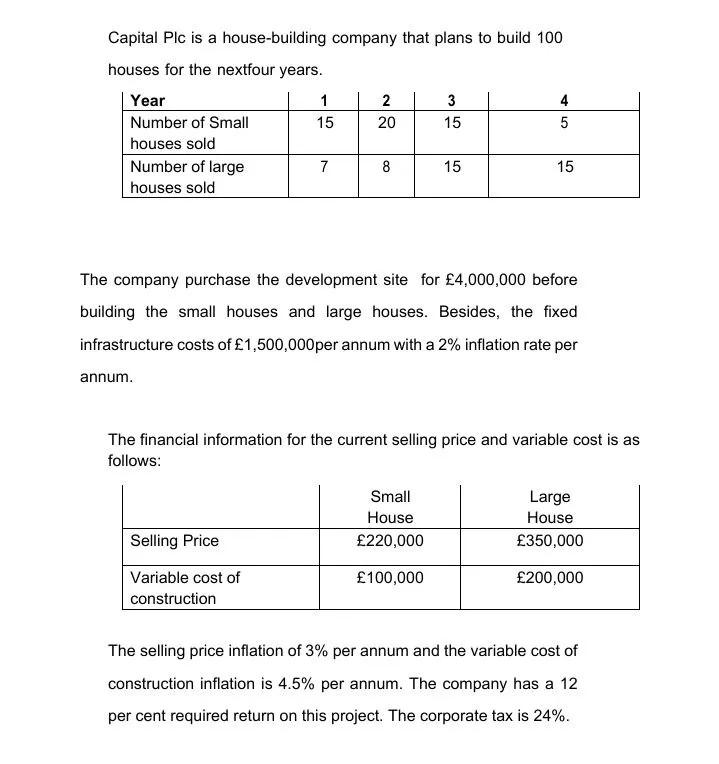

Capital Plc is a house-building company that plans to build 100 houses for the nextfour years. Year 1 2 3 4 Number of Small 15

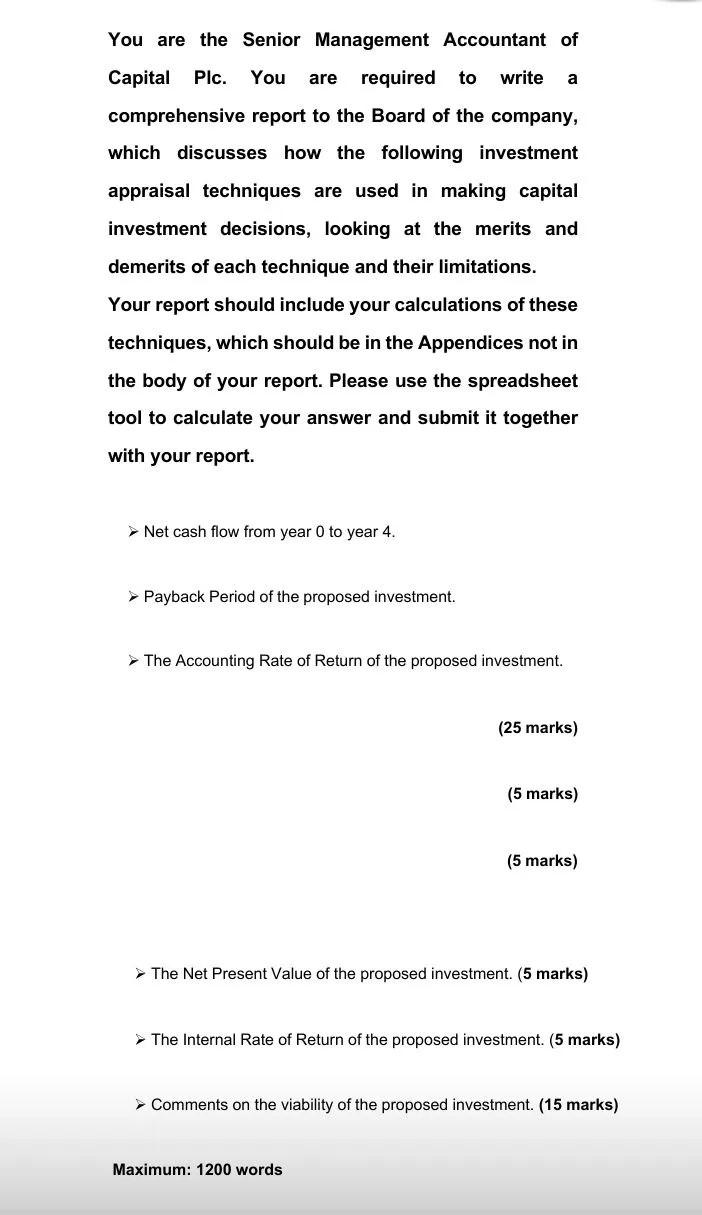

Capital Plc is a house-building company that plans to build 100 houses for the nextfour years. Year 1 2 3 4 Number of Small 15 20 15 5 houses sold Number of large 7 8 15 15 houses sold The company purchase the development site for 4,000,000 before building the small houses and large houses. Besides, the fixed infrastructure costs of 1,500,000 per annum with a 2% inflation rate per annum. The financial information for the current selling price and variable cost is as follows: Small House 220,000 Large House 350,000 Selling Price 100,000 200,000 Variable cost of construction The selling price inflation of 3% per annum and the variable cost of construction inflation is 4.5% per annum. The company has a 12 per cent required return on this project. The corporate tax is 24%. You are the Senior Management Accountant of Capital Plc. You are required to write a comprehensive report to the Board of the company, which discusses how the following investment appraisal techniques are used in making capital investment decisions, looking at the merits and demerits of each technique and their limitations. Your report should include your calculations of these techniques, which should be in the Appendices not in the body of your report. Please use the spreadsheet tool to calculate your answer and submit it together with your report. Net cash flow from year 0 to year 4. Payback period of the proposed investment. The Accounting Rate of Return of the proposed investment. (25 marks) (5 marks) (5 marks) The Net Present Value of the proposed investment. (5 marks) > The Internal Rate of Return of the proposed investment. (5 marks) Comments on the viability of the proposed investment. (15 marks) Maximum: 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started