Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Capital rationing decision for a service company involving four proposals Renaissance Capital Group is considering allocating a limited amount of capital investment funds among four

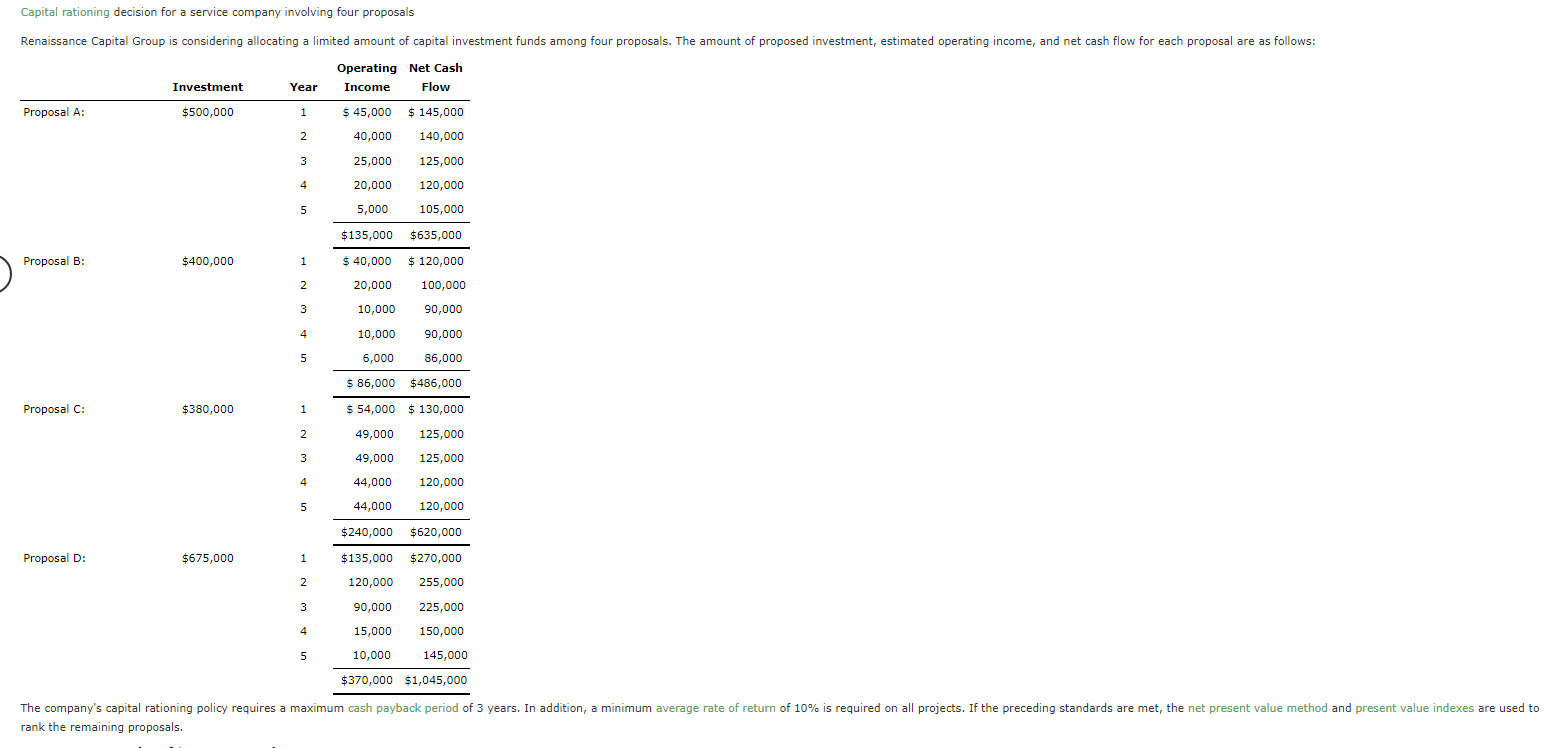

Capital rationing decision for a service company involving four proposals

Renaissance Capital Group is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated operating income, and net cash flow for each proposal are as follows:

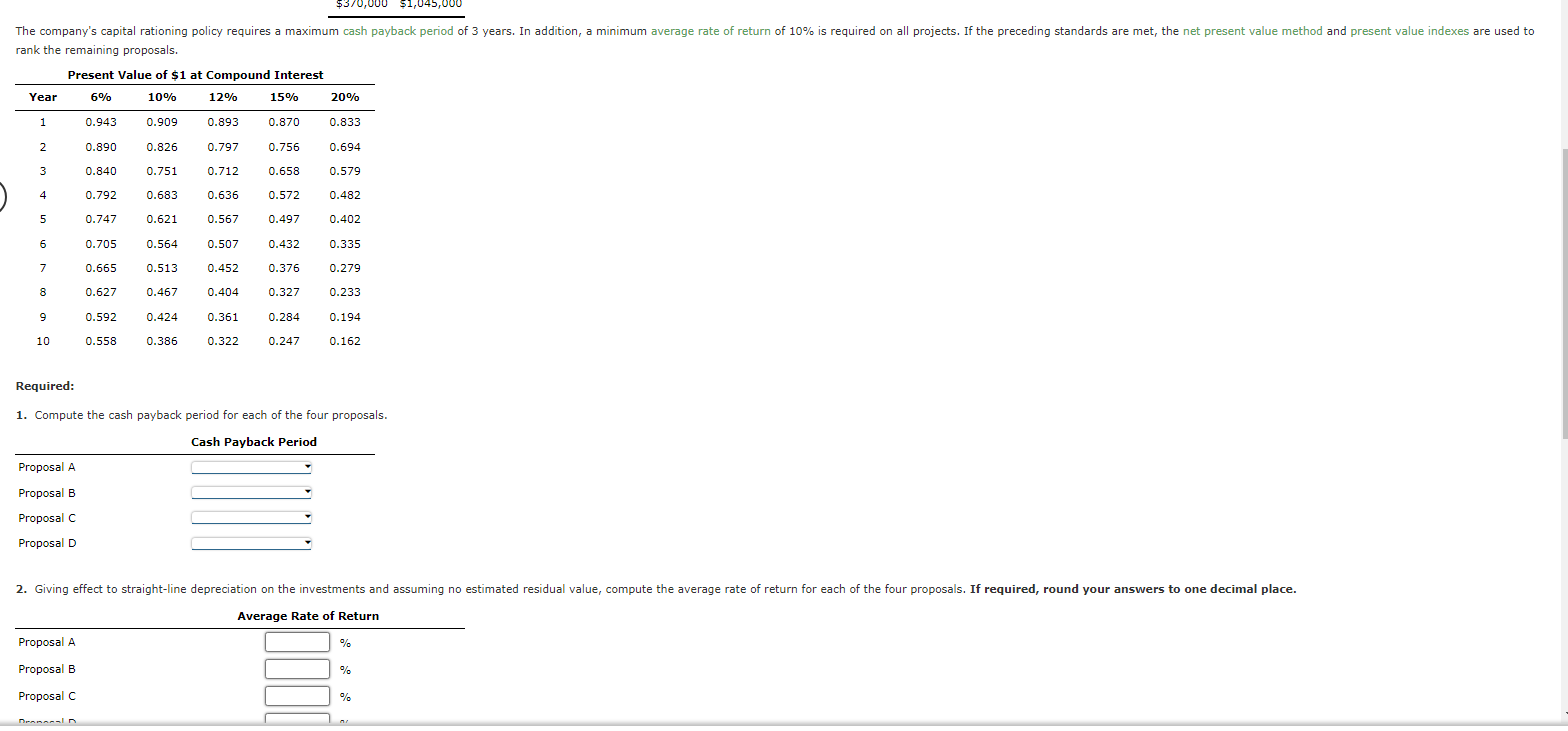

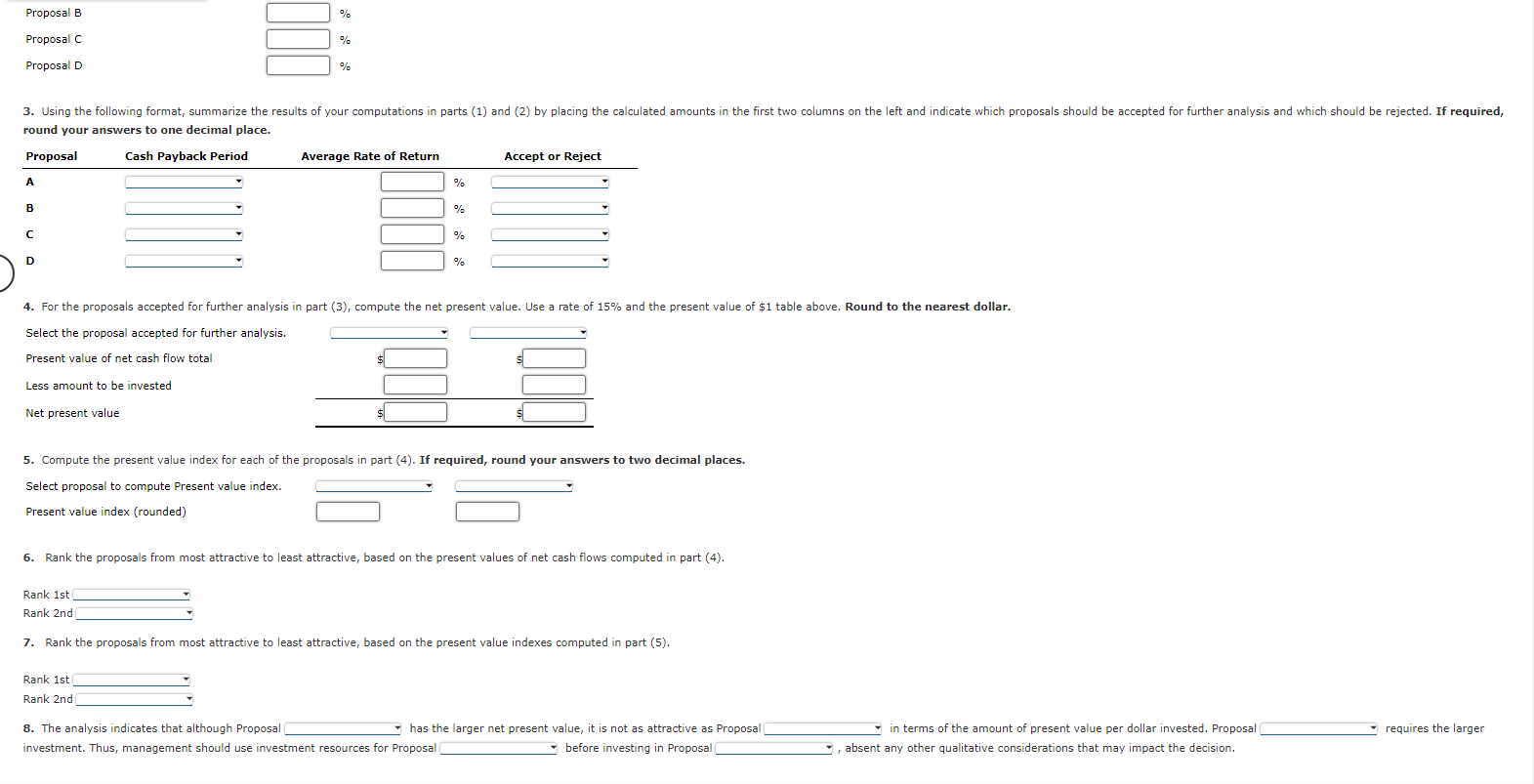

1. Compute the cash payback period for each of the four proposals. Select proposal to compute Present value index. Present value index (rounded) 6. Rank the proposals from most attractive to least attractive, based on the present values of net cash flows computed in part (4). Rank 1st Rank 2nd 7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5). Rank 1st Rank 2nd 8. The analysis indicates that although Proposal has the larger net present value, it is not as attractive as Proposal in terms of the amount of present value per dollar invested. Proposal requires the larger investment. Thus, management should use investment resources for Proposal before investing in Proposal , absent any other qualitative considerations that may impact the decision. Capital rationing decision for a service company involving four proposals \begin{tabular}{|c|c|c|c|c|} \hline & Investment & Year & \begin{tabular}{l} Operating \\ Income \end{tabular} & \begin{tabular}{c} Net Cash \\ Flow \end{tabular} \\ \hline \multirow[t]{6}{*}{ Proposal A: } & $500,000 & 1 & $45,000 & $145,000 \\ \hline & & 2 & 40,000 & 140,000 \\ \hline & & 3 & 25,000 & 125,000 \\ \hline & & 4 & 20,000 & 120,000 \\ \hline & & 5 & 5,000 & 105,000 \\ \hline & & & $135,000 & $635,000 \\ \hline \multirow[t]{6}{*}{ Proposal B: } & $400,000 & 1 & $40,000 & $120,000 \\ \hline & & 2 & 20,000 & 100,000 \\ \hline & & 3 & 10,000 & 90,000 \\ \hline & & 4 & 10,000 & 90,000 \\ \hline & & 5 & 6,000 & 86,000 \\ \hline & & & $86,000 & $486,000 \\ \hline \multirow[t]{6}{*}{ Proposal C: } & $380,000 & 1 & $54,000 & $130,000 \\ \hline & & 2 & 49,000 & 125,000 \\ \hline & & 3 & 49,000 & 125,000 \\ \hline & & 4 & 44,000 & 120,000 \\ \hline & & 5 & 44,000 & 120,000 \\ \hline & & & $240,000 & $620,000 \\ \hline \multirow[t]{6}{*}{ Proposal D: } & $675,000 & 1 & $135,000 & $270,000 \\ \hline & & 2 & 120,000 & 255,000 \\ \hline & & 3 & 90,000 & 225,000 \\ \hline & & 4 & 15,000 & 150,000 \\ \hline & & 5 & 10,000 & 145,000 \\ \hline & & & $370,000 & $1,045,000 \\ \hline \end{tabular} rank the remaining proposals. 1. Compute the cash payback period for each of the four proposals. Select proposal to compute Present value index. Present value index (rounded) 6. Rank the proposals from most attractive to least attractive, based on the present values of net cash flows computed in part (4). Rank 1st Rank 2nd 7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5). Rank 1st Rank 2nd 8. The analysis indicates that although Proposal has the larger net present value, it is not as attractive as Proposal in terms of the amount of present value per dollar invested. Proposal requires the larger investment. Thus, management should use investment resources for Proposal before investing in Proposal , absent any other qualitative considerations that may impact the decision. Capital rationing decision for a service company involving four proposals \begin{tabular}{|c|c|c|c|c|} \hline & Investment & Year & \begin{tabular}{l} Operating \\ Income \end{tabular} & \begin{tabular}{c} Net Cash \\ Flow \end{tabular} \\ \hline \multirow[t]{6}{*}{ Proposal A: } & $500,000 & 1 & $45,000 & $145,000 \\ \hline & & 2 & 40,000 & 140,000 \\ \hline & & 3 & 25,000 & 125,000 \\ \hline & & 4 & 20,000 & 120,000 \\ \hline & & 5 & 5,000 & 105,000 \\ \hline & & & $135,000 & $635,000 \\ \hline \multirow[t]{6}{*}{ Proposal B: } & $400,000 & 1 & $40,000 & $120,000 \\ \hline & & 2 & 20,000 & 100,000 \\ \hline & & 3 & 10,000 & 90,000 \\ \hline & & 4 & 10,000 & 90,000 \\ \hline & & 5 & 6,000 & 86,000 \\ \hline & & & $86,000 & $486,000 \\ \hline \multirow[t]{6}{*}{ Proposal C: } & $380,000 & 1 & $54,000 & $130,000 \\ \hline & & 2 & 49,000 & 125,000 \\ \hline & & 3 & 49,000 & 125,000 \\ \hline & & 4 & 44,000 & 120,000 \\ \hline & & 5 & 44,000 & 120,000 \\ \hline & & & $240,000 & $620,000 \\ \hline \multirow[t]{6}{*}{ Proposal D: } & $675,000 & 1 & $135,000 & $270,000 \\ \hline & & 2 & 120,000 & 255,000 \\ \hline & & 3 & 90,000 & 225,000 \\ \hline & & 4 & 15,000 & 150,000 \\ \hline & & 5 & 10,000 & 145,000 \\ \hline & & & $370,000 & $1,045,000 \\ \hline \end{tabular} rank the remaining proposals

1. Compute the cash payback period for each of the four proposals. Select proposal to compute Present value index. Present value index (rounded) 6. Rank the proposals from most attractive to least attractive, based on the present values of net cash flows computed in part (4). Rank 1st Rank 2nd 7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5). Rank 1st Rank 2nd 8. The analysis indicates that although Proposal has the larger net present value, it is not as attractive as Proposal in terms of the amount of present value per dollar invested. Proposal requires the larger investment. Thus, management should use investment resources for Proposal before investing in Proposal , absent any other qualitative considerations that may impact the decision. Capital rationing decision for a service company involving four proposals \begin{tabular}{|c|c|c|c|c|} \hline & Investment & Year & \begin{tabular}{l} Operating \\ Income \end{tabular} & \begin{tabular}{c} Net Cash \\ Flow \end{tabular} \\ \hline \multirow[t]{6}{*}{ Proposal A: } & $500,000 & 1 & $45,000 & $145,000 \\ \hline & & 2 & 40,000 & 140,000 \\ \hline & & 3 & 25,000 & 125,000 \\ \hline & & 4 & 20,000 & 120,000 \\ \hline & & 5 & 5,000 & 105,000 \\ \hline & & & $135,000 & $635,000 \\ \hline \multirow[t]{6}{*}{ Proposal B: } & $400,000 & 1 & $40,000 & $120,000 \\ \hline & & 2 & 20,000 & 100,000 \\ \hline & & 3 & 10,000 & 90,000 \\ \hline & & 4 & 10,000 & 90,000 \\ \hline & & 5 & 6,000 & 86,000 \\ \hline & & & $86,000 & $486,000 \\ \hline \multirow[t]{6}{*}{ Proposal C: } & $380,000 & 1 & $54,000 & $130,000 \\ \hline & & 2 & 49,000 & 125,000 \\ \hline & & 3 & 49,000 & 125,000 \\ \hline & & 4 & 44,000 & 120,000 \\ \hline & & 5 & 44,000 & 120,000 \\ \hline & & & $240,000 & $620,000 \\ \hline \multirow[t]{6}{*}{ Proposal D: } & $675,000 & 1 & $135,000 & $270,000 \\ \hline & & 2 & 120,000 & 255,000 \\ \hline & & 3 & 90,000 & 225,000 \\ \hline & & 4 & 15,000 & 150,000 \\ \hline & & 5 & 10,000 & 145,000 \\ \hline & & & $370,000 & $1,045,000 \\ \hline \end{tabular} rank the remaining proposals. 1. Compute the cash payback period for each of the four proposals. Select proposal to compute Present value index. Present value index (rounded) 6. Rank the proposals from most attractive to least attractive, based on the present values of net cash flows computed in part (4). Rank 1st Rank 2nd 7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5). Rank 1st Rank 2nd 8. The analysis indicates that although Proposal has the larger net present value, it is not as attractive as Proposal in terms of the amount of present value per dollar invested. Proposal requires the larger investment. Thus, management should use investment resources for Proposal before investing in Proposal , absent any other qualitative considerations that may impact the decision. Capital rationing decision for a service company involving four proposals \begin{tabular}{|c|c|c|c|c|} \hline & Investment & Year & \begin{tabular}{l} Operating \\ Income \end{tabular} & \begin{tabular}{c} Net Cash \\ Flow \end{tabular} \\ \hline \multirow[t]{6}{*}{ Proposal A: } & $500,000 & 1 & $45,000 & $145,000 \\ \hline & & 2 & 40,000 & 140,000 \\ \hline & & 3 & 25,000 & 125,000 \\ \hline & & 4 & 20,000 & 120,000 \\ \hline & & 5 & 5,000 & 105,000 \\ \hline & & & $135,000 & $635,000 \\ \hline \multirow[t]{6}{*}{ Proposal B: } & $400,000 & 1 & $40,000 & $120,000 \\ \hline & & 2 & 20,000 & 100,000 \\ \hline & & 3 & 10,000 & 90,000 \\ \hline & & 4 & 10,000 & 90,000 \\ \hline & & 5 & 6,000 & 86,000 \\ \hline & & & $86,000 & $486,000 \\ \hline \multirow[t]{6}{*}{ Proposal C: } & $380,000 & 1 & $54,000 & $130,000 \\ \hline & & 2 & 49,000 & 125,000 \\ \hline & & 3 & 49,000 & 125,000 \\ \hline & & 4 & 44,000 & 120,000 \\ \hline & & 5 & 44,000 & 120,000 \\ \hline & & & $240,000 & $620,000 \\ \hline \multirow[t]{6}{*}{ Proposal D: } & $675,000 & 1 & $135,000 & $270,000 \\ \hline & & 2 & 120,000 & 255,000 \\ \hline & & 3 & 90,000 & 225,000 \\ \hline & & 4 & 15,000 & 150,000 \\ \hline & & 5 & 10,000 & 145,000 \\ \hline & & & $370,000 & $1,045,000 \\ \hline \end{tabular} rank the remaining proposals Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started