Answered step by step

Verified Expert Solution

Question

1 Approved Answer

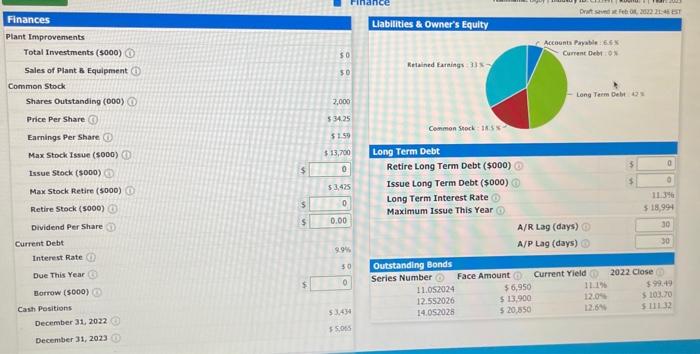

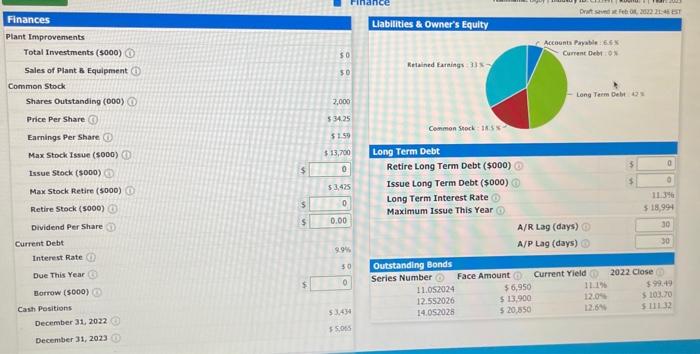

capstone Drut show Llabilities & Owner's Equity Accounts Payable Current Debro 50 Retained Earnings 50 Finances Plant Improvements Total Investments (5000) Sales of Plant &

capstone

Drut show Llabilities & Owner's Equity Accounts Payable Current Debro 50 Retained Earnings 50 Finances Plant Improvements Total Investments (5000) Sales of Plant & Equipment Common Stock Shares Outstanding (000) Price Per Share Earnings Per Share Max Stock Issue (5000) Issue Stock (5000) Long Term Debt 2,000 534.25 Common Stock IS 5159 $ 13,700 0 $ $3,425 Max Stock Retire (5000) Retire Stock (5000) $ 0 $ 0.00 Dividend Per Share Current Debt Interest Rate Due This Year Long Term Debt Retire Long Term Debt (5000) 0 Issue Long Term Debt ($000) Long Term Interest Rate 1 Maximum Issue This Year 518,994 A/R Lag (days) 30 A/P Lag (days) 30 Outstanding Bonds Series Number Face Amount Current Yield 2022 Close 11.05.2024 $6,950 11.16 $99.49 12.552026 $13.900 12.04 $ 100.70 14.052026 $ 20,850 12:54 52 994 50 $ Borrow (5000) Cash Positions December 31, 2022 $1434 @ @ 5505 December 31, 2023 Drut show Llabilities & Owner's Equity Accounts Payable Current Debro 50 Retained Earnings 50 Finances Plant Improvements Total Investments (5000) Sales of Plant & Equipment Common Stock Shares Outstanding (000) Price Per Share Earnings Per Share Max Stock Issue (5000) Issue Stock (5000) Long Term Debt 2,000 534.25 Common Stock IS 5159 $ 13,700 0 $ $3,425 Max Stock Retire (5000) Retire Stock (5000) $ 0 $ 0.00 Dividend Per Share Current Debt Interest Rate Due This Year Long Term Debt Retire Long Term Debt (5000) 0 Issue Long Term Debt ($000) Long Term Interest Rate 1 Maximum Issue This Year 518,994 A/R Lag (days) 30 A/P Lag (days) 30 Outstanding Bonds Series Number Face Amount Current Yield 2022 Close 11.05.2024 $6,950 11.16 $99.49 12.552026 $13.900 12.04 $ 100.70 14.052026 $ 20,850 12:54 52 994 50 $ Borrow (5000) Cash Positions December 31, 2022 $1434 @ @ 5505 December 31, 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started