Answered step by step

Verified Expert Solution

Question

1 Approved Answer

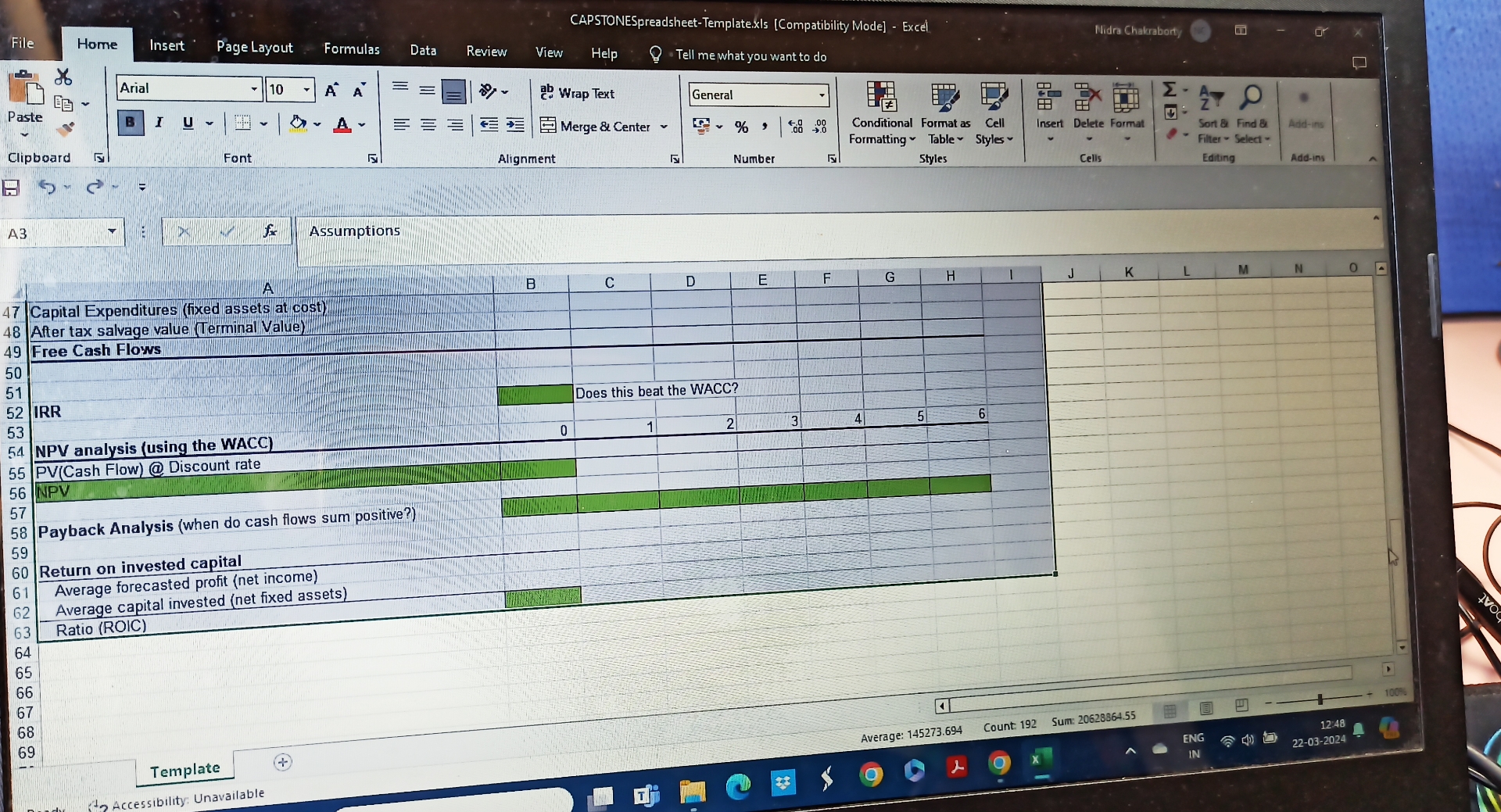

CAPSTONESpreadsheet-Template.xls [Compatibility Mode] - Excel File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Arial 10

CAPSTONESpreadsheet-Template.xls [Compatibility Mode] - Excel File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Arial 10 A A == ab Wrap Text General Paste B I U v == Merge & Center %' Conditional Format as Cell Formatting Table Styles Insert Delete Format Clipboard E Font Alignment Number Styles Cells A3 47 Capital Expenditures (fixed assets at cost 48 After tax salvage value (Terminal Value) 49 Free Cash Flows 50 Assumptions 51 52 IRR 53 54 NPV analysis (using the WACC) 55 PV(Cash Flow) @ Discount rate 56 NPV 57 58 Payback Analysis (when do cash flows sum positive?) 59 60 Return on invested capital Average forecasted profit (net income) 61 62 Average capital invested (net fixed assets) 63 Ratio (ROIC) 64 65 66 67 68 69 Template Accessibility: Unavailable B C D E F G H Does this beat the WACC? 0 1 2 3 4 5 6 r Nidra Chakraborty COM T 0 Sort & Find & Filter -Select- Editing Add-ins Add-ins K L M N 0 Average: 145273.694 Count: 192 Sum: 20628864.55 ENG 12:48 O IN 22-03-2024 100% DoAt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started