Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Captain America Ple is a high-tech company operating in the defense systems industry, which is also traded in the stock market. At the beginning

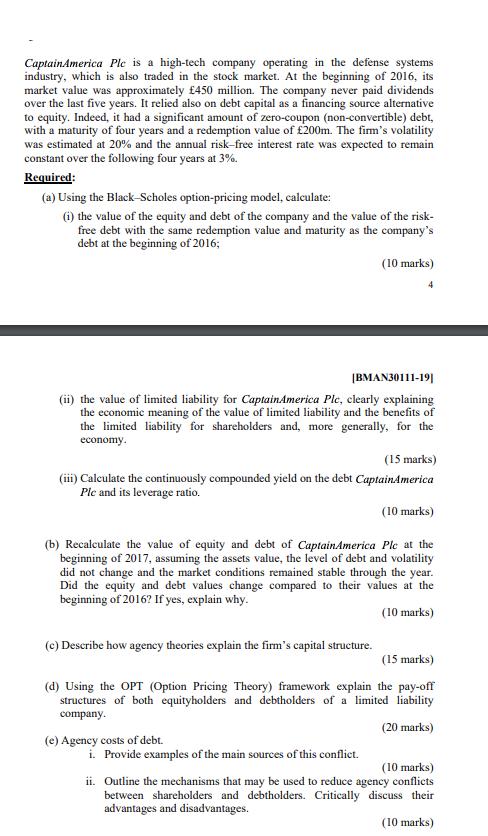

Captain America Ple is a high-tech company operating in the defense systems industry, which is also traded in the stock market. At the beginning of 2016, its market value was approximately 450 million. The company never paid dividends over the last five years. It relied also on debt capital as a financing source alternative to equity. Indeed, it had a significant amount of zero-coupon (non-convertible) debt, with a maturity of four years and a redemption value of 200m. The firm's volatility was estimated at 20% and the annual risk-free interest rate was expected to remain constant over the following four years at 3%. Required: (a) Using the Black-Scholes option-pricing model, calculate: (i) the value of the equity and debt of the company and the value of the risk- free debt with the same redemption value and maturity as the company's debt at the beginning of 2016; |BMAN30111-19] (ii) the value of limited liability for Captain America Plc, clearly explaining the economic meaning of the value of limited liability and the benefits of the limited liability for shareholders and, more generally, for the economy. (15 marks) (iii) Calculate the continuously compounded yield on the debt Captain America Plc and its leverage ratio. (10 marks) (b) Recalculate the value of equity and debt of Captain America Ple at the beginning of 2017, assuming the assets value, the level of debt and volatility did not change and the market conditions remained stable through the year. Did the equity and debt values change compared to their values at the beginning of 2016? If yes, explain why. (10 marks) (c) Describe how agency theories explain the firm's capital structure. (10 marks) (15 marks) (d) Using the OPT (Option Pricing Theory) framework explain the pay-off structures of both equityholders and debtholders of a limited liability company. (20 marks) (e) Agency costs of debt. i. Provide examples of the main sources of this conflict. (10 marks) ii. Outline the mechanisms that may be used to reduce agency conflicts between shareholders and debtholders. Critically discuss their advantages and disadvantages. (10 marks)

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a i The value of the equity and debt of the company and the value of the riskfree debt with the same redemption value and maturity as the companys debt at the beginning of 2016 can be calculated using ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started