Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two members of the Stones family, Mr Loki and Ms Aether Stones, decided to list their mining company, InfinityStones Ltd, on the stock market

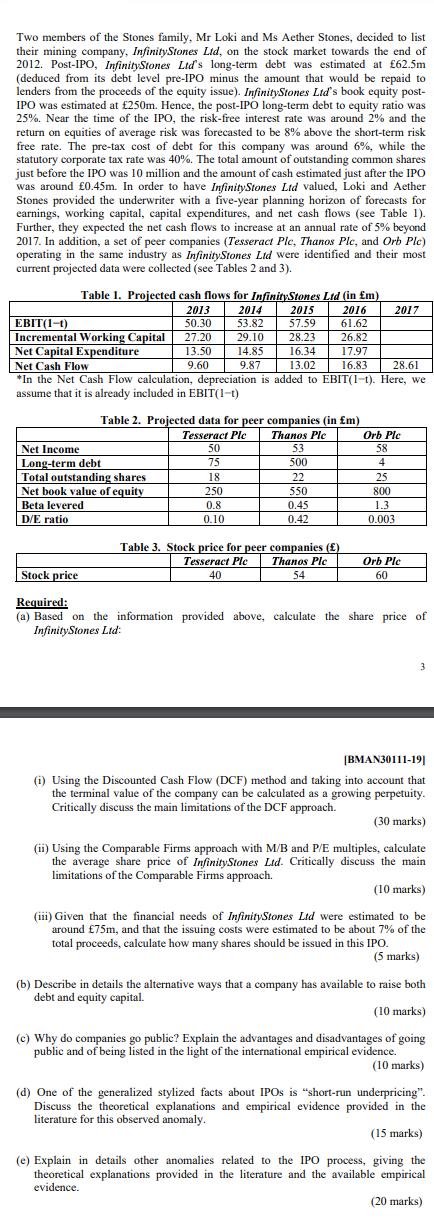

Two members of the Stones family, Mr Loki and Ms Aether Stones, decided to list their mining company, InfinityStones Ltd, on the stock market towards the end of 2012. Post-IPO, InfinityStones Ltd's long-term debt was estimated at 62.5m (deduced from its debt level pre-IPO minus the amount that would be repaid to lenders from the proceeds of the equity issue). InfinityStones Ltd's book equity post- IPO was estimated at 250m. Hence, the post-IPO long-term debt to equity ratio was 25%. Near the time of the IPO, the risk-free interest rate was around 2% and the return on equities of average risk was forecasted to be 8% above the short-term risk free rate. The pre-tax cost of debt for this company was around 6%, while the statutory corporate tax rate was 40%. The total amount of outstanding common shares just before the IPO was 10 million and the amount of cash estimated just after the IPO was around 0.45m. In order to have InfinityStones Ltd valued, Loki and Aether Stones provided the underwriter with a five-year planning horizon of forecasts for earnings, working capital, capital expenditures, and net cash flows (see Table 1). Further, they expected the net cash flows to increase at an annual rate of 5% beyond 2017. In addition, a set of peer companies (Tesseract Plc, Thanos Plc, and Orb Plc) operating in the same industry as InfinityStones Ltd were identified and their most current projected data were collected (see Tables 2 and 3). Table 1. Projected cash flows for InfinityStones Ltd (in m) 2013 2016 EBIT(1-1) 50.30 61.62 Incremental Working Capital 27.20 26.82 Net Capital Expenditure 13.50 17.97 Net Cash Flow 9.60 16.83 28.61 *In the Net Cash Flow calculation, depreciation is added to EBIT(1-t). Here, we assume that it is already included in EBIT(1-t) Net Income Long-term debt Total outstanding shares Net book value of equity Beta levered D/E ratio Stock price Table 2. Projected data for peer companies (in m) Tesseract Plc Thanos Ple 50 75 18 250 2014 53.82 29.10 14.85 9.87 0.8 0.10 2015 57.59 28.23 16.34 13.02 53 500 22 550 0.45 0.42 Table 3. Stock price for peer companies () Tesseract Ple 40 Thanos Plc 54 2017 Orb Ple 58 4 25 800 1.3 0.003 Orb Ple 60 Required: (a) Based on the information provided above, calculate the share price of InfinityStones Ltd: 3 [BMAN30111-19] (i) Using the Discounted Cash Flow (DCF) method and taking into account that the terminal value of the company can be calculated as a growing perpetuity. Critically discuss the main limitations of the DCF approach. (30 marks) (ii) Using the Comparable Firms approach with M/B and P/E multiples, calculate the average share price of InfinityStones Ltd. Critically discuss the main limitations of the Comparable Firms approach. (10 marks) (iii) Given that the financial needs of InfinityStones Ltd were estimated to be around 75m, and that the issuing costs were estimated to be about 7% of the total proceeds, calculate how many shares should be issued in this IPO. (5 marks) (b) Describe in details the alternative ways that a company has available to raise both debt and equity capital. (10 marks) (c) Why do companies go public? Explain the advantages and disadvantages of going public and of being listed in the light of the international empirical evidence. (10 marks) (d) One of the generalized stylized facts about IPOs is "short-run underpricing". Discuss the theoretical explanations and empirical evidence provided in the literature for this observed anomaly. (15 marks) (e) Explain in details other anomalies related to the IPO process, giving the theoretical explanations provided in the literature and the available empirical evidence. (20 marks)

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a i Using the Discounted Cash Flow DCF method and taking into account that the terminal value of the company can be calculated as a growing perpetuity To calculate the share price of Infinity Stones L...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started