Question

Car ID Inc. is a U.S.-based distributor of auto supplies for several domestic and foreign car companies. On November 1, Year 1, Car ID sold

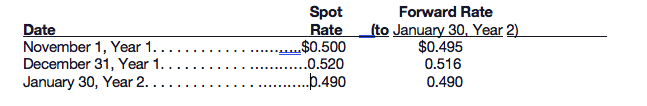

Car ID Inc. is a U.S.-based distributor of auto supplies for several domestic and foreign car companies. On November 1, Year 1, Car ID sold and shipped auto parts to a customer in Switzerland for a price of 500,000 Swiss francs (CHF). Payment is to be received on January 30, Year 2. On the date of sale, Car ID also entered into a three-month forward contract to sell CHF 500,000. The forward contract is properly designated as a cash flow hedge of a foreign currency receivable. Car ID's incremental borrowing rate is 12%. The present value factor for one month at an incremental borrowing rate of 12% is .99010. Relevant exchange rates are as follows:

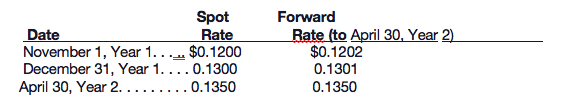

Car ID Inc. placed an order with a company in South Africa to purchase vinyl and related upholstery materials for a total of 5,000,000 South Africa Rand (ZAR). Relevant exchange rates are as follows:

Car ID Inc. closes the books and

prepares financial statements on December 31, Year 1.

What is the impact on net income for each year,

and in total, due to the foreign currency aspects of this transaction?

Date November 1, Year 1.. December 31, Year 1.. January 30, Year 2.. Spot Rate $0.500 ..0.520 ...490 Forward Rate (to January 30, Year 2) $0.495 0.516 0.490 Spot Date Rate November 1, Year 1... $0.1200 December 31, Year 1. .0.1300 April 30, Year 2. .0.1350 Forward Rate (to April 30, Year 2) $0.1202 0.1301 0.1350 . . Date November 1, Year 1.. December 31, Year 1.. January 30, Year 2.. Spot Rate $0.500 ..0.520 ...490 Forward Rate (to January 30, Year 2) $0.495 0.516 0.490 Spot Date Rate November 1, Year 1... $0.1200 December 31, Year 1. .0.1300 April 30, Year 2. .0.1350 Forward Rate (to April 30, Year 2) $0.1202 0.1301 0.1350Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started