Answered step by step

Verified Expert Solution

Question

1 Approved Answer

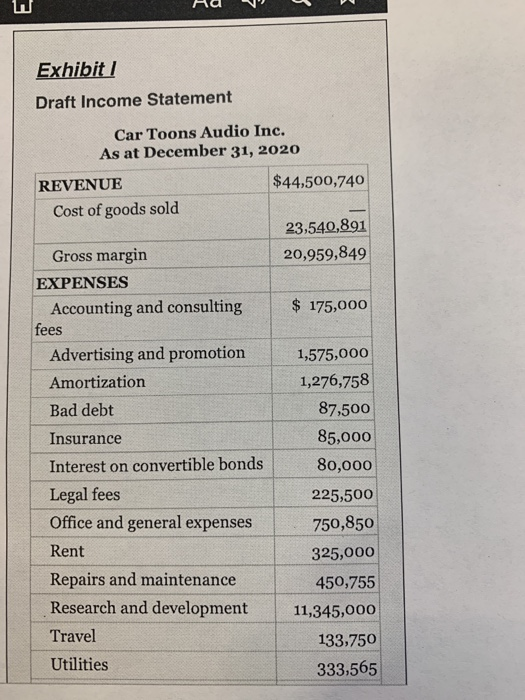

Car Toons Audio Inc. Car Toons Audio Inc. (CTAI) is a young company that recently completed its initial public offering. The company designs and develops

Car Toons Audio Inc.

Car Toons Audio Inc. (CTAI) is a young company that recently completed its initial public offering. The company designs and develops leading-edge car stereo equipment, including MP4 compatible decks, speakers, amplifiers, and subwoofers. The company is investing heavily in research and development. In order to reduce strain on cash, the management team is compensated mostly through share-based compensation in the current year. In addition, the company has raised cash through the issuance of common shares in the open market and by offering various complex financial instruments. Management believes that all cash should be diverted toward the research and development process in order for the company to become the leader in automotive stereo equipment. In addition to the stock options, management receives a bonus of 5% of net income if diluted EPS is greater than $0.10. The bonus is the only cash compensation that management receives at this stage of the companys life cycle. Management is excited because this years draft income statement (Exhibit I) shows diluted EPS in excess of $0.10, and therefore, a bonus will be paid.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started