Question

Cardinal Company is considering a five-year project that would require a $2,915,000 investment in equipment with a useful life of five years and no salvage

Cardinal Company is considering a five-year project that would require a $2,915,000 investment in equipment with a useful life of five years and no salvage value. The companys discount rate is 16%. The project would provide net operating income in each of five years as follows:

| Sales | $ | 2,863,000 | ||

| Variable expenses | 1,014,000 | |||

| Contribution margin | 1,849,000 | |||

| Fixed expenses: | ||||

| Advertising, salaries, and other fixed out-of-pocket costs | $ | 781,000 | ||

| Depreciation | 583,000 | |||

| Total fixed expenses | 1,364,000 | |||

| Net operating income | $ | 485,000 | ||

What is the project profitability index for this project?

What is the projects internal rate of return?

What is the projects payback period?

What is the projects simple rate of return for each of the five years?

If the companys discount rate was 18% instead of 16%, would you expect the project's net present value to be higher, lower, or the same?

If the equipment had a salvage value of $300,000 at the end of five years, would you expect the projects payback period to be higher, lower, or the same?

If the equipment had a salvage value of $300,000 at the end of five years, would you expect the project's net present value to be higher, lower, or the same?

If the equipment had a salvage value of $300,000 at the end of five years, would you expect the projects simple rate of return to be higher, lower, or the same?

Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 45%. What was the projects actual net present value?

Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 45%. What was the projects actual payback period?

Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 45%. What was the projects actual simple rate of return?

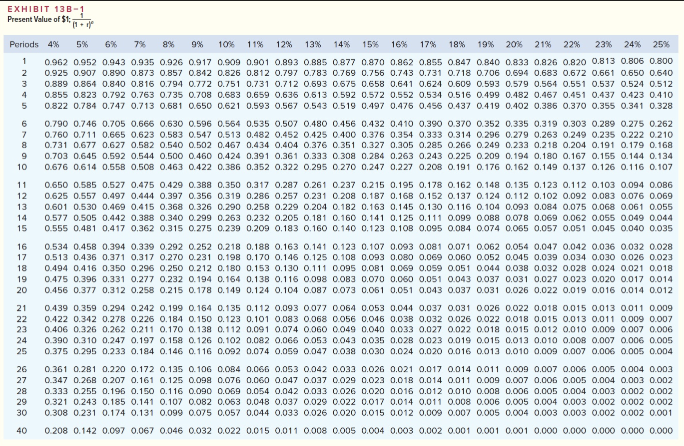

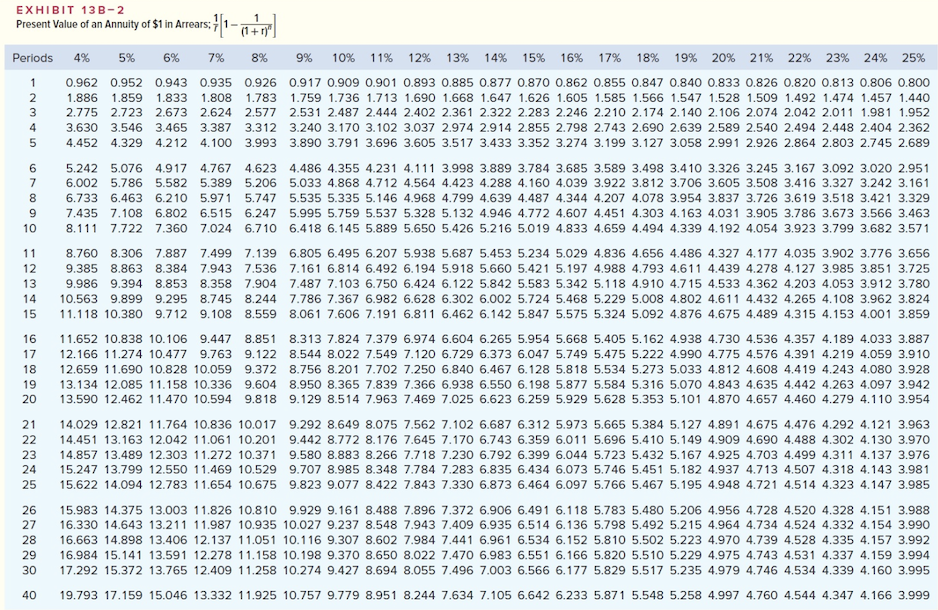

EXHIBIT 13B Present Value of $1; Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 1 0962 0.952 0.943 0.935 0926 0917 0.909 0.901 0.893 0885 0877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0806 0.800 2 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 O.797 .783 0.76g 0.756 0.743 0.731 0.718 0.706 0.694 0.683 0.672 0.661 0.650 0.640 3 088 0.579 0.564 0.551 0.537 0.524 0.512 4 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.467 0.451 0.437 0.423 0.410 650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 6 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.39O 0.370 0.352 0.335 0.319 0.303 0.289 0.275 0.262 7 0.760 0.711 0,665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.263 0.249 0.235 0.222 0.210 8 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.218 0.204 0.191 0.179 0.168 9 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.2B4 0.263 0.243 0.225 0.209 0.194 0.180 0.167 0.155 0.144 0.134 10 0.676 0.614 0.55B 0.508 0.463 0422 0.386 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.149 0.137 0.126 0.116 0.107 89 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0675 0.658 0.641 0.624 0.609 0.593 5 0822 0.784 0.747 0.713 0.681 06 0.402 0.386 0.37O 0.355 0341 0.328 49 0.233 0.218 0.204 0.191 0.179 0.215 0.195 0.178 0.162 0.14 11 12 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0.123 0.112 0.103 0.094 0.086 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.2860.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.102 0.092 0.083 0.076 0.069 0601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.084 0.075 0.068 0.061 0.055 0577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181 0.160 0.141 0.125 0.111 0.099 0088 0.078 0.069 0.062 0.055 0.049 0.044 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.160 0.140 0.123 0.10B 0.095 0.084 0.074 0.055 0.057 0.051 0.045 0.040 0.035 15 16 0.534 0.458 0.394 0.339 0.2 8 O.163 0.141 0.123 0.107 0.093 0.081 0.071 0062 0.054 0.047 0.042 0.036 0.032 0028 17 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0052 0.045 0.039 0.034 0.030 0.026 0.023 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 0.095 0.0B1 0.069 0.059 o.051 0.044 0.038 0.032 0.028 0.024 0.021 0.018 475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0037 0.031 0.027 0.023 0.020 0017 0.014 20 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 0073 0.061 0.051 0.043 0.037 0.031 0.026 0,022 0.019 0.016 0.014 0.012 292 0.252 0.218 0.18 21 0439 0.359 0.294 0.242 0.199 0.164 0.135 0.112 0.093 0.077 0064 0.053 0.044 0.037 0031 0.026 0.022 0.018 0.015 0.013 0.011 0.009 422 O 342 0.278 O 226 . 184 0150 0.123 O. 101 O,083 0068 0056 0.046 0038 0032 0026 0022 0018 0.015 0013 0011 0009 0007 406 0 326 0.262 0.211 O 170 O 138 O. 11 2 0091 .074 O060 OO49 004 0033 0027 0022 0018 0015 0012 0010 0009 000700 24 0.390 0.310 0.247 0.197 O.158 0.126 0.102 0.0 2 0.060.053 0.043 0.035 0.028 0.023 0019 0,015 0.013 0.010 0.008 0.007 0.006 0.005 25 0.375 0.295 0.233 003 0.030 0.024 0.020 0.016 0013 0.010 0.009 0.007 0.006 0.005 0.004 0.184 0.146 0116 0.092 0.074 0.059 0.047 26 0.361 0.2B1 0.220 0.172 0.135 0.106 0.084 0.066 0.053 0.042 0033 0.026 0.021 0.017 0.014 0011 0.009 0.007 0.006 o.005 0.004 0.003 27 0.347 0.268 0.207 0.161 0.125 0098 0.076 0.060 0.047 0.037 0029 0.023 0.018 0.014 0.011 0009 0.007 0.006 0.005 0.004 0.003 0.002 0.333 0255 0.196 0.150 0 116 0090 0069 0 0 54 .042 0033 O026 0020 0016 0012 0010 0008 0006 0005 0004 0003 0002 0002 0.321 0.243 0. 185 O.141 O. 107 OO82 0.053 0.048 .037 0029 0022 0.017 0 014 O.O 11 O008 O 006 0.005 0.004 0003 0002 0002 0002 30 0.308 0.231 O.174 O.131 0.099 0.075 0.057 0.044 O.033 0.026 0020 0.015 0.012 .009 0.007 0.005 0.004 0.003 0.003 0.002 0.002 0.001 40 0 208 0.142 0.097 0.067 0.046 0032 0.022 0.015 0.011 0008 0005 0.004 0.003 0.002 0.001 0001 0001 0.000 0.000 0.000 0.000 0.000 Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800 2 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528 1.509 1.492 1.474 1.457 1.440 2.283 2.246 2.210 2.174 2.140 2.106 2.074 2.042 2.011 1.981 1.952 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 2.540 2.494 2.448 2.404 2.362 5 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991 2.926 2.864 2.803 2.745 2.689 3 2.7 775 2.723 2.673 2.624 2.577 2.531 2.487 2.444 2.402 2.361 2.322 6 7 8 9 10 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 3.326 3.245 3.167 3.092 3.020 2.951 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 3.508 3.416 3.327 3.242 3.161 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3.837 3.726 3.619 3.518 3.421 3.329 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 3.905 3.786 3.673 3.566 3.463 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192 4.054 3.923 3.799 3.682 3.571 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327 4.177 4.035 3.902 3.776 3.656 9.385 8.863 8.384 7.9437.536 7.161 6.814 6.492 6.194 5.918 5.660 5.421 5.197 4.988 4.793 4.611 4.439 4.278 4.127 3.985 3.851 3.725 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 6.122 5.842 5.583 5.342 5.118 4.910 4.715 4.533 4.362 4.203 4.053 3.912 3.780 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611 4.432 4.265 4.108 3.962 3.824 11.118 10.380 9.712 9.108 8.559 8.061 7.606 7.191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 4.489 4.315 4.153 4.001 3.859 12 13 14 15 16 17 18 19 20 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730 4.536 4.357 4.189 4.033 3.887 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.549 7.120 6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775 4.576 4.391 4.219 4.059 3.910 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812 4.608 4.419 4.243 4.080 3.928 13.134 12.085 11.158 10.3369.604 8.950 8.365 7.839 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843 4.635 4.442 4.263 4.097 3.942 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7.469 7.025 6.623 6.259 5.929 5.628 5.353 5.101 4.870 4.657 4.460 4.279 4.110 3.954 21 14.029 12.821 11.764 10.836 10.017 9.292 8.649 8.075 7.562 7.102 6.687 6.312 5.973 5.665 5.384 5.127 4891 4.675 4.476 4.292 4.121 3.963 22 14.451 13.163 12.042 11.061 10.201 9.442 8.772 8.176 7.645 7.170 6.743 6.359 6.011 5.696 5.410 5.149 4.909 4.690 4.488 4.302 4.130 3.970 23 14.857 13.489 12.303 11.272 10.371 9.580 8.883 8.266 7.718 7.230 6.792 6.399 6.044 5.723 5.432 5.167 4.925 4.703 4.499 4.311 4.137 3.976 24 15.247 13.799 12.550 11.469 10.529 9.707 8.985 8.348 7.784 7.283 6.835 6.434 6.073 5.746 5.451 5.182 4.937 4.713 4.507 4.318 4.143 3.981 25 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 4.721 4.514 4.323 4.147 3.985 26 27 28 29 30 15.983 14.375 13.003 11.826 10.810 9.929 9.161 8.488 7.896 7.372 6.906 6.491 6.118 5.783 5.480 5.206 4.956 4.728 4.520 4.328 4.151 3.988 16.330 14.643 13.211 11.987 10.935 10.027 9.237 8.548 7.943 7.409 6.935 6.514 6.136 5.798 5.492 5.215 4.964 4.734 4.524 4.332 4.154 3.990 16.663 14.898 13.406 12.137 11.051 10.116 9.307 8.602 7.984 7.441 6.961 6.534 6.152 5.810 5.502 5.223 4.970 4.739 4.528 4.335 4.157 3.992 16.984 15.141 13.591 12.278 11.158 10.198 9.370 8.650 8.022 7.470 6.983 6.551 6.166 5.820 5.510 5.229 4.975 4.743 4.531 4.337 4.159 3.994 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7.496 7.003 6.566 6.177 5.829 5.517 5.235 4.979 4.746 4.534 4.339 4.160 3.995 40 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244 7.634 7.105 6.642 6.233 5.871 5.548 5.258 4.997 4.760 4.544 4.347 4.166 3.999

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started