Question

Exercise 12-10 Treasury Stock Transactions Including Retirement The following stock transactions of Carmel Corporation represent all its treasury stock transactions for the year: June 1

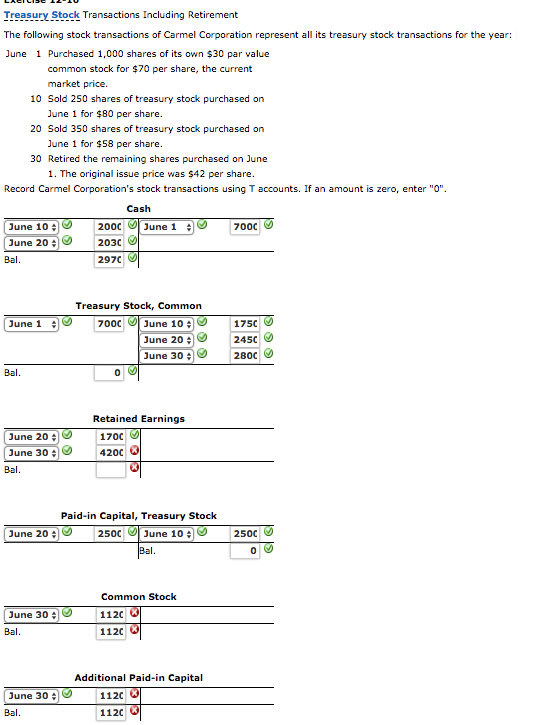

Exercise 12-10 Treasury Stock Transactions Including Retirement

The following stock transactions of Carmel Corporation represent all its treasury stock transactions for the year:

| June | 1 | Purchased 1,000 shares of its own $30 par value common stock for $70 per share, the current market price. |

| 10 | Sold 250 shares of treasury stock purchased on June 1 for $80 per share. | |

| 20 | Sold 350 shares of treasury stock purchased on June 1 for $58 per share. | |

| 30 | Retired the remaining shares purchased on June 1. The original issue price was $42 per share. |

Record Carmel Corporation's stock transactions using T accounts. If an amount is zero, enter "0".

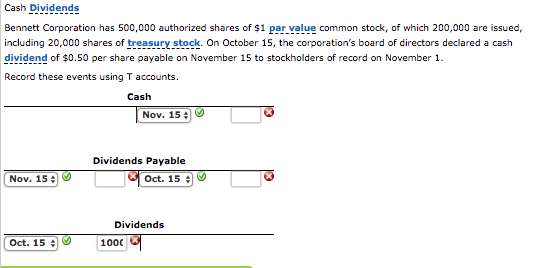

Cash Dividends

Bennett Corporation has 500,000 authorized shares of $1 par value common stock, of which 200,000 are issued, including 20,000 shares of treasury stock. On October 15, the corporations board of directors declared a cash dividend of $0.50 per share payable on November 15 to stockholders of record on November 1.

Record these events using T accounts.

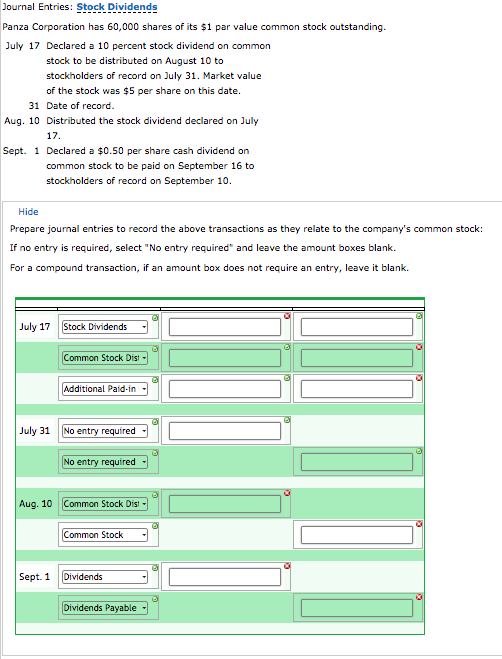

Journal Entries: Stock Dividends

Panza Corporation has 60,000 shares of its $1 par value common stock outstanding.

| July | 17 | Declared a 10 percent stock dividend on common stock to be distributed on August 10 to stockholders of record on July 31. Market value of the stock was $5 per share on this date. |

| 31 | Date of record. | |

| Aug. | 10 | Distributed the stock dividend declared on July 17. |

| Sept. | 1 | Declared a $0.50 per share cash dividend on common stock to be paid on September 16 to stockholders of record on September 10.

|

Treasury Stock Transactions Including Retirement The following stock transactions of Carmel Corporation represent all its treasury stock transactions for the year: June Purchased 1,000 shares of its own $30 par value common stock for $70 per share, the current 10 Sold 250 shares of treasury stock purchased on 20 Sold 350 shares of treasury stock purchased on 30 Retired the remaining shares purchased on June market price. June 1 for $80 per share. June 1 for $58 per share. 1. The original issue price was $42 per share Record Carmel Corporation's stock transactions using T accounts. If an amount is zero, enter "O" Cash 200C June 1 2030 297C | June 10 7000 Bal Treasury Stock, Common une 1 1750 2450 2800 700C June 10 Bal Retained Earnings 170C GO 4200 | June 20 Bal Stock Paid-in Capital, Treasury 250c l June 10 June 20 2500 | June 30 Bal Common Stock 1120 1120 Additional Paid-in Capital | June 30 Bal 1120 1120

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started