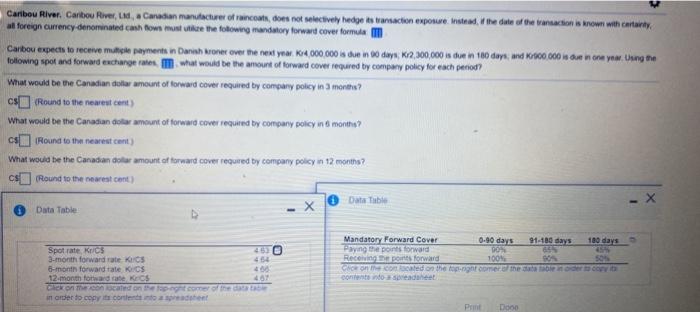

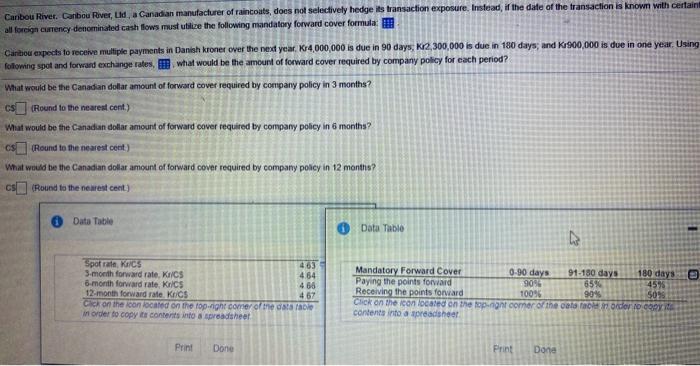

Caribou River. Caribou River, La, Canadian manufacturer of raincoat, does not selectively hedge is transaction exposure. Instead, the date of the action is known with many al foreign currency denominated cash flow must be the following mandatory forward cover formula Carbou expects to receive multiple payments in Danish Kroner over the next year 4000,000 is due in 60 days 12,300,000 is due in 180 days, and 300 000 in due in one year long the following spot and forward exchange rates what would be the amount of forward cover required by compwy policy for each period What would be the Canadian dollar amount or forward cover required by company policy in 3 months? csRound to the newest cent) What would be the Canadian dollar amount of forward cover required by company policy in 6 month? cs Round to the newest cent) What would be the Canadian dollar amount of forward cover required by company policy in 12 months? csRound to the newest cont) - X Data Table Data Table 0 Spot rate, Krics 3-month forward rate KICS 6-month forward tate ICS 12 month fotade Kecs Geocon con la comer in order to copy content 454 40 407 Mandatory Forward Cover 0-10 days 91-180 days 180 days Paying the points forward Receipts forward 100% 50% Cicerone con cated on the roagot mer the GMC content indo-seadet Pane D000 Canbou River. Canbou River, Lid, a Canadian manufacturer of raincoats, does not selectively hedge its transaction exposure. Instead, if the date of the transaction is known with certain all foreign currency denominated cash flows must utilize the following mandatory forward cover formula: Caribou expects to receive multiple payments in Danish kroner over the next year. K:4,000,000 is due in 90 days, K12,300,000 is due in 180 days, and K 500,000 is due in one year. Using following spot and forward exchange rates, what would be the amount of forward cover required by company policy for each period? What would be the Canadian dollar amount of forward cover required by company policy in 3 months? cs (Round to the nearest cent) What would be the Canadian dollar amount of forward cover required by company policy in 6 months (Round to the nearest cent) What would be the Canadian dollar amount of forward cover required by company poley in 12 months? cs (Round to the nearest ceet) Data Table Data Table 9 Spotrat, Kacs 2% 3-month forward rate, K/CS 4.64 6-month forward rate, Krics 4 66 12-month forward rate Kucs 4 57 Click on the con located on the top.ight comer of the datatable in order to copy it contrats into spreadsheet Mandatory Forward Cover 0-90 days 91-180 days 180 days Paying the points forward 9096 65% 45% Receiving the points forward 100% 90% 50% Click on the confocaled on the topgnt comer of the celle de foco content into a spreadsher Print Done Print Done Caribou River. Caribou River, La, Canadian manufacturer of raincoat, does not selectively hedge is transaction exposure. Instead, the date of the action is known with many al foreign currency denominated cash flow must be the following mandatory forward cover formula Carbou expects to receive multiple payments in Danish Kroner over the next year 4000,000 is due in 60 days 12,300,000 is due in 180 days, and 300 000 in due in one year long the following spot and forward exchange rates what would be the amount of forward cover required by compwy policy for each period What would be the Canadian dollar amount or forward cover required by company policy in 3 months? csRound to the newest cent) What would be the Canadian dollar amount of forward cover required by company policy in 6 month? cs Round to the newest cent) What would be the Canadian dollar amount of forward cover required by company policy in 12 months? csRound to the newest cont) - X Data Table Data Table 0 Spot rate, Krics 3-month forward rate KICS 6-month forward tate ICS 12 month fotade Kecs Geocon con la comer in order to copy content 454 40 407 Mandatory Forward Cover 0-10 days 91-180 days 180 days Paying the points forward Receipts forward 100% 50% Cicerone con cated on the roagot mer the GMC content indo-seadet Pane D000 Canbou River. Canbou River, Lid, a Canadian manufacturer of raincoats, does not selectively hedge its transaction exposure. Instead, if the date of the transaction is known with certain all foreign currency denominated cash flows must utilize the following mandatory forward cover formula: Caribou expects to receive multiple payments in Danish kroner over the next year. K:4,000,000 is due in 90 days, K12,300,000 is due in 180 days, and K 500,000 is due in one year. Using following spot and forward exchange rates, what would be the amount of forward cover required by company policy for each period? What would be the Canadian dollar amount of forward cover required by company policy in 3 months? cs (Round to the nearest cent) What would be the Canadian dollar amount of forward cover required by company policy in 6 months (Round to the nearest cent) What would be the Canadian dollar amount of forward cover required by company poley in 12 months? cs (Round to the nearest ceet) Data Table Data Table 9 Spotrat, Kacs 2% 3-month forward rate, K/CS 4.64 6-month forward rate, Krics 4 66 12-month forward rate Kucs 4 57 Click on the con located on the top.ight comer of the datatable in order to copy it contrats into spreadsheet Mandatory Forward Cover 0-90 days 91-180 days 180 days Paying the points forward 9096 65% 45% Receiving the points forward 100% 90% 50% Click on the confocaled on the topgnt comer of the celle de foco content into a spreadsher Print Done Print Done