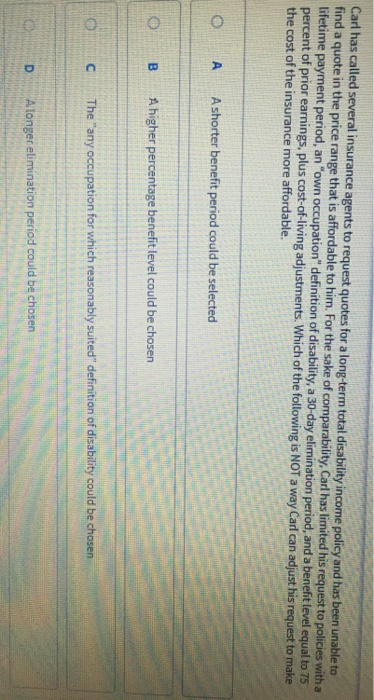

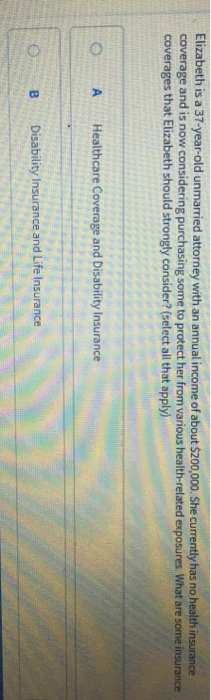

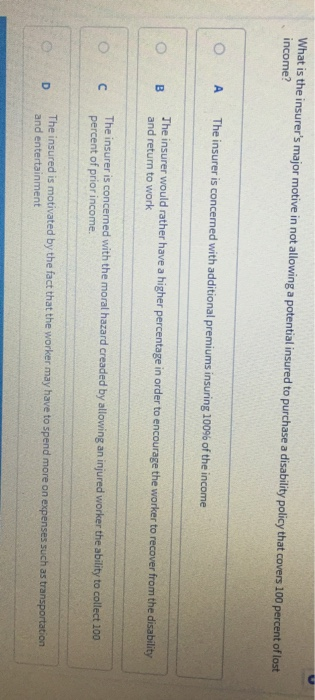

Carl has called several insurance agents to request quotes for a long-term total disability income policy and has been unable to find a quote in the price range that is affordable to him. For the sake of comparability, Carl has limited his request to policies with a lifetime payment period, an "own occupation" definition of disability, a 30-day elimination period, and a benefit level equal to 75 percent of prior earnings, plus cost-of-living adjustments. Which of the following is NOT a way Carl can adjust his request to make the cost of the insurance more affordable. O A A shorter benefit period could be selected B A higher percentage benefit level could be chosen The "any occupation for which reasonably suited" definition of disability could be chosen Alonger elimination period could be chosen Elizabeth is a 37-year-old unmarried attorney with an annual income of about $200,000. She currently has no health insurance coverage and is now considering purchasing some to protect her from various health-related exposures. What are some insurance coverages that Elizabeth should strongly consider? (select all that apply) Healthcare Coverage and Disability Insurance Disability Insurance and Life Insurance What is the insurer's major motive in not allowing a potential insured to purchase a disability policy that covers 100 percent of lost income? O A The insurer is concerned with additional premiums insuring 100% of the income The insurer would rather have a higher percentage in order to encourage the worker to recover from the disability and return to work The insurer is concerned with the moral hazard creaded by allowing an injured worker the ability to collect 100 percent of prior income. The insured is motivated by the fact that the worker may have to spend more on expenses such as transportation and entertainment Toff: Employer and employee contributions to a health savings account are tax deductible? True B False John Smith owns a health insurance policy with a $1,000 calendar-year deductible, an 80 percent coinsurance provision, and a $5,000 coinsurance cap. Assuming that all charges are covered and are reasonable and customary, what is the amount that the insurance company would pay for the following expense that occurred in the same calendar year. On January 15, John broke an arm and incurred medical expenses of $750. Numeric Answer: John Smith owns a health insurance policy with a $1,000 calendar year deductible, an 80 percent coinsurance provision and a $5,000 coinsurance cap. Assuming that all charges are covered and are reasonable and customary, what is the amount that the insurance company would pay for the following expense that occurred in the same calendar year July 30, John suffered a heart attack and was hospitalized for several days with bills of $3,100 Numeric