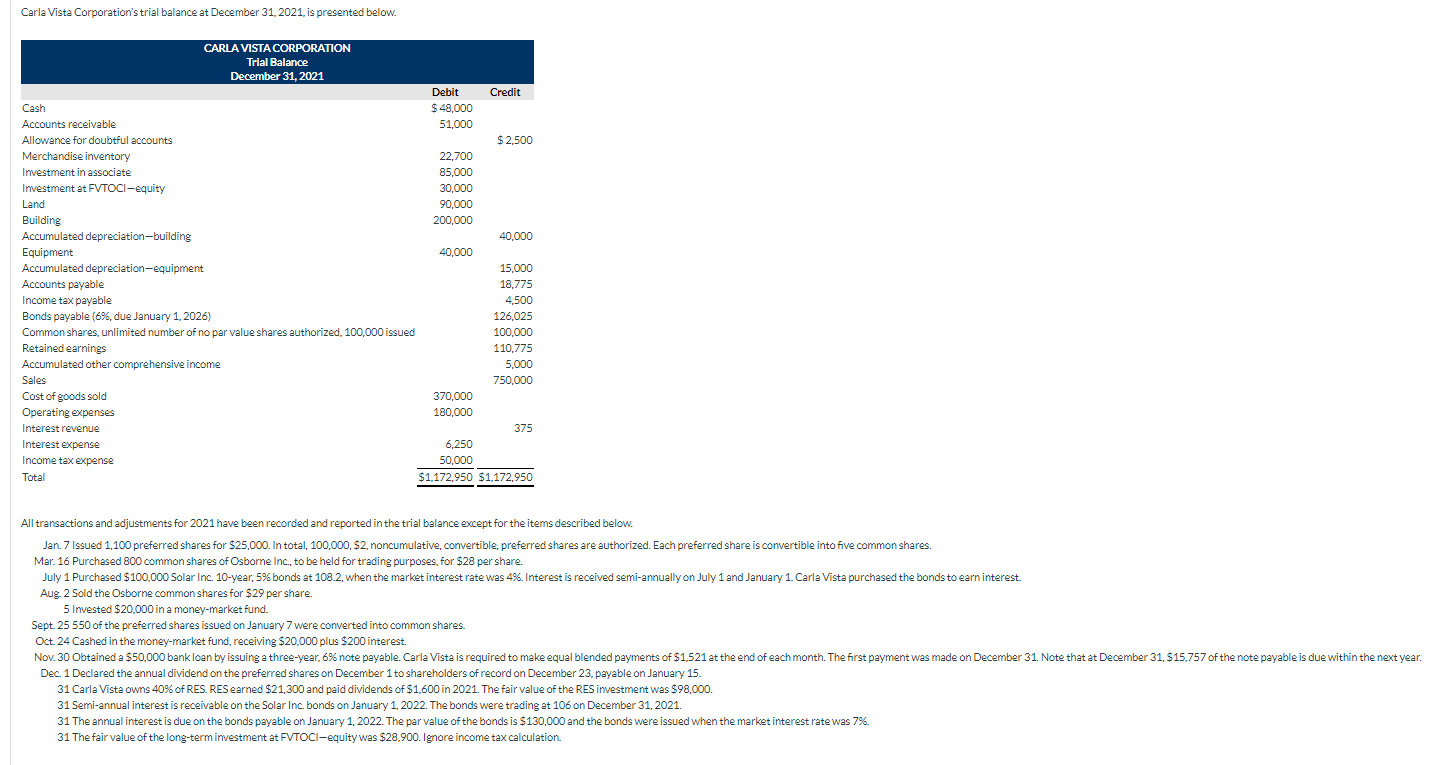

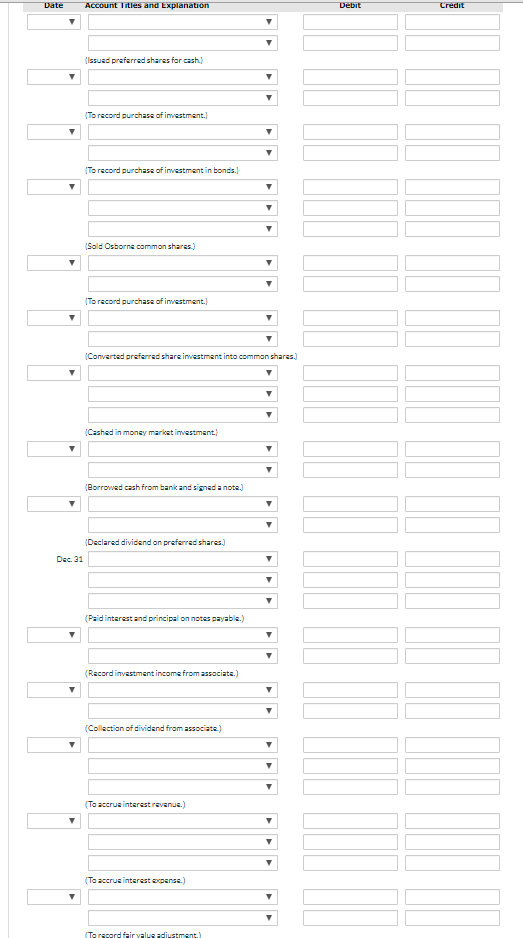

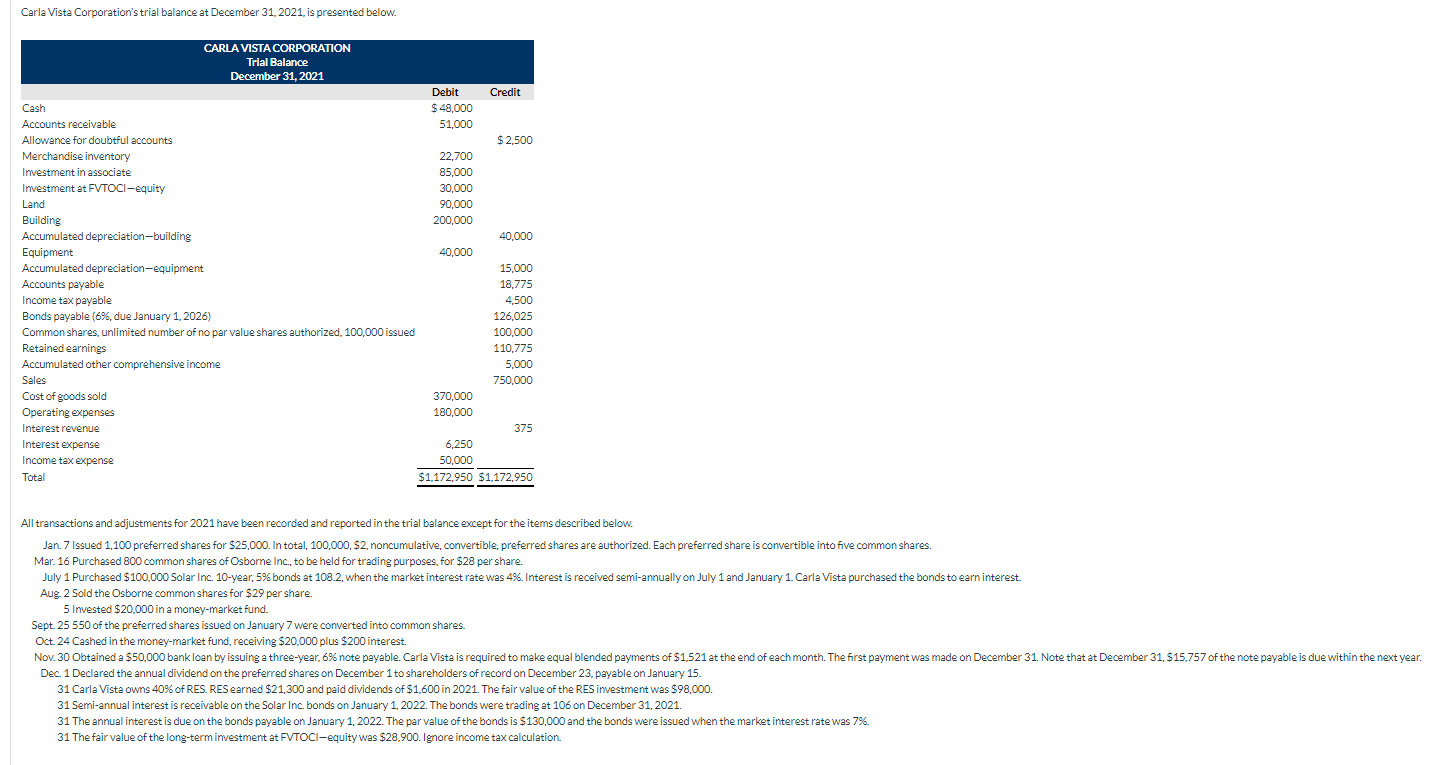

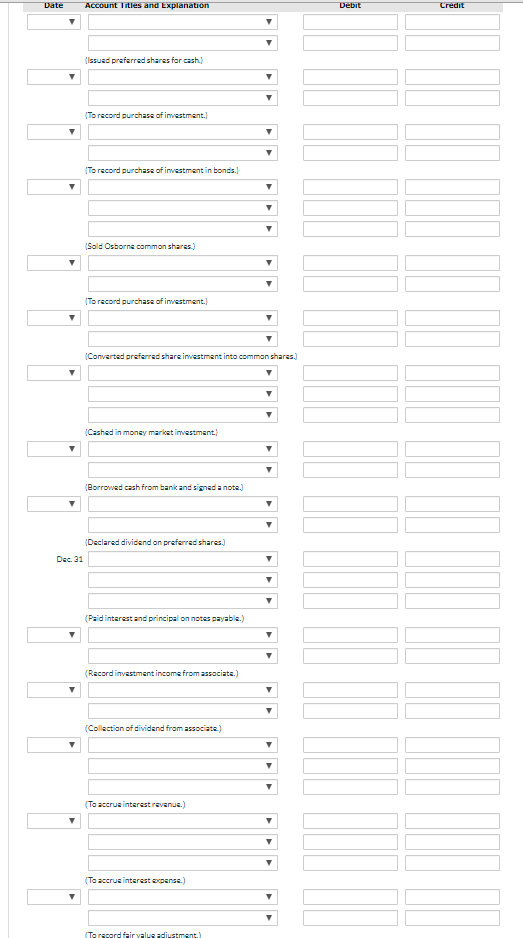

Carla Vista Corporation's trial balance at December 31, 2021. is presented below. CARLA VISTA CORPORATION Trial Balance December 31, 2021 Cash Accounts receivable Allowance for doubtful accounts Merchandise inventory Investment in associate Investment at FVTOCI-equity Land Building Accumulated depreciation-building Equipment Accumulated depreciation equipment Accounts payable Income tax payable Bonds payable (6%, due January 1, 2026) Common shares, unlimited number of no par value shares authorized. 100,000 issued Retained earnings Accumulated other comprehensive income Sales Cost of goods sold Operating expenses Interest revenue Interest expense Income tax expense Total Debit Credit $ 48,000 51,000 $ 2.500 22,700 85,000 30.000 90.000 200,000 40,000 40,000 15,000 18.775 4.500 126,025 100,000 110.775 5.000 750.000 370,000 180,000 375 6,250 50,000 $1,172,950 $1,172,950 All transactions and adjustments for 2021 have been recorded and reported in the trial balance except for the items described below. Jan 7 Issued 1,100 preferred shares for $25,000. In total, 100,000 $2, noncumulative, convertible, preferred shares are authorized. Each preferred share is convertible into five common shares. Mar. 16 Purchased 800 common shares of Osborne Inc., to be held for trading purposes, for $28 per share. July 1 Purchased $100.000 Solar Inc. 10-year, 5% bonds at 108.2, when the market interest rate was 4%. Interest is received semi-annually on July 1 and January 1 Carla Vista purchased the bonds to earn interest Aug 2 Sold the Osborne common shares for $29 per share 5 Invested $20,000 in a money-market fund. Sept. 25 550 of the preferred shares issued on January 7 were converted into common shares. Oct 24 Cashed in the money-market fund, receiving $20.000 plus $200 interest. Nov. 30 Obtained a $50,000 bank loan by issuing a three-year, 6% note payable. Carla Vista is required to make equal blended payments of $1,521 at the end of each month. The first payment was made on December 31. Note that at December 31, $15,757 of the note payable is due within the next year. Dec. 1 Declared the annual dividend on the preferred shares on December 1 to shareholders of record on December 23. payable on January 15. 31 Carla Vista owns 40% of RES. RES earned $21,300 and paid dividends of $1,600 in 2021. The fair value of the RES investment was $98,000. 31 Semi-annual interest is receivable on the Solar Inc. bonds on January 1, 2022. The bonds were trading at 106 on December 31, 2021. 31 The annual interest is due on the bonds payable on January 1, 2022. The per value of the bonds is $130,000 and the bonds were issued when the market interest rate was 7%. 31 The fair value of the long-term investment at FVTOCI-equity was $28.900. Ignore income tax calculation Date Account Titles and Explanation Debit Credit 7 Issued preferred shares for cash) 7 (To record purchase of investment 7 7 (To record purchase of investment in bonds. 7 7 (Sold Osborne common shares.) 7 (To record purchase of investment 7 Converted preferred share investment into common shares.) 7 (Cashed in money maricat investment) 7 (Borrowed cash from bank and signed a note. 7 (Declared dividend on preferred shares. Dec 31 V 7 (Paid interest and principal on notes payable.) 7 (Record investment income from associats.) 7 (Collection of dividend from associate) (To accrue interest revenue.) V 7 (To accrue interest expense. To record fair valusadiustment.)