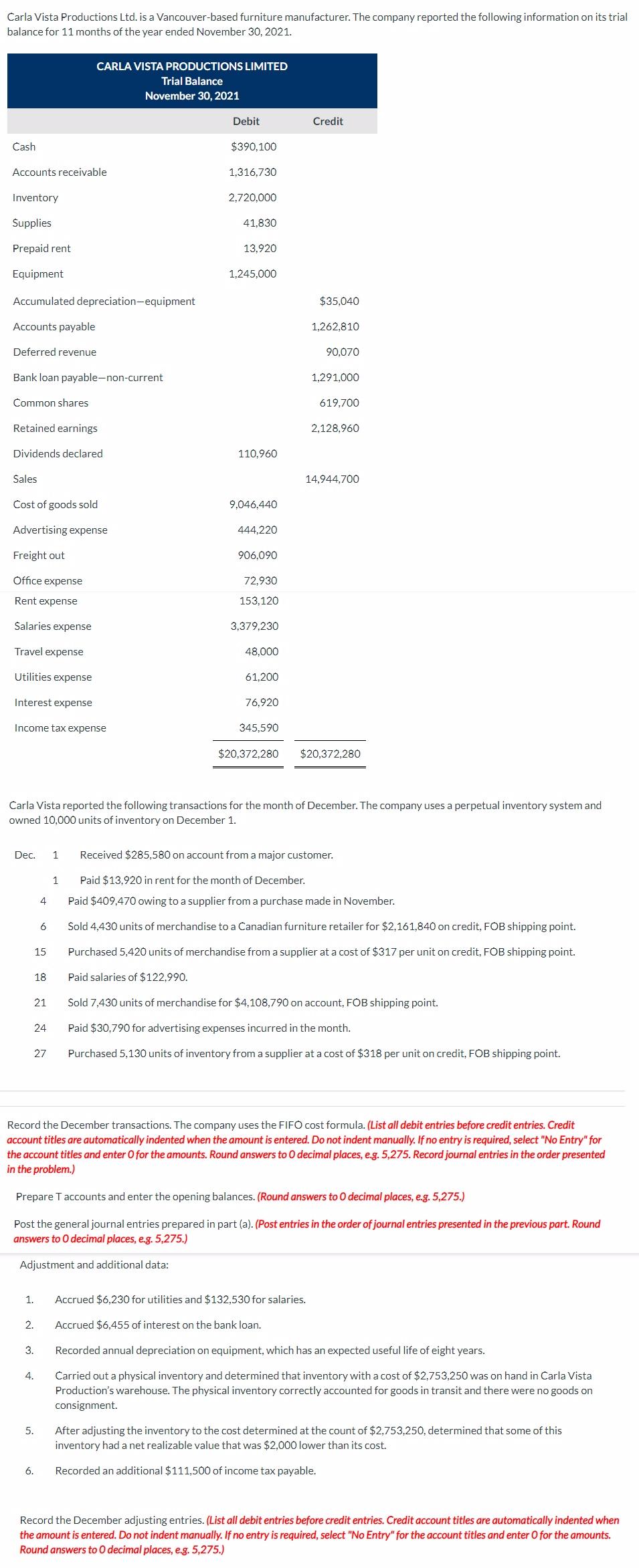

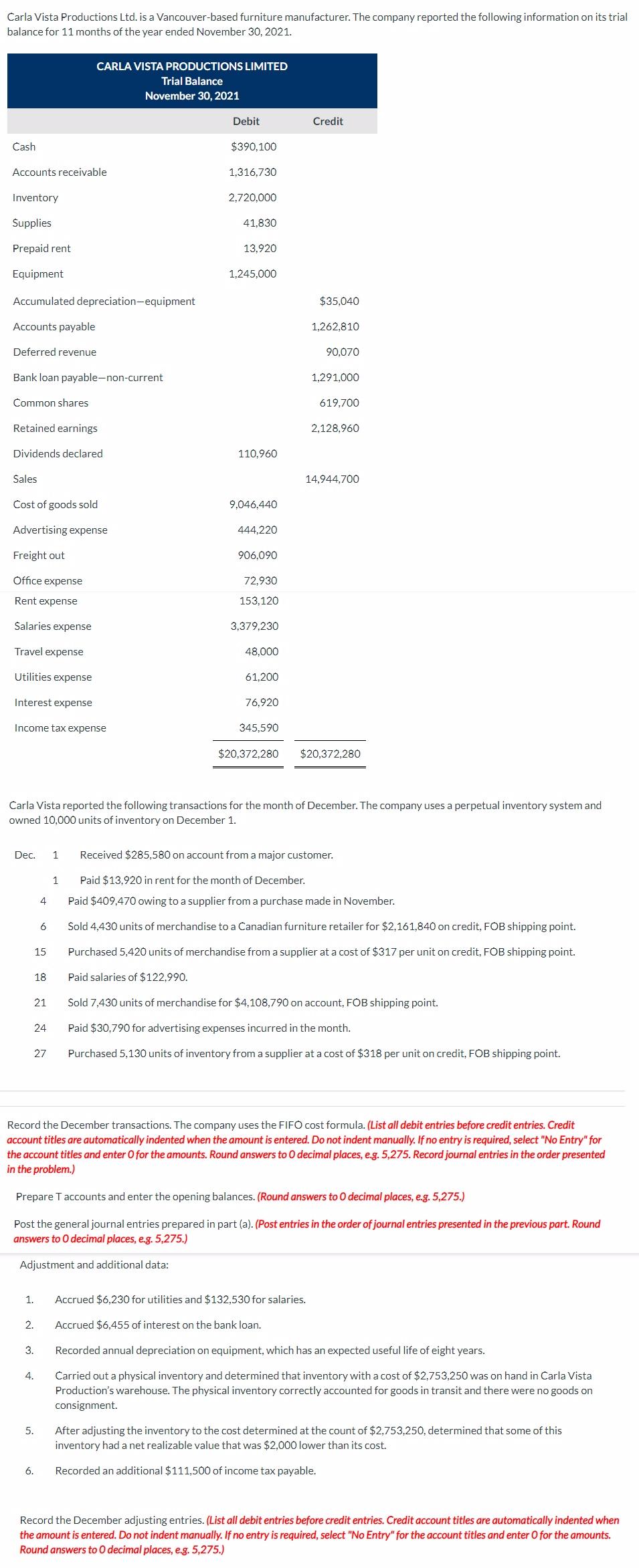

Carla Vista Productions Ltd. is a Vancouver-based furniture manufacturer. The company reported the following information on its trial balance for 11 months of the year ended November 30, 2021. Carla Vista reported the following transactions for the month of December. The company uses a perpetual inventory system and owned 10,000 units of inventory on December 1. Dec. 1 Received $285,580 on account from a major customer. 1 Paid $13,920 in rent for the month of December. 4 Paid $409,470 owing to a supplier from a purchase made in November. 6 Sold 4,430 units of merchandise to a Canadian furniture retailer for $2,161,840 on credit, FOB shipping point. 15 Purchased 5,420 units of merchandise from a supplier at a cost of $317 per unit on credit, FOB shipping point. 18 Paid salaries of $122,990 21 Sold 7,430 units of merchandise for $4,108,790 on account, FOB shipping point. 24 Paid $30,790 for advertising expenses incurred in the month. 27 Purchased 5,130 units of inventory from a supplier at a cost of $318 per unit on credit, FOB shipping point. Record the December transactions. The company uses the FIFO cost formula. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. Record journal entries in the order presented in the problem.) Prepare T accounts and enter the opening balances. (Round answers to 0 decimal places, e.g. 5,275.) Post the general journal entries prepared in part (a). (Post entries in the order of journal entries presented in the previous part. Round answers to 0 decimal places, e.g. 5,275.) Adjustment and additional data: 1. Accrued $6,230 for utilities and $132,530 for salaries. 2. Accrued $6,455 of interest on the bank loan. 3. Recorded annual depreciation on equipment, which has an expected useful life of eight years. 4. Carried out a physical inventory and determined that inventory with a cost of $2,753,250 was on hand in Carla Vista Production's warehouse. The physical inventory correctly accounted for goods in transit and there were no goods on consignment. 5. After adjusting the inventory to the cost determined at the count of $2,753,250, determined that some of this inventory had a net realizable value that was $2,000 lower than its cost. 6. Recorded an additional $111,500 of income tax payable. Record the December adjusting entries. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places, e.g. 5,275.) Carla Vista Productions Ltd. is a Vancouver-based furniture manufacturer. The company reported the following information on its trial balance for 11 months of the year ended November 30, 2021. Carla Vista reported the following transactions for the month of December. The company uses a perpetual inventory system and owned 10,000 units of inventory on December 1. Dec. 1 Received $285,580 on account from a major customer. 1 Paid $13,920 in rent for the month of December. 4 Paid $409,470 owing to a supplier from a purchase made in November. 6 Sold 4,430 units of merchandise to a Canadian furniture retailer for $2,161,840 on credit, FOB shipping point. 15 Purchased 5,420 units of merchandise from a supplier at a cost of $317 per unit on credit, FOB shipping point. 18 Paid salaries of $122,990 21 Sold 7,430 units of merchandise for $4,108,790 on account, FOB shipping point. 24 Paid $30,790 for advertising expenses incurred in the month. 27 Purchased 5,130 units of inventory from a supplier at a cost of $318 per unit on credit, FOB shipping point. Record the December transactions. The company uses the FIFO cost formula. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. Record journal entries in the order presented in the problem.) Prepare T accounts and enter the opening balances. (Round answers to 0 decimal places, e.g. 5,275.) Post the general journal entries prepared in part (a). (Post entries in the order of journal entries presented in the previous part. Round answers to 0 decimal places, e.g. 5,275.) Adjustment and additional data: 1. Accrued $6,230 for utilities and $132,530 for salaries. 2. Accrued $6,455 of interest on the bank loan. 3. Recorded annual depreciation on equipment, which has an expected useful life of eight years. 4. Carried out a physical inventory and determined that inventory with a cost of $2,753,250 was on hand in Carla Vista Production's warehouse. The physical inventory correctly accounted for goods in transit and there were no goods on consignment. 5. After adjusting the inventory to the cost determined at the count of $2,753,250, determined that some of this inventory had a net realizable value that was $2,000 lower than its cost. 6. Recorded an additional $111,500 of income tax payable. Record the December adjusting entries. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places, e.g. 5,275.)