Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carla Vista Theatres Inc. operates specialty film format theatres that display images of greater size and higher-quality resolution. Carla Vista is considering expanding its theatres

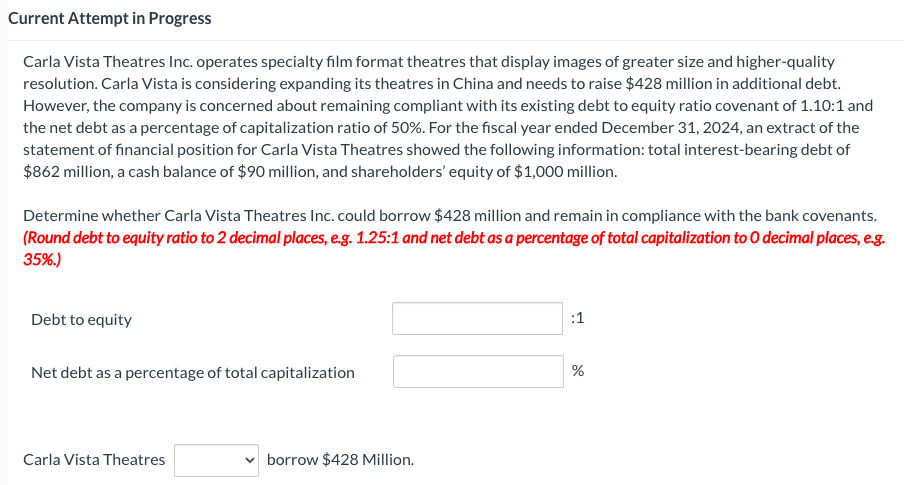

Carla Vista Theatres Inc. operates specialty film format theatres that display images of greater size and higher-quality resolution. Carla Vista is considering expanding its theatres in China and needs to raise $428 million in additional debt. However, the company is concerned about remaining compliant with its existing debt to equity ratio covenant of 1.10:1 and the net debt as a percentage of capitalization ratio of 50%. For the fiscal year ended December 31,2024 , an extract of the statement of financial position for Carla Vista Theatres showed the following information: total interest-bearing debt of $862 million, a cash balance of $90 million, and shareholders' equity of $1,000 million. Determine whether Carla Vista Theatres Inc. could borrow $428 million and remain in compliance with the bank covenants. (Round debt to equity ratio to 2 decimal places, e.g. 1.25:1 and net debt as a percentage of total capitalization to 0 decimal places, e.g. 35%.) Debt to equity :1 Net debt as a percentage of total capitalization % Carla Vista Theatres borrow $428 Million

Carla Vista Theatres Inc. operates specialty film format theatres that display images of greater size and higher-quality resolution. Carla Vista is considering expanding its theatres in China and needs to raise $428 million in additional debt. However, the company is concerned about remaining compliant with its existing debt to equity ratio covenant of 1.10:1 and the net debt as a percentage of capitalization ratio of 50%. For the fiscal year ended December 31,2024 , an extract of the statement of financial position for Carla Vista Theatres showed the following information: total interest-bearing debt of $862 million, a cash balance of $90 million, and shareholders' equity of $1,000 million. Determine whether Carla Vista Theatres Inc. could borrow $428 million and remain in compliance with the bank covenants. (Round debt to equity ratio to 2 decimal places, e.g. 1.25:1 and net debt as a percentage of total capitalization to 0 decimal places, e.g. 35%.) Debt to equity :1 Net debt as a percentage of total capitalization % Carla Vista Theatres borrow $428 Million Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started