Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carlton, a single taxpayer, owns a Pelican LLC, a computer service, and operates it as a sole proprietorship. In 2020, Pelican LLC's taxable income

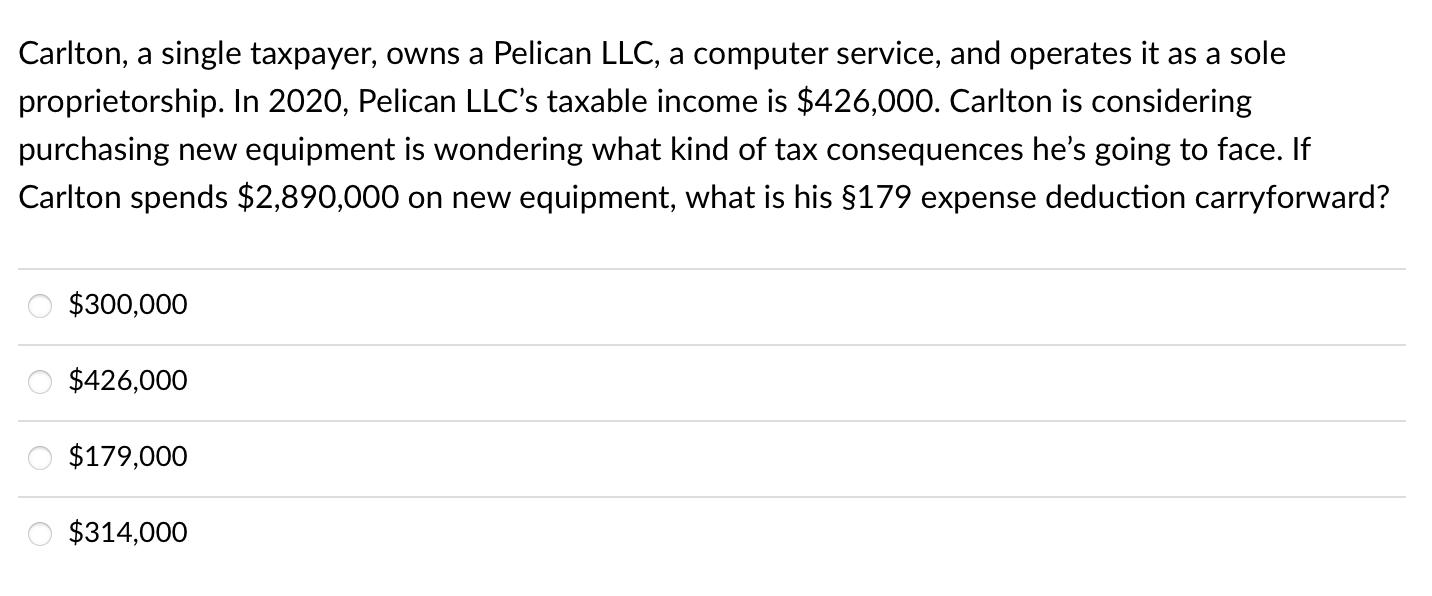

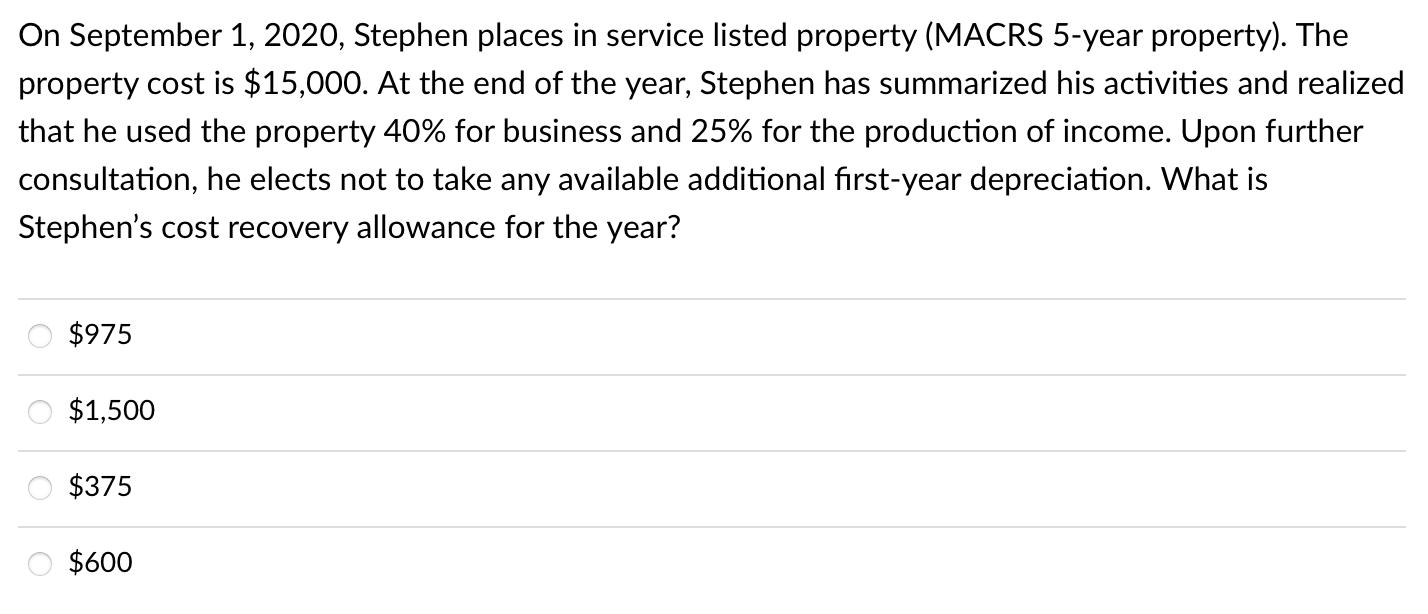

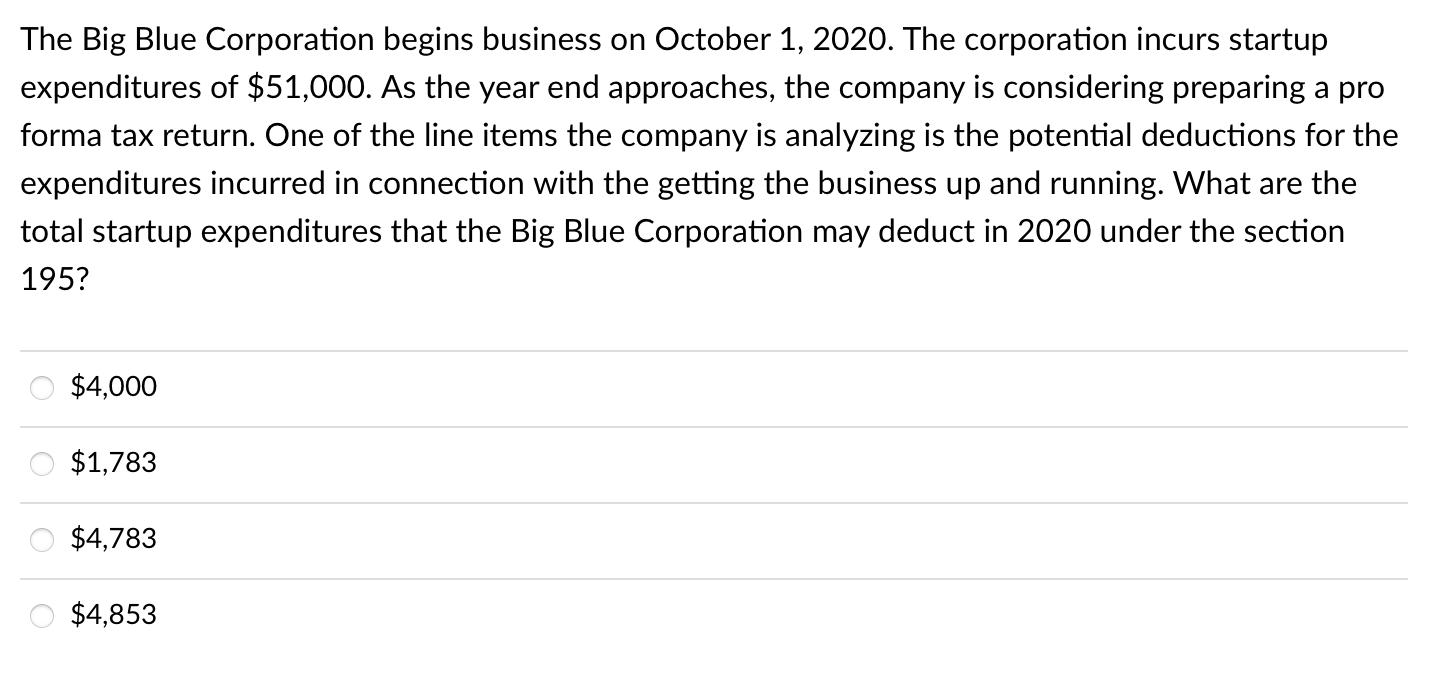

Carlton, a single taxpayer, owns a Pelican LLC, a computer service, and operates it as a sole proprietorship. In 2020, Pelican LLC's taxable income is $426,000. Carlton is considering purchasing new equipment is wondering what kind of tax consequences he's going to face. If Carlton spends $2,890,000 on new equipment, what is his 179 expense deduction carryforward? $300,000 $426,000 $179,000 $314,000 On September 1, 2020, Stephen places in service listed property (MACRS 5-year property). The property cost is $15,000. At the end of the year, Stephen has summarized his activities and realized that he used the property 40% for business and 25% for the production of income. Upon further consultation, he elects not to take any available additional first-year depreciation. What is Stephen's cost recovery allowance for the year? $975 $1,500 $375 $600 The Big Blue Corporation begins business on October 1, 2020. The corporation incurs startup expenditures of $51,000. As the year end approaches, the company is considering preparing a pro forma tax return. One of the line items the company is analyzing is the potential deductions for the expenditures incurred in connection with the getting the business up and running. What are the total startup expenditures that the Big Blue Corporation may deduct in 2020 under the section 195? $4,000 $1,783 $4,783 $4,853

Step by Step Solution

★★★★★

3.53 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

Dec130 1021 Solution 1 2 3 4 5 6 7 Answer is highlighted in yellow Particulars Property p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started