Carol County administers a pension trust fund for some of its employees. The following represents some of the transactions recorded by the Carol County

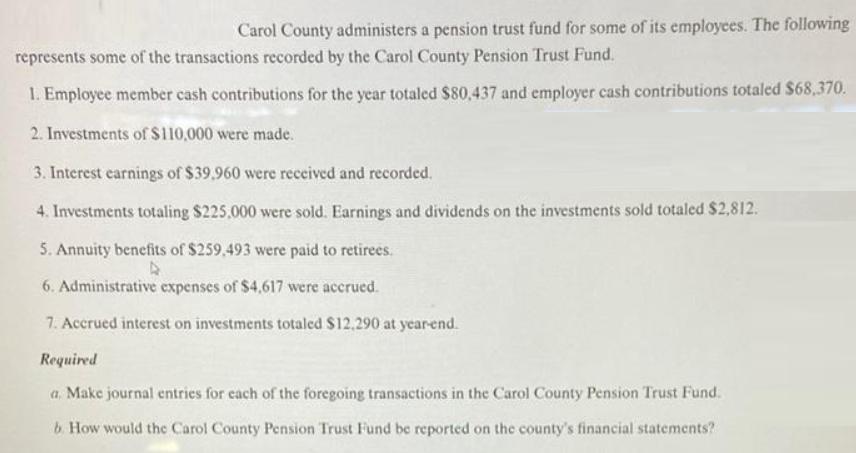

Carol County administers a pension trust fund for some of its employees. The following represents some of the transactions recorded by the Carol County Pension Trust Fund. 1. Employee member cash contributions for the year totaled $80,437 and employer cash contributions totaled $68,370. 2. Investments of S110,000 were made. 3. Interest earnings of $39,960 were received and recorded. 4. Investments totaling $225,000 were sold. Earnings and dividends on the investments sold totaled $2,812. 5. Annuity benefits of $259,493 were paid to retirees. 6. Administrative expenses of $4,617 were accrued. 7. Accrued interest on investments totaled $12,290 at year-end. Required a, Make journal entries for each of the foregoing transactions in the Carol County Pension Trust Fund. b. How would the Carol County Pension Trust Fund be reported on the county's financial statements?

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

A B Step 1 Fund Base Accounting Under this we have to make seperate books for each fund to report in...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started