Question

Caroline is investing her funds for the next five years, when she will need the money for one of her goals. She is considering two

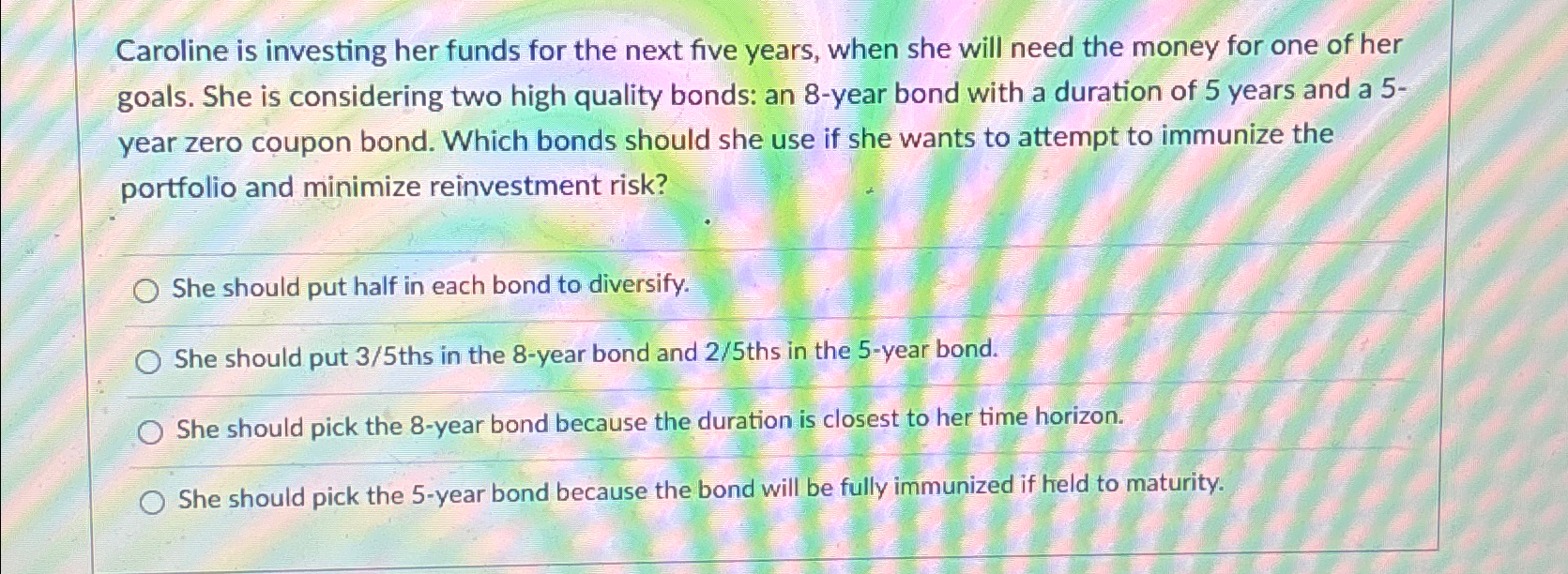

Caroline is investing her funds for the next five years, when she will need the money for one of her goals. She is considering two high quality bonds: an 8-year bond with a duration of 5 years and a 5year zero coupon bond. Which bonds should she use if she wants to attempt to immunize the portfolio and minimize reinvestment risk?\ She should put half in each bond to diversify.\ She should put

(3)/(5)ths in the 8-year bond and

(2)/(5)ths in the 5-year bond.\ She should pick the 8-year bond because the duration is closest to her time horizon.\ She should pick the 5-year bond because the bond will be fully immunized if held to maturity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started